Cash Flow Statement Indirect Method

The statement of cash flows is one of the components of a company's set of financial

statements, and is used to reveal the sources and uses of cash by a business. It presents

information about cash generated from operations and the effects of various changes in the

balance sheet on a company's cash position.

Under the indirect method of presenting the statement of cash flows, the presentation of this

statement begins with net income or loss, with subsequent additions to or deductions from

that amount for non-cash revenue and expense items, resulting in net income provided by

operating activities.

The format of the indirect method appears in the following example. In the presentation

format, cash flows are divided into the following general classifications:

Cash flows from operating activities

Cash flows from investing activities

Cash flows from financing activities

The indirect method of presentation is very popular, because the information required for it is

relatively easily assembled from the accounts that a business normally maintains in its chart

of accounts. The indirect method is less favored by the standard-setting bodies, since it does

not give a clear view of how cash flows through a business (as is shown under the direct

method of presentation).

Statement of Cash Flows Indirect Method Example

For example, Lowry Locomotion constructs the following statement of cash flows using the

indirect method:

Lowry Locomotion

Statement of Cash Flows

for the year ended 12/31x1

Cash flows from operating activities

Net income

Adjustments for:

$3,000,000

�Depreciation and amortization

Provision for losses on accounts receivable

Gain on sale of facility

$125,000

20,000

(65,000)

80,000

Increase in trade receivables

(250,000)

Decrease in inventories

325,000

Decrease in trade payables

(50,000)

25,000

Cash generated from operations

3,105,000

Cash flows from investing activities

Purchase of property, plant, and equipment

Proceeds from sale of equipment

(500,000)

35,000

Net cash used in investing activities

(465,000)

Cash flows from financing activities

Proceeds from issue of common stock

150,000

Proceeds from issuance of long-term debt

175,000

Dividends paid

(45,000)

Net cash used in financing activities

280,000

Net increase in cash and cash equivalents

2,920,000

Cash and cash equivalents at beginning of period

2,080,000

Cash and cash equivalents at end of period

Related Topics

Statement of cash flows overview

Direct method

How to prepare a cash flow statement

$5,000,000

�Cash Flow Statement Direct Method

The direct method of presenting the statement of cash flows presents the specific cash flows

associated with items that affect cash flow. Items that typically do so include:

Cash collected from customers

Interest and dividends received

Cash paid to employees

Cash paid to suppliers

Interest paid

Income taxes paid

The advantage of the direct method over the indirect method is that it reveals operating cash

receipts and payments.

The standard-setting bodies encourage the use of the direct method, but it is rarely used, for

the excellent reason that the information in it is difficult to assemble; companies simply do

not collect and store information in the manner required for this format. Using the direct

method may require that the chart of accounts be restructured in order to collect different

types of information. Instead, they use the indirect method, which can be more easily derived

from existing accounting reports.

Statement of Cash Flows Direct Method Example

Lowry Locomotion constructs the following statement of cash flows using the direct method:

Lowry Locomotion

Statement of Cash Flows

for the year ended 12/31/x1

Cash flows from operating activities

�Cash receipts from customers

$45,800,000

Cash paid to suppliers

(29,800,000)

Cash paid to employees

(11,200,000)

Cash generated from operations

4,800,000

Interest paid

(310,000)

Income taxes paid

(1,700,000)

Net cash from operating activities

$2,790,000

Cash flows from investing activities

Purchase of property, plant, and equipment

Proceeds from sale of equipment

(580,000)

110,000

Net cash used in investing activities

(470,000)

Cash flows from financing activities

Proceeds from issuance of common stock

1,000,000

Proceeds from issuance of long-term debt

500,000

Principal payments under capital lease obligation

(10,000)

Dividends paid

(450,000)

Net cash used in financing activities

1,040,000

Net increase in cash and cash equivalents

3,360,000

Cash and cash equivalents at beginning of period

1,640,000

Cash and cash equivalents at end of period

$5,000,000

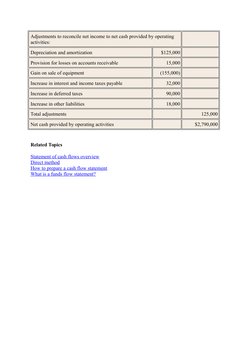

Reconciliation of net income to net cash provided by operating activities:

Net income

$2,665,000

�Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization

Provision for losses on accounts receivable

Gain on sale of equipment

$125,000

15,000

(155,000)

Increase in interest and income taxes payable

32,000

Increase in deferred taxes

90,000

Increase in other liabilities

18,000

Total adjustments

Net cash provided by operating activities

Related Topics

Statement of cash flows overview

Direct method

How to prepare a cash flow statement

What is a funds flow statement?

125,000

$2,790,000