100% found this document useful (1 vote)

690 views8 pagesPromissory Note

1) Beatrice Ventura has taken out a home loan of $136,000 from Wells Fargo Mortgage to buy a house located at 363 N Franklin St in Hemet, California.

2) The loan does not charge interest and must be repaid in a single lump sum payment on an unspecified due date.

3) Failure to repay the full amount by the due date will result in default, allowing Wells Fargo to seek repayment from Beatrice Ventura's personal assets.

Uploaded by

andrew & lateacha venturaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

690 views8 pagesPromissory Note

1) Beatrice Ventura has taken out a home loan of $136,000 from Wells Fargo Mortgage to buy a house located at 363 N Franklin St in Hemet, California.

2) The loan does not charge interest and must be repaid in a single lump sum payment on an unspecified due date.

3) Failure to repay the full amount by the due date will result in default, allowing Wells Fargo to seek repayment from Beatrice Ventura's personal assets.

Uploaded by

andrew & lateacha venturaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Parties: Defines the parties involved in the promissory note agreement, specifying the borrower and lender.

- Payment Terms: Details the terms of payment, including the lump sum payment and applicable interest.

- Promise to Pay: Outlines the borrower's promise to pay the principal amount as per agreed terms.

- Default and Acceleration: Details the conditions under which the borrower is considered in default and the consequences thereof.

- Prepayment: Describes the terms under which the borrower may prepay the note without penalty.

- Attorney Fees: States the responsibility for attorney fees in the case of legal action to enforce the promissory note.

- Collateral: Indicates the collateral backing the loan outlined in the promissory note.

- Recourse: Specifies the lender's recourse options in case of default or breach by the borrower.

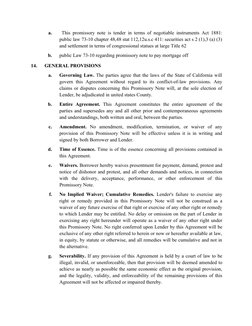

- General Provisions: Includes provisions about governing law, waivers, time of essence, and entire agreement clause.

- Miscellaneous Terms and Conditions: Covers additional terms and conditions applicable to the agreement not covered in other sections.

- Execution: Specifies the signatures required from the borrower, lender, and witnesses to execute the promissory note.

- Notary Acknowledgment: Contains the notary acknowledgment form to verify the identity of the parties signing the document.

- Instructions for Your Promissory Note: Provides instructions on how to fill out and execute the promissory note form properly.

![[Signature page to Promissory Note]

IN WITNESS WHEREOF, the parties have executed this Promissory Note on _____________.

Bo](https://screenshots.scribd.com/Scribd/252_100_85/326/454021649/5.jpeg)