0% found this document useful (0 votes)

84 views2 pagesFinancial Ratios and Performance Metrics

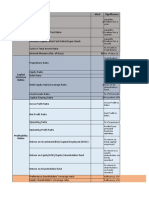

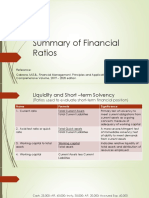

This document contains definitions and calculations for various financial ratios that can be used to analyze a company's liquidity, capital structure, profitability, operating performance, asset utilization, and market valuation. It includes liquidity ratios like current ratio and acid test ratio, leverage ratios like debt-to-equity ratio, return on investment ratios like return on assets and return on equity, operating ratios like gross profit margin and net profit margin, turnover ratios like inventory turnover and cash turnover, and market ratios like price-to-earnings ratio and dividend yield. It also briefly discusses some Indonesian accounting standards related to financial statements, cash flow statements, investments, inventories, property and equipment, intangible assets, assets held for sale,

Uploaded by

Natasha WijayaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

84 views2 pagesFinancial Ratios and Performance Metrics

This document contains definitions and calculations for various financial ratios that can be used to analyze a company's liquidity, capital structure, profitability, operating performance, asset utilization, and market valuation. It includes liquidity ratios like current ratio and acid test ratio, leverage ratios like debt-to-equity ratio, return on investment ratios like return on assets and return on equity, operating ratios like gross profit margin and net profit margin, turnover ratios like inventory turnover and cash turnover, and market ratios like price-to-earnings ratio and dividend yield. It also briefly discusses some Indonesian accounting standards related to financial statements, cash flow statements, investments, inventories, property and equipment, intangible assets, assets held for sale,

Uploaded by

Natasha WijayaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd