Oracle General Ledger

Closing Journals

Release 11i

J uly 2001

J an Godfrey

2

Table of Contents

INTRODUCTION 3

RECOMMENDED STEPS TO SET UP AND CREATE CLOSING JOURNALS 3

INCOME STATEMENT CLOSE 4

PREREQUISITES FOR RUNNING THE INCOME STATEMENT CLOSE 5

HOW TO RUN THE PROGRAM 5

INCOME STATEMENT CLOSING EXAMPLE 6

AFTER RUNNING THE INCOME STATEMENT CLOSE 7

INCOME STATEMENT CLOSING JOURNAL ATTRIBUTES 8

ADDITIONAL NOTES FOR MRC 8

ADDITIONAL NOTES FOR AVERAGE BALANCES 8

BALANCE SHEET CLOSE 10

PREREQUISITES FOR RUNNING THE BALANCE SHEET CLOSE 10

HOW TO RUN THE PROGRAM 10

BALANCE SHEET CLOSE EXAMPLE 11

AFTER RUNNING THE BALANCE SHEET CLOSE 12

BALANCE SHEET CLOSING JOURNAL ATTRIBUTES 13

ADDITIONAL NOTES FOR MRC 13

ADDITIONAL NOTES FOR AVERAGE BALANCES 13

Introduction

General Ledger can create closing journals for year-end and other closing periods.

Income Statement Close: This journal closes all of the income statement accounts to

the retained earnings account.

Balance Sheet Close: This journal posts all asset and liability balances to a closing

account that you specify. This is designed to meet globalization requirements.

Oracle General Ledgers closing journals address global audit and statutory reporting

requirements for Greece, Italy, Portugal, Spain, Columbia, Mexico and a few other

countries. Other countries, such as the United States, may have the need to create an

auditable closing journal at times other than year-end. These journals can fulfill both

requirements.

This feature is new in Oracle General Ledger Release 11i.

Recommended Steps to Set Up and Create Closing Journals

1. Set up the last day of your fiscal year as an adjusting period.

2. Set up the first day of your new fiscal year as an adjusting

period.

3. Ensure the period you are closing is an Open period.

4. Complete your routine accounting before the last day of the year.

5. Post your adjustments and closing entries in the adjusting

period.

6. In the last adjusting period of the fiscal year you want to close:

a) Run the Create Income Statement Closing Journals process to

transfer income statement yearend account balances of your

revenue and expense accounts to the retained earnings account.

** This is the audit trail showing how the retained earnings

amount was calculated.

b) Run the Create Balance Sheet Closing Journals process to close

and zero out the yeartodate balances of all balance sheet

accounts: assets, liabilities, and owners equity.

4

7. In the first adjusting period of your new fiscal year:

a) Run the Open Period program to open the first Income

Statement period of the new year.

b) Reverse and post the Balance Sheet closing journals to reopen

those balances.

Note: You are closing actual balances. You cannot close budget

or encumbrance balances.

Warning: If you are using Multiple Reporting Currencies,

make sure you define a conversion rule to prevent replication

of your yearend closing journals from your primary set of

books to each of your reporting sets of books. See: Define

General Ledger Conversion Rules, Multiple Reporting Currencies

Users Guide.

Income Statement Close

In Release 11.5.2 (or after applying Patchset A for 11.5.1 (1339658)), there are two

options for the Close Process - Create Income Closing Journals program. Only the first

option is available in 11.5.1 (without Patchset A). It appears that at this time (10-NOV-

2000), that only the first option is available in 11.0 also.

1) Journal entries are created to reverse debits and credits of ending year-to-date actual

balances for the period you want to close. The income statement accounts are zeroed out,

and the balance (net of the reversed revenue and expense accounts) is transferred to the

closing account you specify. If the account processed has both debit and credit balances,

the two balances will not be netted. Instead, that accounts debit balance is posted to the

credit column and the credit balance is posted to the debit column in the same journal

line. To use this option, do not specify an Income Offset Account when running the

program.

2) Income Statement Offset Account Option - Instead of zeroing out each revenue and

expense account, you can choose to post the reciprocal of the net income amount to a

single income offset account while the net income amount is posted to the retained

earnings account. The program will take the net sum of the revenue and expense

accounts. This sum includes the balance in the income statement offset account.

5

To use the new option (2) , just specify a value for the Income Offset Account parameter

whenever you run the Close Process - Create Income Statement Closing Journals

program.

Prerequisites for Running the Income Statement Close

Post all revenue and expense adjustment entries to the appropriate periods.

Review the General Ledger accounting and analysis reports.

Ensure the period you are closing is an open period.

How To Run the Program

1) Navigate to the Standard Report Submission Window.

Navigation = ReportsRequestStandard

2) Select Single Request, then Close Process - Create Income Closing Journals.

3) Enter the Parameters:

Period: The latest open period will be defaulted here. Typically, you specify an

adjustment period that represents the last day of your fiscal year.

Account From/To: Enter the starting and ending account ranges. The range can

span multiple balancing segments and include the entire chart of accounts.

General Ledger only extracts balances of revenue and expense accounts within

the range you specify.

Closing Account: This is typically the retained earnings account. You may

specify any account that is valid and enabled. If you are closing multiple

balancing segments, General Ledger creates separate closing accounts for each

balancing segment.

Category: Income Closing Statement is defaulted for the journal category.

Source: Closing Journals is defaulted.

Income Offset Account (optional): Available if Patchset A (1339658) has been

applied. Instead of zeroing out each revenue and expense account, you can

choose to post the reciprocal of the net income amount to a single income offset

account while the net income amount is posted to the retained earnings account.

6

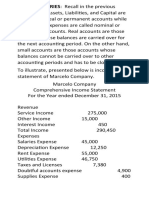

Income Statement Closing Example

Balances of Income Statement accounts before running the Income Statement Close

Program, and posting the journal:

Parameters for running the program Close Process - Income Statement Close:

- close2-99 is an adjusting period that contains the last day of the year. This is the last

period of the year.

- 3300 is the retained earnings account.

Jan sob Date: 03-

NOV-00 09:20:21

All Income Statement Accounts Page: 1

Current Period: close2-99

currency USD

No specific Company requested

YTD-Actual

Company Account Cost Center close2-99

----------------------------------------- --------------------

01 4400 001 <500.00>

01 4400 002 <3,000.00>

00 6100 000 <100.00>

01 7111 001 125.00

00 9999 001 100.00

7

Income Closing Journal created:

After Running the Income Statement Close

- Post the journal entry created by the Income Statement Close program.

- Run the Open Period program to open the first period of the new

fiscal year. The Open Period program closes out all revenue and expense

accounts to the Retained Earnings account. However, because

posting of the closing journals has already zeroed out the revenue

and expense accounts to the Retained Earnings account, there are

no balances to transfer and no further effect on Retained Earnings.

The retained earnings balance is carried forward from the prior period.

Jan sob Unposted Journals Report Date: 01-NOV-2000 13:12

For close2-99 Page: 1 of 1

Posting Status: Unposted

Currency: USD

Source: Closing Journal

Batch Name: Income Statement Close: Request 463955 close Batch Effective Date: 31-DEC-99 Balance: Actual

Posted Date:

Journal Entry Name: Income Statement Close: USD Category: Income Statement Close

Journal Reference: Currency: USD

Line Accounting Flexfield Trans Date Description Line Item Debits Credits Units

---------------------------------------------------------------------------------------------------------------------------------------------

10 01.7111.001 31-DEC-99 Income Statement 0.00 125.00 0.00

20 01.4400.001 31-DEC-99 Income Statement 500.00 0.00 0.00

30 01.4400.002 31-DEC-99 Income Statement 3,000.00 0.00 0.00

40 00.6100.000 31-DEC-99 Income Statement 100.00 0.00 0.00

50 00.9999.001 31-DEC-99 Income Statement 0.00 100.00 0.00

60 00.3300.000 31-DEC-99 Income Statement 100.00 100.00 0.00

70 01.3300.000 31-DEC-99 Income Statement 125.00 3,500.00 0.00

-------------------------------------------------

Header Total: 3,825.00 3,825.00 0.00

---------------------------------------------------

Batch Total: 3,825.00 3,825.00 0.00

---------------------------------------------------

Closing Journal Total: 3,825.00 3,825.00 0.00

---------------------------------------------------

Grand Total: 3,825.00 3,825.00 0.00

8

- If revenue and expense adjustments need to be made after opening

the new fiscal year, posting those backdated adjustments will

automatically update the beginning balances of the Retained

Earnings account for all open periods in the new year. However,

amounts in the closing journal will not reflect the adjustments. For

accuracy, you must reverse the closing journals, post, enter your

adjustments, run the Create Income Statement Closing Journals,

and post.

Income Statement Closing J ournal Attributes

General Ledger automatically creates a separate closing account for each balancing

segment if you specify an account range that includes multiple balancing segments.

The effective date of your closing journal entries is the last day of the period you

specify in the parameters window, typically the adjusting period on the last day of

your fiscal year.

The closing journals you generate are marked for reversal in the same period the

journals were generated. The reversal method defaults to Change Sign.

General Ledger closes functional and foreign currency balances with different journal

entries:

- Functional Currency: Journal entries reflect only entered amounts. Journal

entries do not address foreign converted or account for amounts.

- Foreign Currency: Journal entries reflect both foreign entered amounts as well

as the converted amounts.

Additional Notes for MRC

MRC Sets of Books: You should run the Create Income Statement

Closing Journals separately for the MRC primary set of books, and then

for each of the reporting sets of books. Post your generated closing

journals separately as well.

Additional Notes for Average Balances

Average Balance Sets of Books: Create Income Statement Closing

Journals only creates standard closing journal entries for any set of

books with average balance processing enabled.

NonConsolidating Set of Books: The effective date of the closing

journal entries is the last day of the specified period unless you

assign effective date rules for the journal source called Closing

Journals in the Journal sources window. See: Journal Sources When

the closing journals are posted, the standard and average balances

are both updated.

9

If the closing account is specified as an income statement account,

the revenue and expense account balances are transferred to this

closing account. There is no effect on average balances.

If the closing account is specified as a balance sheet account, and

the defined period is the last period of the fiscal year, the average

balance of the closing account is updated. The average balance of

the Net Income account and the net average of all income

statement accounts is also updated.

Consolidating Set of Books: The Create Income Statement Closing

Journals will only create closing journals for standard account

balances, not average account balances.

10

Balance Sheet Close

When you run Create Balance Sheet Closing Journals, journal entries

are created to reverse debits and credits of ending yeartodate actual

balances for the period you want to close. The balance, net of the

reversed asset and liability accounts, is transferred to the closing

account you specify.

Note: Your balance sheet should be balanced if you completed

the Close Process: Create Income Statement Closing Journals to

update the retained earnings account. If the range of balance

sheet accounts is balanced, then there is no transfer of balances.

Prerequisites for Running the Balance Sheet Close

Post any adjustment entries to the appropriate periods.

Print General Ledger accounting and analysis reports.

Ensure the period you are closing is an Open period.

How To Run the Program

1) Navigate to the Standard Report Submission Window.

Navigation = ReportsRequestStandard

2) Select Single Request, then Close Process - Create Balance Sheet Closing

Journals.

3) Enter the Parameters:

Period: The latest open period will be defaulted here. Typically, you specify an

adjustment period that represents the last day of your fiscal year.

Account From/To: Enter the starting and ending account ranges. The range can

span multiple balancing segments and include the entire chart of accounts.

General Ledger only extracts balance sheet account balances within the range

you specify.

Closing Account: You may specify any account that is valid and enabled. If you

are closing multiple balancing segments, General Ledger creates separate

closing accounts for each balancing segment.

Category: Balance Sheet Close is defaulted for the journal category. NOTE: If

the balance sheet closing account is within the range you specified, General

Ledger ignores this account when extracting balances.

11

Balance Sheet Close Example

Balances of Balance Sheet accounts before running the Balance Sheet Statement Close

Program, and posting the journal:

Parameters for running the Balance Sheet Closing Program:

Jan sob Date: 03-

NOV-00 13:12:24

All Balance Sheet Accounts Page: 1

Current Period: close2-99

currency USD

No specific Company requested

YTD-Actual

Company Account Cost Center close2-99

------------------------------------------ -----------------

01 2111 001 <125.00>

01 2111 100 3,000.00

01 1001 001 500.00

12

Journal created by the Balance Sheet Closing program:

After Running the Balance Sheet Close

- Post the balance sheet closing journals to zeroout balance sheet

account balances.

Note: Should you need to make adjustments after the balance

sheet closing journals are posted, reverse and post the original

closing entries, make your adjustments, then run the closing

process to capture the new adjustments.

- In the first adjusting period of the new fiscal year, reverse the

balance sheet closing journals to repopulate the balance sheet

accounts.

Jan sob Unposted Journals Report Date: 03-NOV-2000 12:43

For close2-99 Page: 1 of 1

Posting Status: Unposted

Currency: USD

Source: Closing Journal

Batch Name: Balance Sheet Close: Request 463981 close2-9 Batch Effective Date: 31-DEC-99 Balance: Actual

Posted Date:

Journal Entry Name: Balance Sheet Close: USD Category: Balance Sheet Close

Journal Reference: Currency: USD

Line Accounting Flexfield Trans Date Description Line Item Debits Credits Units

---------------------------------------------------------------------------------------------------------------------------------------------------

10 01.2111.001 31-DEC-99 Balance Sheet Clo 125.00 0.00 0.00

20 01.1001.001 31-DEC-99 Balance Sheet Clo 0.00 500.00 0.00

30 01.2111.100 31-DEC-99 Balance Sheet Clo 0.00 3,000.00 0.00

40 01.9800.000 31-DEC-99 Balance Sheet Clo 3,500.00 125.00 0.00

---------------- ---------------- ----------------

Header Total: 3,625.00 3,625.00 0.00

---------------- ---------------- ----------------

Batch Total: 3,625.00 3,625.00 0.00

---------------- ---------------- ----------------

Closing Journal Total: 3,625.00 3,625.00 0.00

---------------- ---------------- ----------------

Grand Total: 3,625.00 3,625.00 0.00

13

Balance Sheet Closing J ournal Attributes

- The effective date of your closing entries is the last day of the

period you select in the Parameters window, typically an

adjusting period representing the last day of the fiscal year.

- General Ledger automatically creates a separate closing account

for each balancing segment if you specify an account range that

includes multiple balancing segments.

- Closing journals are marked for reversal in the period following

the period the closing journals were generated. To change the

reversal method default, see Changing The Default Reversal

Method, below.

- General Ledger closes functional currency balances only. Foreign

currency balances are ignored.

Additional Notes for MRC

MRC Sets of Books: You should run the Create Balance Sheet Closing

Journals program separately for the MRC primary set of books, and

then for each of the reporting sets of books. Post your generated closing

journals separately as well.

Additional Notes for Average Balances

The Create Balance Sheet Closing Journals program creates journal entries for standard

account balances for sets of books with average balancing enabled.

Companies using average balance processing should create an accounting calendar with

two adjusting periods at the end of the fiscal year. Assign the last day of the year to both

adjusting periods. The first adjusting period is used to generate the Closing Journals. The

second adjusting period is used to reverse the closing journal. This ensures that average

balance calculation is unaffected.

Technical Information

Program Name: GLYCCJ

Short Name:

GLYCCJ1 - Close Process - Create Balance Sheet Closing Journals

GLYCCJ2 - Close Process - Create Income Statement Closing Journals

Forms: FNDRSRUN - Submit Request

Tables:

GL_YEAR_END_BAL_INT_XX

GL_YEAR_END_ACCT_INT_XX

14

Indexes:

GL_YEAR_END_BAL_INT_N1

GL_YEAR_END_BAL_INT_N2

GL_YEAR_END_BAL_INT_N3

GL_YEAR_END_ACCT_INT_N1

GL_YEAR_END_ACCT_INT_U1

Related Bugs/Patches

1339658 - GL Patchset A for 11i, includes Income Offset Account Enhancement.

1288388 - Income Offset Enhancement.

857853 - Document Sequencing doesnt work for closing journals. Module glycje.lpc was

fixed and included in patches 1288388 and 1339658 for 11I, and 757064 and 1178837

for 11.0.

757064 - Backport the Yearend Closing feature to 11.0. (This is also included in Patchset

E - 1178837.)

Glossary of Terms

Income Statement Account - Revenue and Expense accounts.

Balance Sheet Account - Asset, Liability and Owners Equity/Retained

Earnings accounts.

Frequently Asked Questions

Question: Will this feature be backported to 10.7 and 11?

Yes, this feature is backported to Release 11.0.3 with patchset E - 1178837.

It is not backported to release 10.7. As of 10-NOV-2000, the Income

Statement Offset option has not been backported to 11.0.

Question: Is running the Income Statement Closing Journals and Balance Sheet Closing

Journals programs a requirement?

No, these are both optional programs. However, running the Income

Statement Closing Journals program will give you the audit trail for the

Retained Earnings calculation.

Question: How do you size the year end tables that are used with the closing journals

15

programs?

The recommended sizes for the tables and indexes are already pre-seeded and

can be found in the Storage Parameters form (Setup -> System -> Storage).

You can update the values here as you see fit. See Note 141226.1 for more

detailed information.

Question: You ran the closing journals program(s) and now you see zeros in your FSG

Income Statement for the last period of the year. You may see zero balances

in other periods, depending on which period you ran the program in.

You need to reverse the journal you posted that was created by the Income

Statement and/or Balance Sheet Closing Journals programs. See Note

141110.1 for more information.

Sources

Oracle General Ledger Release 11i New Features Class Book

Oracle General Ledger Users Guide Release 11I

Oracle General Ledger Closing Journals Income Statement Offset Option Release

11.5.2 - MetaLink General Ledger Product Documentation