0% found this document useful (0 votes)

127 views11 pagesBusiness Financial Plan Template

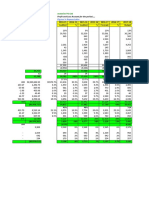

This document provides guidelines for filling out a financial plan template to start a new business. It includes sections for key company information like location and taxes; products/services including pricing, costs, and example projections; employees and wages; initial investments and working capital needs; recurring operating expenses; and sources of equity and financing. The document emphasizes simplicity and focuses on providing essential information to build a robust financial plan to attract funding. Examples are provided to illustrate how to fill out each section.

Uploaded by

Evert TrochCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

127 views11 pagesBusiness Financial Plan Template

This document provides guidelines for filling out a financial plan template to start a new business. It includes sections for key company information like location and taxes; products/services including pricing, costs, and example projections; employees and wages; initial investments and working capital needs; recurring operating expenses; and sources of equity and financing. The document emphasizes simplicity and focuses on providing essential information to build a robust financial plan to attract funding. Examples are provided to illustrate how to fill out each section.

Uploaded by

Evert TrochCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 11