0% found this document useful (0 votes)

47 views16 pagesBusiness Transaction Records 2019-2020

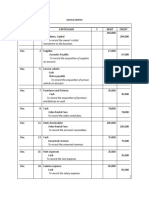

The document appears to be a ledger recording transactions for a business over the month of February 2020. It records initial investments and purchases of equipment totaling $105,000. It also records ongoing business expenses like taxes, rent, salaries and supplies as well as income from services and collections. The various debit and credit entries maintain the balance sheet accounts for the business throughout the month.

Uploaded by

John Carlo AmodiaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

47 views16 pagesBusiness Transaction Records 2019-2020

The document appears to be a ledger recording transactions for a business over the month of February 2020. It records initial investments and purchases of equipment totaling $105,000. It also records ongoing business expenses like taxes, rent, salaries and supplies as well as income from services and collections. The various debit and credit entries maintain the balance sheet accounts for the business throughout the month.

Uploaded by

John Carlo AmodiaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd