100% found this document useful (1 vote)

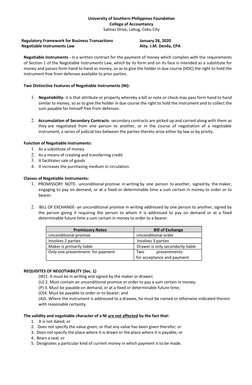

977 views8 pagesRFBT Negotiable Instruments Law

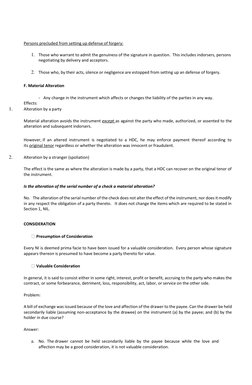

No, D cannot hold A liable. Even though D is an HDC, the check was incomplete and undelivered. A merely signed the blank check but did not deliver it to anyone with authority to complete and negotiate it. Since the check was completed and delivered without A's authority, it is not a valid contract against A, even in the hands of an HDC like D. Subsequent indorsers like B and C may be liable, but not the original signer A in this case.

Uploaded by

Katzkie Montemayor GodinezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

977 views8 pagesRFBT Negotiable Instruments Law

No, D cannot hold A liable. Even though D is an HDC, the check was incomplete and undelivered. A merely signed the blank check but did not deliver it to anyone with authority to complete and negotiate it. Since the check was completed and delivered without A's authority, it is not a valid contract against A, even in the hands of an HDC like D. Subsequent indorsers like B and C may be liable, but not the original signer A in this case.

Uploaded by

Katzkie Montemayor GodinezCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd