0%(2)0% found this document useful (2 votes)

3K views25 pagesBaysalupisan C8 Exercises PDF

Uploaded by

Feliz Victoria CañezalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0%(2)0% found this document useful (2 votes)

3K views25 pagesBaysalupisan C8 Exercises PDF

Uploaded by

Feliz Victoria CañezalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

- Exercises

- Problems

- Multiple Choice Questions

- True or False Section

- Identification Section

- Multiple Choice – Theory and Problems

- Test Materials

st . Chapter 8— Organization and Formation rey

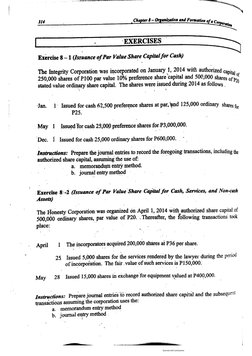

Value Share Capital for Cash)

The Integrity Corporation was incorporated on January 1, 2014 with authorized capt

250,000 shares of P100 par value 10% preference share ‘capital and 500,000 shares of pt

stated value ordinary share capital. The shares were issued during 2014 a8 follows.

Jan, 1° Issued for cash 62,500 preference shares at par, nd 125,000 ordinary shares fy

P25,

May 1 Issued for cash 25,000 preference shares for-P3,000,000.

Dec, { Issued for cash 25,000 ordinary shares for P600,000.

Instructions: Prepare the journal entries to record the foregoing transactions, including the

authorized share capital, assuming the use of:

a. memorandum entry method.

b. journal entry method

Exercise 8--2 (Issuance of Par Value Share Capital for Cash, Services, and Non-cash

Assets)

The Honesty Corporation was organized on April 1, 2014 with authorized share capital of

500,000 ordinary shares, par value of P20. . Thereafter, the following transactions took

place:

April 1 The incorporators acquired 200,000 shaires at P36 per share.

25 Issued 5,000 shares for the services rendered by the lawyer during the period

of incorporation, The fair. value of such services is P150,000.

May 28 _Issued 15,000 shares in exchange for equipment yalued at P400,000.

ent

Instructions: Prepare journal entries to record authorized share capital and the subsequ

transactions assuming the corporation uses the:

‘a. memorandum entry method

b. journal entry method

_chapir 8 Orgetzaton and Formation of « Corporation us

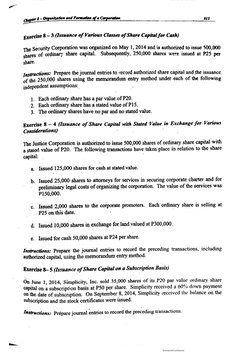

gxercise 8~3 (Issuance of Various Classes of Share Capital for Cash)

‘The Security Corporation was organized on May 1, 2014 and is authorized to issue 500,000

shares of ordinary share capital, Subsequently, 250,000 shares were issued at P25 per

share.

Instructions: Prepare the journal entries to record authorized share capital and the issuance

of the 250,000 shares using the memorandum entry method under each of the following

independent assumptions: .

1. Each ordinary share has a par value of P20.

2), Bach ordinary share has a stated value of P15.

3. The ordinary shares have no par and no stated value.

Exercise 8 — 4 (Issuance of Share Capital with Stated Value in Exchange for Various

Considerations)

‘The Justice Corporation is authorized to issue 500,000 shares of ordinary share capital with

a stated value of P20. The following transactions have taken place in relation to the share

capital:

a. Issued 125,000 shares for cash at stated value.

b. Issued 25,000 shares to attorneys for services in securing corporate charter and for

preliminary legal costs of ‘organizing the corporation. The value of the services was

P150,000.

¢. Issued 2,000 shares to the corporate promoters. Each ordinary share is selling at

P25 on this date. .

4. Issued 10,000 shares in exchange for land valued at P300,000.

e. Issued for cash 50,000 shares at P24 per share.

Instructions: Prepare the journal entries to record the preceding transactions, including

authorized capital, using the memorandum entry method.

Exercise 8- 5 (Issuance of Share Capital oni a Subscription Basis)

On June 1, 2014, Simplicity, Inc. sold 35,000 shares of its P20 par value ordinary share

capital on a subscription basis at PS0 per share. Simplicity received a 60% down payment

on the date of subscription. On September 8, 2014, Simplicity received the balance on the

subscription and the stock certificates were issued.

Instructions: Prépare journal entries to record the preceding transactions.

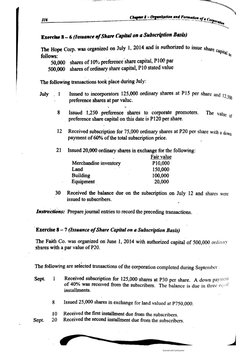

Exercise 8 — 6 (Issuance of Share Capital on @ Subscription Basis)

‘The Hope Corp. was organized on July 1, 2014 and is authorized to issue share cq

follows: . . Pital

50,000 shares of 10% preference share capital, P100 par

500,000 shares of ordinary share capital, P10 stated value

‘The following transactions took place during July:

July. 1 Issued to incorporators 125,000 ordinary shares at PIS per share and 12

preference shares at par valuc.

8 Issued 1,250 preference shares to corporate promoters. The value

preference share capital on this date is P120 per share.

12 Received subscription for 75,000 ordinary shares at P20 per share witha doy

payment of 60% of the total subscription price.

21 Issued 20,000 ordinary shares in exchange for the following:

Fair value

Merchandise inventory P10,000

Land 150,000

Building 100,000

Equipment 20,000

30 Received the balance due on the subscription on July 12 and shares were

issued to subscribers.

Instrections: Prepare journal entries to record the preceding transactions.

Exercise 8 ~7 (Issuance of Share Capital on a Subscription Basis)

The Faith Co. was organized ori June 1, 2014 with authorized capital of 500,000 ordinacy

shares with a par value of P20.

‘The following are selécted transactions of the corporation completed during September

Sept. 1 Received subscription for 125,000'shares at P30 per share. A down pay:

of 40% was received from the subscribers. The balance is due in three ¢«)"

installments.

8 Issued 25,000 shares in exchange for land valued at P750,000.

10 Received the first installment due from the subscribers.

Sept. 20 Received the second installment due from the subscribers.

Organteation and Formation of « Corporation wT

nape 8

30 Received the final installment from all subscribers and shares of stock were

issued.

Instructions: Prepare journal entries to record the preceding transactions.

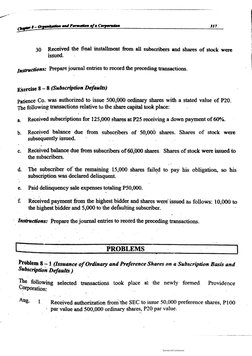

Exercise 8 - 8 (Subscription Defaults)

Patience Co. was authorized to issue 500,000 ordinary shares with a stated value of P20.

‘The following transactions relative to the share capital took place:

a. Received subscriptions for 125,000 shares at P25 receiving a down payment of 60%.

b, Received balance due from subscribers of 50,000 shares. Shares of stock were

subsequently issued.

c Received balance due from subscribers of 60,000 shares. Shares of stock were issued to

the subscribers.

4. The subscriber of the remaining 15,000 shares failed to pay his obligation, so his

subscription was declared delinquent.

©. Paid delinquency sale expenses totaling P50,000.

£ Received payment from the highest bidder and shares were issued as follows: 10,000 Co

the highest bidder and 5,000 to the defaulting subscriber.

Instructions: Prepare the journal entries to record the preceding transactions.

PROBLEMS

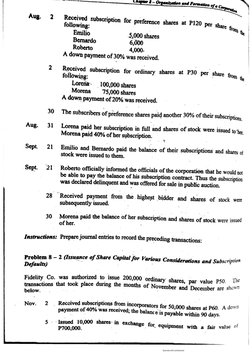

Problem 8 — 1 (Issuance of Ordinary and Preference Shares on a Subscription Basis and

Subscription Defaults )

The following selected transactions took place at the newly formed Providence

ration:

Aug. 1 Received authorization from the SEC to issue 50,000 preference shares, P100

~ par value and 500,000 ordinary shares, P20 par value.

— er S| and Formation of ¢

|

Aug. 2° Received subsctiption for preference shares at P120 Per share

following: from, th

Emilio 5,000 sh

Bemardo 3,000 ees |

Roberto 4,000. |

A down payment of. 30% was received.

2 Received subscription for ordinary shares at P30 per I

following: ° Per He fom

Loren _ 100,000 shares

Morena —_75,000 shares

A down payment of 20% was received.

30 The subscribers of preference shares paid another 30% of their subscriptions

Aug. 31 Lorena paid her Subscription in full and shares of stock were issued to ‘her,

Morena paid 40% of her subscription.

Sept. 21 Emilio and Bemardo Paid the balance of their subscriptions and shares of

stock were issued to them.

Sept. 21 Roberto officially informed the officials of the corporation that he would nt

be able to pay the balance of his subscription contract. Thus the subscription

was declared delinquent and was offered for sale in public auction,

28 Received payment from the highest bidder and shares of stock were

subsequently issued.

30 Morena paid the balance of her subscription and shares of stock were issued

of her. 0

Instructions: Prepare journal entries to record the Preceding transactions:

Problem 8 - 2 (Issuance of Share Capital for Various Considerations and Subscription

Defaults)

Fidelity Co. was authorized to issue 200,000 ordinary’ shares, par value P50. The

transactions that took place during the months of November and Deceinber are show?

below.

Nov. 2. . Received subscriptions from incorporators for 50,000 shares at P60. A dows

payment of 40% was received; the balance is payable within 90 days.

5 - Issued 10,000 shares: in exchang:

P700,000.

© for. equipment with a fair value of

(nagar 1 Onponssaion and Formation of « Corporation

7 “9

16 Received subseriptions for 30,000

‘ . shares at PO”) with a dow

M payment of

Ny

20s The balance 1s payable within 30 days

rk Revered te halance due from ine

shares. The shares of stock were (sa) ns Eee

te 1h Kecerved the balance due from subscribers of 25,000 shares on Nov. 16. Th

. The

Comresporsting shares of stock were issued

Ih Declared +s delinquent shares the subsenption for $,000 shares.

20 Paid advestising expenses of P15,000 relative to the del:nquency sale

2h Received payment from highest bidder and shares were issued

Instructions: Prepare jr samnal entries to reourd the preceding transactions

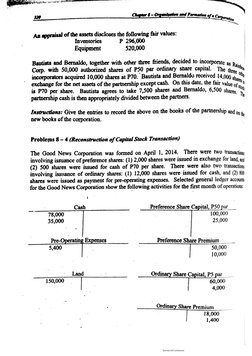

orporation of a Partnership: New books for the Corporation)

iy for Bautista and Bernaldo, prepared on September 30,

cagy and lasses in the ratio of 3:1, respectively

Problem 8 3 (Inc

A sutement of finan sal pose

appears below Partners sare cary

Bautista and Bernaldo

Statement of Finazc1al Position

September 36, 2014

wets

Cash Pp 42,000

Accounts Recervable P 124,000 5

Less Allowance for nee Sire Je Acenunt 12,000 112,000

Inventones > [Link] 206,000

Equipment ' a 00 440,000

Less Accumulated Deprec 210" ee

Goodwill

Pp 900,000

Total Assets

Luatslices and Beat p 104,000

Accounts Payable 394,000

Bautista, Capital 402,000

Bemaldo, Capital _P 90,000

x's Fyuity

Total Larbilites and Owne!

rte ttn,

‘An appraisal of the assets discloses the following fair values:

Inventories P 296,000

Equipment 520,000

Bautista and Bernaldo, together with other three friends, decided to incorporate as Rai

Corp. with 50,000 authorized shares of P50 par ordinary share capital. The three hoy

incorporators acquired 10,000 shares at P70, Bautista and Bernaldo received 14,009 g My

exchange for the net assets of the partnership except cash. On this date, the fair value of."

is P70 per share. Bautista agrees to take 7,500 shares and Bernaldo, 6,500 shares,

partnership cash is then appropriately divided between the partners. Te

Instructions: Give the entries to record the above on the books of the partnership and ont

new books of the corporation. :

Problems 8 — 4 (Reconstruction of Capital Stock Transaction)

The Good News Corporation was formed on April 1, 2014. There were two transects

involving issuance of preference shares: (1) 2,000 shares were issued in exchange for land, af

(2) 500 shares were issued for cash of P70 per share. There were also two transaction;

involving issuance of ordinary shares: (1) 12,000 shares were issued for cash, and (2) 80

shares were issued as payment for pre-operating expenses. Selected general ledger accouns

for the Good News Corporation 'show the following activities for the first month of operations:

_ Cash Preference Share Capital, P50 par__

78,000 100,000

25,000

35,000

Pre-Operating Expenses Preference Share Premium

50,000

10,000

Land Ordinary Share Capital, PS par

150,000 60,000

4,000

——___Ordinary Share Premium

18,000

1,400

sastructions:

Reconstruct the journal entries made for shirs capital transactions during the month of

April.

Determine the total number of preference and ordinary shares outstanding.

2

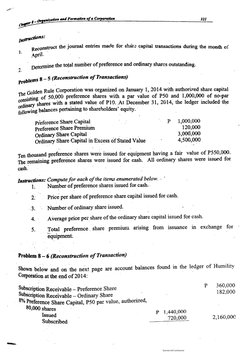

proplents 8-5 Reconstruction of Transactions)

Golden Rule Corporation was organized on January 1, 2014 with authorized share capital

THe ging of 50,000 preference shares with a par value of P50 atid 1,000,000 of no-par

covinary shases with a stated value of P10. At December 31, 2014, the ledger included the

ing balances pertaining to shareholders’ equity.

followi

Preference Share Capital P_ 1,000,000

Preference Share Premium 120,000

Ordinary Share Capital . 3,000,000

Ordinary Share Capital in Excess of Stated Value . 4,500,000

‘Ten thousand preference shares were issued for equipment having a fair value of P550,000.

‘The remaining preference shares were issued for cash. All ordinary shares were issued for

cash.

Instructions: Compute for each of the items enumerated below.

1. Number of preference shares issued for cash.

Price per share of preference share capital issued for cash.

Number of ordinary share issued.

Average price per share of the ordinary share capital issued for cash.

ye en

Total preference. share premiura arising from issuance in exchange for

equipment.

Problem 8 - 6 (Reconstruction of Transaction)

Shown below and on the next page are account balances found in the ledger of Humility

Corporation at the end of 2014:

Subscription Receivable — Preference Shere P 360,000

Subscription Receivable — Ordinary Share 182,000

8% Preference Share Capital, P50 par value, authorized,

80,000 shares

Issued P 1,440,000

0,000_ 2,160,000

Subscribed

™

Chapter 3 — Orgentzation and Formation of « Cor

522

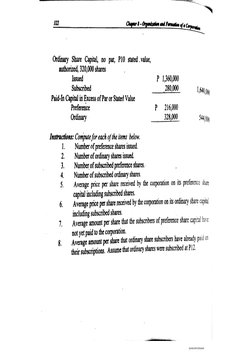

Ordinary Share Capital, no par, P10 stated . value,

authorized, 320,000 shares

Issued P. 1,360,000

Subscribed "280,000 1640,

Paid-In Capital in Excess of Par or Stated Value mn

Preference P 216,000

Ordinary 328,000 544,00

Instractions: Compute for each of the items below.

1 Number of preference shares issued.

Number of ordinary shares issued.

Number of subscribed preference shares.

Number of subscribed ordinary shares.

Average price per share received by the corporation on its preference share

capital including subscribed shares.

‘Average price per share received by the corporation on its ordinary share capital

including subscribed shares.

‘Average amount per share that the subscribers of preference share capital have

not yet paid to the corporation.

‘Average amount per share that ordinary share subscribers have already paid on

8.

their subscriptions. Assume that ordinary shares were subscribed at P12.

2.

3.

4.

5.

a»

_—

hager 8~ Organon and Formation of Corporation 323

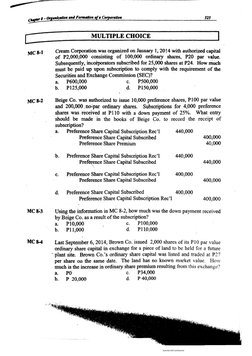

MC81

MC 82

MC83

Cream Corporation was organized on January 1, 2014 with authorized capital

of P2,000,000 consisting of 100;000 ordinary shares, P20 par value.

‘Subsequently, incofporators subscribed for 25,000 shares at P24. How much

must be paid up upon subscription to comply with the requirement of the

Securities and Exchange Commission (SEC)?

a. P600,000 ©. 500,000

b. P125,000 4. 150,000

Beige Co. was authorized to issue 10,000 preference shares, P100 par value

and 200,[Link]:par ordinary shares. Subscriptions for 4,000 preference

shares was received at P110 with a down payment of 25%. What entry

should be made in the books of Beige Co. to record the receipt of

subscription?

a. Preference Share Capital Subscription Rec’l 440,000

Preference Share Capital Subscribed 400,000

Preference Share Premium 40,000

b. Preference Share Capital Subscription Rec’l 440,000

Preference Share Capital Subscribed 440,000

c. Preference Share Capital Subscription Rec’! 400,000

Preference Share Capital Subscribed 400,000

4. Preference Share Capital Subscribed 400,000

Preference Share Capital Subscription Rec’! 400,000

Using the information in MC 8-2, how much was the down payment received

by Beige Co. as a result of the subscription?

a. 10,000 cc. P100,000

b. -P11,000 4. P110,000

Last September 6, 2014, Brown Co. issued 2,000 shares of its P10 par value

ordinary share capital in exchange for a piece of land to be held for a future

* plant site. Brown Co.’s ordinary share capital was listed and traded at P27

per share on the same date. The land has no known market value. How

much is the increase in ordinary share premium resulting from this exchange?

a. PO c. P34,000

b. P 20,000 d. P-40,000

al 1, 2014 with

January 1, 201 authori,

mar value. During 2014, Vio py

‘he shareholders” equity, Co RN a

‘hares at P22 per share. Ny

y

sev 10008808 for legal service when the fy,

D Mg

Mar. 25 F a per sae:

qssued 5 (000 shares for piece of equipment When

issued 51 bey

Sept. 30 was P26 per share:

¢ of the ordinary share capital acco,,,

How

September 30? c. 700,000

. ven 4 P704,000

b x

ving te inet MC 8-5, what amount should be repon,

5 format

me ordinary share premium? c, -P64,000

a. 50,000 ° Fea 000

b.P54,000 ee

sncorporated on June 1, 2014 with an authorized 25

MC8-7 Aqua Corp. was iteoTPOt Capital, stated value PIS and 10,000 sh

no-par ordinary :

at ces Share capital, par value PSO. Transaction aff

amptay'sshae capital as of June 30, 2014 were as follows: "

June 1 __ Issued 50,000 ordinary shares for cash at P15 per share.

_5 Issued $0,000 ordinary shares in exchange for asses with wl

market value of P900,000.

June 15. Received subscriptions for 100,000 ordinary shares at

for 5,000 preference shares at P55.

25. Received full payment for subscriptions received on June !5

and the corresponding stock were issued.

ue for b

ly - +o peers in excess of par and stated »

b. P300,000 4 Pie7s000

MCE8s ou? information in MC 8-7, hoy: much is the total shart

Paso a Pasns.o00

MC 8-10

MC8-11

and Formation of « Corporation , ne

Lavender Corp. issued 20,000 ordinary shares, par value P15 in exchange for

an equipment. At the date of exchange, the shares are selling at P20 and no

fair value is known for the equipment. How will the exchange be recorded

on the books of Lavender Corp.?

2. Equipment 400,000

Ordinary Share Capital 400,009

b. Equipment 400,000

Ordinary Share Capital 300,000

Ordinary Share Premium 100,000

ec. Equipment 400,000

Ordinary Share Capital 300,000

Gain on Exchange . 100,000

4. Equipment 300,000

Ordinary Share Capital 300,000

Indigo Corp. has authorized 200,000 shares of P30 par value ordinary share

capital and 5,000 shares of P50 par, 9% preference share capital. On June 3,

2014, the company issued 100,000 ordinary shares and 3,000 preference

shares, both at par. Which of the following is the correct journal entry in

recording the transaction?

a. Cash 3,600,000

Ordinary Share Capital 3,000,000

Preference Share Capital 600,000

b. Cash 1,540,000

Ordinary Share Capital 1,000,000

Preference Share Capital 540,000

©. Ordinary Share Capital 3,000,000

Preference Share Capital 600,000

Income from Sale of Share Capit 3,600,000

d. Cash 3,150,000

Ordinary Share Capital 3,000,000

Preference Share Capital 150,000

Javier and Edralin are partners. They decide to incorporate their business and

are recording the incorporation of the new business. Javier has a P35,000

capital account balance, while Edralin has a P26,400 balance. Javier receives

7,500 shares and Edralin receives 6,000 shares of P4 par ordinary share

capital.

MC#I2

MC814

26,400

540

Ay

35,000

26,400

Si4y

35,000.

, 26,400

.__Javier, Capital int Sy

Balin revelation ‘poo ‘om

» equity of Cecille Corp. revealed the following on June

‘The shareholders’ equity

30, 2014: 8 value" 230,000

"Preference share, P100 par 80,500

Preference share premiuin 525,000

Ordinary share, P15 par 275,000

Oulee ea eer 5,000

Ce 190,000

Retained earings aan

Notes payable. . 2

Subscription receivable ~ ordinary 40,000

How tnuch isthe legal capital of the corporation?

a. 760,000 ©. P1,115,000

& PrTS00 .4. P1,305,500

wins the information in MC 8-12, how much is the additional paid-in

capital?

a. P355,500

trai pana

Using the informer. :

oni? ‘nfomaion in Mc 8:12, how much is the total shareholdes

4 P1305;500

b P1345 S09, c, ee

745,51

meena enassnncnsnenemnnasesrnetintttitita

chapter 8 = Organization ‘and Formation of a Corporation an

C8-15 . On April 1, 2014, Friends Corp. a newly ‘formed company had the

” following shares issued and outstanding:

Preference share, P50 par, 6,000 shares originally issued at P100

Ordinary share, P20 par, 20,000 shares originally issued at P60

Frieids shareholders’ equity should report preference’ share capital,

ordinary share capital and paid-in capital in excess of par, respectively at

a. P600,000, 1,200,000, 0 .

b. 600,900, 400,000, 800,000

c. 300,000, 1,200,000, 300,000

1d 300,000, .. 400,000, 1,100,000

be and Formation,

et Corey

pt

NS

Ri

‘Test Material No, 28 ae

een | Lats)

ame a. | Professor _ =

TRUE or FALSE

Instructions: Encircle the letter T if the statement is true and the letter ¢ if the

statement is false. .

T F 1. All’ incorporators are’ shareholders but not all shareholders aa

incorporators.

T F 2. A comporaticn, like a partnership, may be formed by the mere agreemen:

of five or more persons.

T F 3, The journal entry method may be used in recording authorized share

capital and other stock transactions relating to a no-par and no stated

value share capital.

T F 4, The authorized shares represent the maximum number of shares that ¢

corporation may issue,

T F 5. Unissued shares represent the number of shares that may still be

subscribed.

T F 6. Itis legal to issue share capital at par or at more than par but not a! less

than par. 7

T F 7, When share capital is issued for consideration in the form of property

other than cash, the net book value of the property is used to recor

transaction.

T F 8 The highest bidder is the one who is willing to pay the entire unps

Subscription plus any expenses incurred in [Link] sale and at

same time getting the highest number of shares,

T F 9. Share capital that has been sold and issued to a shareholder is called «

outstanding share capital.

TF 10. The owners of « stock corporation are called sharcholders; the owners of

non-stock corporation are called members, j

T F 11. When the memorandum entry method i

used, the account Share Capital |

is credited upon issuance of stocks,

eager b= mtn end Peron of rpc

F

12.

13.

20.

21,

22.

23.

24.

25.

929

Under the journal entry method, the amount of ital i

f tr share capital issued is

determined by deducting the balance of unissued share capital account

from the balance of authorized share capital account.

When a partnership is incorporated, a new set of books should always be

opened for the new corporation. 5

Partnership net assets that are transferred to the cor i

i poration should be

recorded in the new corporations’ books at their book value.

AA stock certificate is issued to the subscriber upon full payment of his

subscription.

Both the partnership's owners and a corporation's owners have limited

liability for business debts,

‘Additional paid-in capital for the excess of the stock subscription price

cover par or stated value is recorded at the time of subscription.

Organization (pre-operating) costs are expenditures associated with

incorporating a new business. Such costs should be recognized as

expense in the first year of operations.

1 a subscription basis that is payable

A corporation issues share capital oF

ives a payment,

in three installments. Fach time the corporation rec

Share Capital account is credited.

Convertible preference shares allow the issuing corporation to redeem the

shares.

The liability of the shareholders for corporate debts is limited to the

amount of their investment.

‘A corporation is a business owned by its shareholders.

poration is vested on a body called Board of

The management of a co’

Directors.

«in a corporation are payable only in cash.

only two classes of authorized share capital, the

tal and the ordinary share capital.

Share capital subscription:

Generally, there are

preference share cap!

and Formation

|

i |

‘Test Material No. 29 Rating |

Name

Year and Section | Professor —_———————_

|

Instructions: Write the word or

statements.

IDENTIFICATION

group of words. that identify each of the following

‘An artificial being created by operation of law formed by five or

more persons.

The process of formalizing the organization of a corporation.

‘A corporation organized under the Philippine laws.

‘The persons who originally formed the corporation.

‘connection with the incorporation. They include

certifications and filing fees.

par stock by the board of

Costs incurred in

cost of printing stock

‘A value that may bé assigned to no-

directors of a corporatiof.

Class of share capital which entitles the holder to an equal or pro-

rata division of profits without any preference or advantage over

any class of stock.

Class of share capital ‘which enables the holder to ¢njoy

preferences as to receipt of dividends.

A nominal value stated on the face of the stock certificate and io

the articles of incorporatior.

It represents residual ownership equity.

A share capital issued to a shareholder.

A subscriber who fails to pay his subscription balance

The ininimmum . ;

subscribed by ae of authorized share capital that has

capi 3 Orpen end Formerion of Corpereion

I

17.

18.

19.

20.

‘Thie minimum percentage of the subscription in share capi

un ital that

has to be paid by the incosporators i ae

The account credited for the excess of the subscription or issue

price over the stated value of ordinary share capital.

‘The minimum amount upon which no-par, no-stated value share

capital are to be subscribed or issued.

‘The maximum number of years life of 8 corporation.

‘The document evidencing share capital ownership in a corporation.

The account charged for all expenses relating to delinquent

subscription.

The asset recognized upon jncorporation of @ partnership which,

ts the excess of the value of the share capital issued by the

corporation over the fair value of the net assets of the partnership

transferred to the new corporation.

7

3st

s — Chapter 8 -- Organization and Formation

weet

Test Material No. 30 Ratin,

eB

Name

Year and Section __ oe potiaor

He

MULTIPLE CHOICE - Theory and Problems

Instructions: Encircle the letter of the best answer. Show supporting computations

in

good form in a separate work sheet.

Which of the following would not be considered a characteristic of a corporation?

a. Separate legal entity c. Matual agency

b. Limited liability of shareholders. d. Both aandc

1,

Which of the following statements describing a corporation is not true?

2.

a. Shareholders are the owners of a stock corporation.

b. When ownership of @ corporation changes, the ‘corporation does not

terminate. :

c. Shareholders own the business and manage its day-today affairs.

d. A corporation is subject to a greater governmental regulation than a single

proprietorship or partnership.

3. The par value of a share capital

a. is usually different from its market value

b. is often higher for preference share than for ordinary share.

c. is an arbitrary amount assigned to a share of stock

d. all of these -

4. Which of the following is not one of the basic rights of a shareholder?

a. The right to participate in earnings.

b. The right to maintain ‘one’s proportionate interest in the corporation.

the accounting records of the corporation.

le of corporate asse!s

©. The right to inspect

d. The right to participate int the proceeds from the sal

upon liquidation of the company.

5. The ownership of share capital entitles ordinary shareholders to all of the

following rights except:

voting right ,

right to receive @ proportionate share of assets in corporate liqui

b. cad

co oo to receive guaranteed dividends

‘preemptive right

idation-

a.

—_—_

“ and Formation of « Corporation

2.

ich of the following

6 which 'of 1g Statements about

." preference share capital is nog true?

Petco cpa aly ce ah

"i Ak :

erie share capital dividends are usually paid prior to payment of

g. Preference share capital usual i

Poel di a ly ae the right to receive assets pro-rata

n ieee m ae 3 ote of corporate liquidation.

Bi on a een ance

i » . \e right to recei

rata with ordipary ‘shareholders in the event of corporate aidaton, | me

b

maximum number

c of shares of stock that the government gives a corporation

t

permission to issue is the

ited shares c. _ issued shares

a.

d, outstanding shares

grant

pb. __ authorized shares

3 A preference share capital that may be exchanged for ordinary share capital is

mown as .

a cumulative c. Noncumulative

b.__ participating 4, Convertible

9, The cost of organizing a corporation should be

al expensed in the year of | ‘organization

b. reported as an intangible asset

a reported as 2 tangible asset

a deducted from share capital

10, Anon-cash asset received in exchange for share capital is recorded at

a. its book value .

b. its fair market value

c. the lower of its book value or fair market value

d._. the higher of its book value or fair market valus

for fully paid stock

11. The entry to record the issuance of ordinary share capital

subscription is

a ‘Memorandum entry ;

dinary Share Capital subscribed an

wre

4 credit Ordinary Shi

b. Debit O

- Capital

« Debit Ordinary Share Capital subscribed and credit Additional Part"

oon hare Capital subscribed and credit, Subseriple”

d. Debit Ordinary sl

Receivable

- Chaper 4 Ongantenton end Formation oy Sey

. gen

12, The issuance of shares of orditiary share capital to shareholders .

"a increases ordinary share capital authorized Le

b. decreases ordinary share capital authorized

c. increases ordinary share'capital outstanding

4. decreases crdinary share capital outstanding

1, authorized ordinary share capital was soid on a subscription basis a, a

i pee of par value, and 40% of the subscription price was collected,

October 1, the remaining 60% of the subscription price was collected. Ordi 19.

Share Premium will be credited on

June 1 October 1

a. No | ‘Yes

b. No - - Yes

©. Yes No -

d. ‘Yes Yes 20.

14, When there is no bidder for delinquent subscription, the subscribed shares will be

a issued to the delinquent subscriber

b.- _iésued in the name of the corporation,

©, - reverted back to unsubscribed shares

4. retained as subscribed —

15, Violet Inc. issued 8,000 shares of P20 par ordinary share capital. for P24 per

share.’ In recording this sale of shatg capital, Violet will include a credit to .

a. _ gain on issuance of share capital for P32,000

b. © ordinary share capital for P192,000 :

©. paid-in capital in excéss of par for P32,000

4. discount on ordinary share capital for P16,000

16. _ Which of the following is nor typically a characteristic of ference 2

a. Preference as to dividends ae

b. Preference as to voting rights

¢. Cumulative and callable terms

4. Preference over ordinary shareholders during liquidation

i7.

When ordinary shares are issued ini exchange i ;

transaction should be recorded atthe ©” °* S€TV€es or non-cash assets, ths

par value of the ordinary shares issued :

fair market value of the ordinary shares issued

fair market value of the services or non-cash se

fair value of the services or non-cash assets

ordinary shares is more reliably determi able

aege

ts received

unless the fair value of the

aw

ation and Formation of a Corporation 38,

When preference shares are fully participating, this mean that ordinary

18. Suareholders receive dividend rate equal to the preference share and

all excess dividends are shared proportionately between the preference and

* ordinary shareholders

b. all excess dividends are given to the ordinary shareholders

. all excess dividends go to the preference shareholders

the maximum participation rate is applied to the preference shares

19, Preference shares that have no claim on any prior year dividends that may have

passed

cumulative preference shares.

Participating preference shares

non-cumulative preference shares

‘Non-participating preference shares

e

a

20. Securities and Exchange Commission 25%,

25% rule means that

a least 25% of the total authorized share capital has been subscribed

i least 25% of the total subscriptions have been paid

Aonly

Both A and B

Bese pee

‘Test Material No. 31

: Date

ame

Ye a | Pt

PROBLEMS

Problem A

December 31, 2014, the ledger included the following balances Pertaining tp

shareholders* equity:

Preference Share Capital P 3,000,000

Preference Share Premium 300,000

Ordinary Share Capital 5,000,000

Paid-in Capital in Excess of Stated Value — Ordinary Share 2,500.00

F550,000. The remaining prefereace share capital wort issued for cash. ‘All preferred

shares were issued in January. Alll ordinary shares were issued for cash.

Instructions: Compute for each of the items ehumerated below. Present supporting

computation in good form in a Separate work sheet,

1° Number of preference shares issued for cash,

- 2. Price per share of preference share Capital issued for cash,

3." Number of ordinary shares issued.

——— 4. Average price per share of the ordinary share capital issued for cash

5. Total preference share Premium arising from issuance in exchange

equipment.

Cr

cag ogee fs Ceara

337

problem B

BC Corp. recorded the following j

1, ABC Corp. recorded the following journal entry on August 21, 2014;

Ordinary Share Capital = 42,250

Ordinary Share Premium 32.00

the explanation eds, “Issued ordinary share capit 3 What

The - s, m ipital for P130 per share”.

sethepacaie for this share capital, and how many shares were issued?

5, _DEF Company issiied-1,000 shates of its P50 pa ina i

2 od 1, par value ordinary share capital in

“exchange for land witha book value of P40,000 and fi

er pe total increase in ordinary share premium? See

ANSWER:

Using the information in No. 2, how much should be eredited to Ordinary Share

3.

Capital account?

ANSWER:

4, ‘The GHI Corporation was incorporated on January 1, 2014, with the following

authorized capitalization:

40,000 shares of ordinary share capital, no par value, stated velue P50 per

share

© 10,000 shares of 5% cumulative preference share capital, par value P10

ued 24,000 ordinary shares for P6O per share and 6,000

P120 per share. In addition, on December 10, 2014

preference shares were taken at @ purchase price of P150.

was received. The full payment on these subscribed

auary 5, 2014, What should GHI report as total

"=; December 31, 2014 Statement of Financial

During 2014, GHI iss

preference shares at

subscription for 2,000

‘A down payment-of 30%

shares was received on J

increase in shareholders’ equity on it

Position?

ANSWER:

000 shares of its PIO par ordinary share

fair value of P18 per share

stock had a :

Sedinary share premium as # result. of

5. Om June 1, JKL Company issued 8

capital to Robles for a tract of land. Th

on this date. How much is the increase in

- this transaction?

ANSWER: TT

Problem C

,

‘shown below are account balances found in the ledger of Emerald Green Compras

the end of 2014: ny

Subscription Receivable ~ Preference Shares Pn,

Subscription Receivable ~ Ordinary Share sot

10% Preference Share Capital, P50 par value, ]

authorized, 100,000 shares

me Tested P_ 2,880,000

Subscribed — 1440.00. 42204

Ordinary Share Capital, no par, P10 stated value, — :

authorized, 300,000 shares

Issued _ P- 2,720,000

Subscribed 560,000 3,280.9

Paid-In Capital in Excess of Par or Stated Value

Preference share P 432,000

Ordinary share : 656,000 1,088 0

Instructions: Compute for each of the item shown below. Present. Supporting computation

in good form in a separate work sheet.

1, Number of preference share issued.

2.° Number of ordinary shares issued.

3. Number of preference shares subscribed. :

4. Number of ordinary shares subscribed.

5. Average price per share received by the corporation on its preference

share capital including preference share capital subscribed.

6. Average price per share received by the corporation on its ordin2"y

share capital inchiding subscribed ordinary share capital.

7. Average amount pet share that the subscribers of preference share

capital have not yet paid to the corporation.

———* pices paid on pate that ordinary share capital subscribers Is"¢

paid on their subscrij 7 share

capital were subscribed at Pin on Assume that ordinary si"

You might also like

- Corporation Issuance of Shares Illutsrative ProblemNo ratings yetCorporation Issuance of Shares Illutsrative Problem15 pages

- Chapter 5 - Corporation - Share TransactionsNo ratings yetChapter 5 - Corporation - Share Transactions14 pages

- SOLUTION Exercises Acctg For Corp Formation - 250207 - 125111 1No ratings yetSOLUTION Exercises Acctg For Corp Formation - 250207 - 125111 19 pages

- Mindanaoan Resource Corp Share Capital EntriesNo ratings yetMindanaoan Resource Corp Share Capital Entries9 pages

- Accounting for Share Capital TransactionsNo ratings yetAccounting for Share Capital Transactions54 pages

- Module 8 - Shareholders' Equity, Retained Earnings, and DividendsNo ratings yetModule 8 - Shareholders' Equity, Retained Earnings, and Dividends10 pages

- Shareholders' Equity and Dividend AnalysisNo ratings yetShareholders' Equity and Dividend Analysis5 pages

- CA5101 Financial Accounting & Reporting Accounting For Stock Corporation Handout No. 01 Problem 1No ratings yetCA5101 Financial Accounting & Reporting Accounting For Stock Corporation Handout No. 01 Problem 15 pages

- Corporations:Basic Considerations: Module 11-Chapter 14No ratings yetCorporations:Basic Considerations: Module 11-Chapter 1416 pages

- Journal Entries for Equity TransactionsNo ratings yetJournal Entries for Equity Transactions14 pages

- Cebu Centennial Hotel Share Capital AnalysisNo ratings yetCebu Centennial Hotel Share Capital Analysis12 pages

- Equity Securities Investment AccountingNo ratings yetEquity Securities Investment Accounting13 pages

- Sample Problem: Accounting For Notes ReceivableNo ratings yetSample Problem: Accounting For Notes Receivable18 pages

- Treasury Shares Rights Issue and Share SplitNo ratings yetTreasury Shares Rights Issue and Share Split46 pages

- Bank Reconciliation for Sensible CompanyNo ratings yetBank Reconciliation for Sensible Company1 page

- Equity Financing Analysis for Parsons Co.No ratings yetEquity Financing Analysis for Parsons Co.2 pages

- Question Text: Retained Earnings Retained Earnings Retained Earnings Retained EarningsNo ratings yetQuestion Text: Retained Earnings Retained Earnings Retained Earnings Retained Earnings32 pages

- 001 - Percentage Taxes Quizzer Text Ver PDF100% (4)001 - Percentage Taxes Quizzer Text Ver PDF43 pages

- Instalment/Consignment Sales: Partl: Theory of AccountsNo ratings yetInstalment/Consignment Sales: Partl: Theory of Accounts5 pages

- Accounting and Business Quiz Bee QuestionsNo ratings yetAccounting and Business Quiz Bee Questions6 pages