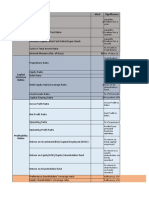

Stock Analysis Checklist

Learn how to research & analyze stocks

Checklist of important points to check when

researching growth stock candidates.

Click Here to Bookmark This Page

Learn How to Analyze Stocks

"Fire Your Stock Analyst"

A Step-by-Step Guide by Harry

Domash

What

Where

One-year

Yahoo! Finance

Price chart

Why

Action

Buying a stock

O.K. to buy

(finance.yahoo.com >

while its in a

if stock

with 50-day

ticker symbol >Charts >)

downtrend is

price is

moving

Click on Technical

dangerous, as it

above its

average

Analysis in the Charts

will likely move

50-day

section. Select 50-day

lower. A stock is

moving

moving average. sample

in a downtrend

average.

if its price is

below its MA,

and in an

uptrend if

above. Use the

50-day MA.

Price/Sales

ratio (P/S)

Valuation

O.K. to buy

check. A stock

if P/S is less

(moneycentral.msn.com >

with a P/S

than

ticker symbol > Financial

above 10 is

10. P/S

Results > Key Ratios >

momentum

ratios

Price Ratios)

priced.

between 3

sample

Buying

and 5 are

momentum

best for

priced stocks is

growth

only

stocks.

recommended

Ratios

in a strong

below 2

MSN Money

Valuation Ratios

�market.

reflect value

priced

stocks.

Cash Flow

MSN Money

per share

Valuation Ratios

Companies with

O.K. to buy

positive

if Cash

operating cash

Flow per

flow are safer

share is a

investments

positive

than cash

number.

burners

(negative cash

flow).

Average

Daily

MSN Money

Institutional

O.K. to buy

Price & Volume

buying is an

if Average

Volume

(moneycentral.msn.com >

important

Daily

(shares)

ticker symbol > Company

catalyst for

Volume is

Report) Look in Stock

stock price

100,000

growth.

shares or

Institutions buy

higher (0.1

hundreds of

mil), and

thousands of

above one

shares and

million

prefer stocks

shares is

with large daily

best.

Activity Section

sample

trading volumes

so they can

easily move in

and out of

positions.

Financial

Morningstar Snapshot

Invest, dont

O.K. to buy

Health

(www.morningstar.com >

gamble! Stick

if Financial

Grade

ticker symbol > Snapshot)

with companies

Health

Morningstar Stock

with solid

Grade = A,

Grades

financials.

B or C

sample

Growth Grade

Consistent

O.K. to buy if

Morningstar Stock

strong sales

Growth Grade =

Grades

growth over

A or B

Morningstar Snapshot

extended

periods

translates to

long-term

�stock price

appreciation.

Lack of

O.K. to buy if

Ownership

institutional

institutions own at

(moneycentral.msn.com >

ownership

least 30% of

means

shares

mutual funds,

outstanding.

Institutional

MSN Money

Ownership

ticker

symbol > Ownership)

sample

pension

plans and

other

institutional

buyers dont

think they will

make money

owning the

stock. Why

would you

want to own

it?

Number of

Analysts Making

Buy/Hold/Sell

Recommendations

Yahoo! Finance

A companys

O.K. to buy if a

(finance.yahoo.com >

performance

total of at least four

can go

analysts are listed

unrewarded

as currently

if nobody

making strong buy,

knows about

buy, hold,

it.

underperform, or

Sufficient

sell

analyst

recommendations.

coverage is

Look only at the

necessary to

total number of

create

analysts making

investor

recommendations,

interest,

not whether there

especially

are more buys

from

than holds, etc.

ticker symbol > Analyst

Opinion)

sample

institutions.

- - - - - - - - - - Advanced Research & Analysis- - - - - - - - - - Calculator Required

�Gross Margin

Trend

Changes in

Gross margin (GM) is

Income Statement

gross margin

the "Gross Profit"

(moneycentral.msn.com >

percentages

divided by "Total

ticker symbol > Financial

from quarter to

Revenue," expressed

Results > Statements >

quarter point to

as a percentage.

changes in a

Calculate the GM for

Interim)

companys

each of the past five

sample

competitive

quarters, and observe

position in its

the GM trend.

MSN Money

Income Statement >

marketplace.

O.K. to buy if the trend

Increasing gross

is flat or increasing.

margins signal a

Ignore variations of

n improving

less than 1%, e.g.

competitive

from41% to 40.5%.

position, and

declining

margins warn of

increasing

competition.

Revenue Growth

Rate

Latest Quarter

compared to

year-ago quarter

Slowing

Use your calculator to

revenue (sales)

compute the most

growth is an

recent quarters

> ticker symbol >

important red

(MRQ) revenue

Financial Highlights)

flag signaling

growth

sample

danger ahead.

rate(percentage) vs. t

Reuters

Financial Highlights

(reuters.com/finance/stocks

he year-ago

quarter.Compare that

figure to the 1 Year

sales growth listed in

the Growth Rate

section.

Ideally, the MRQ

growth should exceed

the 1-year figure,

signaling accelerating

growth. But, it's O.K.

to buy if MRQ growth

is at least 85 % of

1-Year growth.

Forecast Revenue

Growth Rate

Yahoo! Finance

(finance.yahoo.com > ticker

symbol >Consensus

Look at

Check the forecast

consensus

revenue growth

revenue

percentage for the

�Estimates)

forecasts to

current quarter vs. the

sample

determine if

corresponding

historical growth

year-ago quarter.

rates are

Ideally, the growth

expected to

rate should be

continue.

accelerating but

it's O.K. to buy if the

forecast

year-over-year

revenue growth is at

least 80% of the

1-Year

growth from the

previous step.

Accounts

ReceivablesGrowt

h vs. Sales

Growth

Accounts

Compute

Income Statement

receivables are

the ratio for the most

& Balance Sheet

monies owed by

recent and the

(moneycentral.msn.com >

a companys

year-ago quarters.

ticker symbol > Financial

customers for

Ideally the most

goods received.

recent ratio would be

The Accounts

less than year-ago,

Receivables

but it's O.K. to buy if

Ratio (ratio) is

the ratiois the same or

the net

lower than year-ago.

receivables

Ignore increases that

divided by the

are less than 5%, e.g.

revenue for the

from 60% to 64%.

MSN Money

Results > Statements >

Income Statement > Interim

sample

& Balance Sheet > Interim)

sample

same quarter.

A significantly

higher ratio vs.

year-ago is a

red flag pointing

to future

problems.