0% found this document useful (0 votes)

206 views6 pagesOrder Types

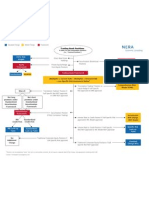

The document describes over 40 order types supported by Trader Workstation that help traders limit risk, improve execution speed, seek price improvement, use discretion, time the market, and simplify the trading process. The order types are grouped into categories like Limit Risk, Speed of Execution, and Price Improvement. Each order type lists the products it supports and a brief description. Clickable links provide more detailed information on specific order types.

Uploaded by

Carlos EduardoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

206 views6 pagesOrder Types

The document describes over 40 order types supported by Trader Workstation that help traders limit risk, improve execution speed, seek price improvement, use discretion, time the market, and simplify the trading process. The order types are grouped into categories like Limit Risk, Speed of Execution, and Price Improvement. Each order type lists the products it supports and a brief description. Clickable links provide more detailed information on specific order types.

Uploaded by

Carlos EduardoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Order Types: Provides a comprehensive list and explanation of different order types available for trading, each with descriptions and applicable product types.

- Speed of Execution: Covers types of market orders that prioritize timely execution of trades and their characteristics.

- Discretion: Addresses discretionary orders which give traders the flexibility to decide execution specifics at their own discretion.

- Simplify Trading: Illustrates order types intended to simplify the trading process, including their specific attributes and uses.

- Special Order Attributes: Details unique attributes of certain orders, such as odd lot considerations and very small price increments in trades.