0% found this document useful (0 votes)

48 views2 pages2011 Compliance Audit: Indirect Taxes

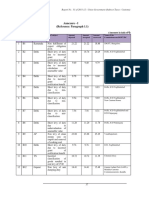

This report from the Comptroller and Auditor General of India examines indirect tax collection by Indian customs authorities for the year ending March 2011. It finds issues with duty exemption programs, incorrect assessment of customs duties, improper use of exemption notifications, and misclassification of goods leading to short collection of duties. The report contains 5 chapters analyzing customs receipts, exemption schemes, incorrect assessments, exemptions, and misclassification, with recommendations to strengthen controls and correct deficiencies.

Uploaded by

Mohsina ChinalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

48 views2 pages2011 Compliance Audit: Indirect Taxes

This report from the Comptroller and Auditor General of India examines indirect tax collection by Indian customs authorities for the year ending March 2011. It finds issues with duty exemption programs, incorrect assessment of customs duties, improper use of exemption notifications, and misclassification of goods leading to short collection of duties. The report contains 5 chapters analyzing customs receipts, exemption schemes, incorrect assessments, exemptions, and misclassification, with recommendations to strengthen controls and correct deficiencies.

Uploaded by

Mohsina ChinalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd