100%(1)100% found this document useful (1 vote) 4K views2 pagesForm 60

Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content,

claim it here.

Available Formats

Download as PDF or read online on Scribd

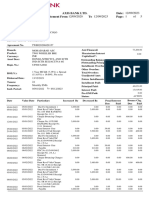

Toon INCOME-TAX RULES, 1962

We understand your word “FORM NO. 60 [See second proviso to rule 1148]

Form for declaration to be filed by an individual or a person (not being @ company or firm) who does not have @ permanent account

umber and who enters into any transaction specified in rule 1148

First Name Date of Bitty Incorporation of declarant

1, | Middle Name 2) 5lolululyly|yly

Sumame

Father's Name (in ease of individual) First Name

3, | Middle Name

‘Sumame

4, | Fiat’ Room No. 5i]| Floor No.

6. [Name of premises 7. | Block Name/No.

8, | Road/ Street/ Lane 9, | Area’ Locality

10, | Town? City Ai, | District 12 | State

43 | Pin code H] Telephone Number (wih STD code) 15] Mobile No.

46. | Amount ofransactin (Rs In case of transaction in joint names, number

47, | Date oftransacton [DDT M[MIVLY [YY] ©| of persons involved in the transaction:

19. | Mode oftransaction |Cicash, Cicheque, LiCard,L] DratvBanker's Cheque, LlOntine transfer, other:

20. | Aachaar Number issued by UIDAI (iFavailable)

21, | f applied for PAN and it is not yet generated enter| D M M ¥ ¥ ¥ ¥

- | date of application and acknowledgement number:

22, | PAN not applied, fil estimated total ncome (Including income of spouse, minor child eto. as per section 64 of Income-tax Act,

* | 1961) for the financial year in which the above transaction is held

@, | Agricultural income (Rs):

b._| Other than agricultural income (Rs)

Document code | Document Name and address of the authority

Details of document being produced in

2g | support of identity in Colunmn 1 (Refer identtcation number | issuing the docurent

Instruction overteaf)

Details of document being produced in [Document code | Document Name and address of the authority

24, | support of address in Columns 4 to 13 identification number | issuing the document

(Refer Instruction overleaf)

Verification

4 do hereby declare that what is stated above is true to the best of my knowledge

arid belleh. | farther dedlare that [do nat have a Permanent Account Number and my/ our estimated total income (including income of spouse,

minor child etc. as per section 64 of Incometax Act, 1961) computed in accordance with the provisions of Income-tax Act, 1961 forthe financial

‘year in uhich the above transaction is held will be less than maximum amount not chargeable to tax

Verted today, the day of 0,

Place: (Signature of Declarant)

Transaction Type :

2 05- Investment in time deposit CO 06- Deposit in cash

1 09-Opening an account (other than savings andtime deposit) C10 Account with balance exceeding Rs. 50,000

1 11- Purchase of bank drafts or pay orders 1 12-Appiication for issue of a creditor debt card

G1 {4-Faymentin comeston wi taveltcanyfocign county} 18- Payment forgrchase, or emitance cus nda,

O 22-Not classified above ..

Note:

1 Before signing the decleraton, the dectaart should setisty himself that the infomation fumished in his fornis ue, comect and complete in allrespects. Any

person making a ake statement inthe declaration shal be aol To paseauton urxer secon 277 atthe Ineame tx At, 186) and on sonvidion be punishable,

Tivn3 cage nhere ta sought to be evaded oxcoods byonly fv lah rupees, wih gorous imprisonment which shal not bo (ass than six months but

Uihich may extend to seven years and with fine, INCOME-TAX RULES, 1302

uy inanyother ease, vain ngereus imprsonmeri hier shal nel Be ess than Fee manins out which may extend two yaers ancwith re

2.The person accoptng the deviaration shall ro gocept fe declaration whe the ameurlafinceme ofthe nature referred toin tem 20) exoeods the maximum

amotrt which fs nef chargeable fa lx unos PAN ts agpled forand eaurnn 2115 duly Tiled�Instruction:

(1) Documents which can be produced in support of identity and address (not required if applied for PAN and item 20

is filled: -

si. Nature of Document Document | Protect | Roraes

‘A_[ For individuals and HUF

1. [AADHAR card 1. Yes Yes

2. [ Bank/Post office passbook bearing photograph of the person 2. Yes Yes

3, [Elector’s photo identity card 2 YES Yes

4 | Ratlon/PubeDitnbuton Sytem card beating photograph ofthe de YES MES

| Driving License 5 YES Yes

6. [Passport 6. Yes Yes

7. [ Pensioner Phato card 7 YES YES

8, | National Rural Employment Guarantee Scheme (NREGS) Job card [__&. Yes Yes

9. [ Caste or Domicile certificate bearing photo ofthe person a YES Yes

10. | Certificate of identityladdrees signed by a Member of Parliament

‘of Member of Legislative Assembly or Municipal Councillor or a] 40. yes ves

Gazetted Officer as per annexure A prescribed in Form 404,

1. | Gatti trom employer as per annexure B presoibed in Form 1". YES Yes

72. | Kisan passbook beating pholo 2 YES NO)

13. | Arm's license 3. Yes NO)

14 | Cental Government Health Scheme fExsericemen Contibuiony [44 = NG:

1: | het Mety card enued by the goverment. Pulle Sector Un ae TES no

16, | Electricity bill (Not more than 3 months old) 16. NO. Yes

17. | Landline Telephone bill (Not more than 3 months old) 47. NO Yes

18, | Weter bill (Not more than 3 months old) 18. NO Yes

18. | Consumer gas cardbookor piped gas bil Not more than months | 4g Ne a

20, [ Bank Account Statement (Not more than 3 months old) 20. NO Yes

21, | Credit Card statement (Nat mare than 3 months old) 24. NO) YES

22, | Depositary Account Statement (Not more than 3 months old) 22. NO YES

23, | Property registration document 23. NO YES

24, | Allotment letter of accommodation fom Government 24. NO. Yes

25, | Passport of spouse bearing name ofthe person 25. NO YES

26. | Property tax payment receipt (Not more than one year old) 26. NO YES

B_| For Association of persons (Trusts)

apy of ust deed or copy of caioate of regidraion sued by Chany | a7, Yes Yes

‘© _| For Association of persons (other than Trusts) or Body of Individu-

als or Local authority or Artificial Juridical Person)

Copy of Agreement or copy of certificate of registration issued by Charity

commissioner or Registrar of Cooperative society or any other com-

petent authority or any other document criginating from any Central or 28. Yes Yes

State Government Department establishing identity and address of such

person.

(2) Incase of a transaction in the name of a Minor, any of the above mentioned documents as proof of Identity

and Address of any of parents/guardians of such minor shall be deemed to be the proof of identity and

address for the minor declarant, and the declaration should be signed by the parent/guardian.

(3) For HUF any document in the name of Karta of HUF is required.

(4) In case the transaction is in the name of more than one person the total number of persons should be

mentioned in SI. No. 18 and the total amount of transaction is to be filled in SI. No. 18.

In case the estimated total income in column 22b exceeds the maximum amount not chargeable to tax the

person should apply for PAN, fill out item 21 and furnish proof of submission of application.