50% found this document useful (2 votes)

1K views1 pageSt. Luke's Medical Center, Inc Vs CIR

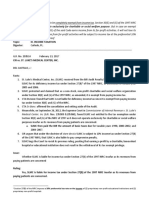

1) A hospital is exempt from income tax if it is organized and operated exclusively for charitable purposes. Otherwise, it pays a 10% income tax rate.

2) St. Luke's Medical Center was assessed deficiency income tax for 2005-2006 but claimed exemption. The Supreme Court previously ruled SLMC pays the 10% tax rate as it is non-profit but not charitable.

3) The Supreme Court reiterated SLMC must pay the 10% income tax rate as it is not operated exclusively for charity. However, SLMC is not required to pay penalties for non-filing as the previous ruling was made after the tax years in question.

Uploaded by

Vel JuneCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

50% found this document useful (2 votes)

1K views1 pageSt. Luke's Medical Center, Inc Vs CIR

1) A hospital is exempt from income tax if it is organized and operated exclusively for charitable purposes. Otherwise, it pays a 10% income tax rate.

2) St. Luke's Medical Center was assessed deficiency income tax for 2005-2006 but claimed exemption. The Supreme Court previously ruled SLMC pays the 10% tax rate as it is non-profit but not charitable.

3) The Supreme Court reiterated SLMC must pay the 10% income tax rate as it is not operated exclusively for charity. However, SLMC is not required to pay penalties for non-filing as the previous ruling was made after the tax years in question.

Uploaded by

Vel JuneCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Issues: Identifies the legal questions and challenges under consideration in this case related to tax exemption qualifications.

- Facts: Details the background information and factual context surrounding the tax deficiencies assessed against the hospital.

- Doctrine to Remember: This section summarizes the primary legal principles that apply to the case regarding hospital tax exemptions and requirements for non-profit organizations.

- Ruling: Presents the court's decision, including interpretations of law and implications for tax assessment.