40% found this document useful (10 votes)

23K views6 pagesProblems and Solutions Chapter 1 Advanced Accounting PDF

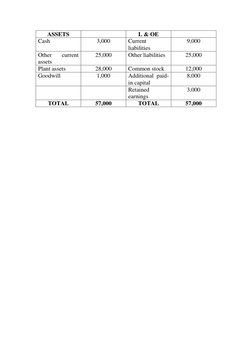

Jose SA acquired Carlos SA by issuing 200,000 common shares worth $10 million. Jose and Carlos' pre-acquisition balance sheets are provided. The post-acquisition balance sheet shows the combination of their assets and liabilities, with an investment in Carlos SA of $10 million and goodwill of $1 million on the asset side.

Uploaded by

Meera KhalilCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

40% found this document useful (10 votes)

23K views6 pagesProblems and Solutions Chapter 1 Advanced Accounting PDF

Jose SA acquired Carlos SA by issuing 200,000 common shares worth $10 million. Jose and Carlos' pre-acquisition balance sheets are provided. The post-acquisition balance sheet shows the combination of their assets and liabilities, with an investment in Carlos SA of $10 million and goodwill of $1 million on the asset side.

Uploaded by

Meera KhalilCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Problem 1-2: Acquisition of Carlos SA

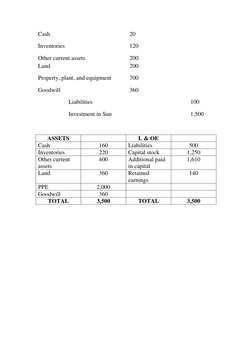

- Problem 1-3: Acquisition of Sun by Pam

- Problem 1-3: Continued Transaction Details