0% found this document useful (0 votes)

59 views1 pageFinancial Formula Sheet

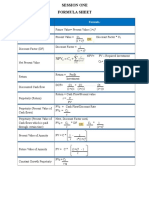

This document contains formulas for calculating present value (PV), future value (FV), interest rate (i), opportunity cost (Oppco st), payment amount (PMT), and price of a discounted instrument. It includes formulas for calculating PV and FV using interest compounded annually or continuously, as well as formulas for calculating yield, discount percentage, and price of a security given its face value, maturity date, and current market price.

Uploaded by

qwerty4324Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

59 views1 pageFinancial Formula Sheet

This document contains formulas for calculating present value (PV), future value (FV), interest rate (i), opportunity cost (Oppco st), payment amount (PMT), and price of a discounted instrument. It includes formulas for calculating PV and FV using interest compounded annually or continuously, as well as formulas for calculating yield, discount percentage, and price of a security given its face value, maturity date, and current market price.

Uploaded by

qwerty4324Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd