0% found this document useful (0 votes)

273 views16 pagesShare and Bond Brokers in Chennai

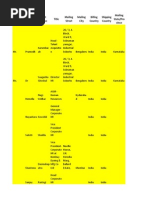

The document provides information about the Relative Strength Index (RSI) technical indicator. The RSI is used to measure the speed and change in price movements of a security or market. It compares the magnitude of recent gains to recent losses to determine overbought and oversold conditions. The RSI values range from 0 to 100, with readings above 70 indicating an overbought state and below 30 indicating an oversold state. The document explains how the RSI is calculated using exponential moving averages and discusses how divergences in the RSI versus price can signal trend reversals.

Uploaded by

Vyshnavi KarthicCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

273 views16 pagesShare and Bond Brokers in Chennai

The document provides information about the Relative Strength Index (RSI) technical indicator. The RSI is used to measure the speed and change in price movements of a security or market. It compares the magnitude of recent gains to recent losses to determine overbought and oversold conditions. The RSI values range from 0 to 100, with readings above 70 indicating an overbought state and below 30 indicating an oversold state. The document explains how the RSI is calculated using exponential moving averages and discusses how divergences in the RSI versus price can signal trend reversals.

Uploaded by

Vyshnavi KarthicCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd