100% found this document useful (1 vote)

11K views21 pagesChapter 5

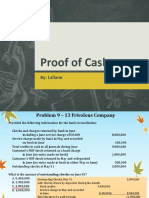

This document discusses three common methods for estimating doubtful accounts: 1) aging accounts receivable, 2) calculating a percentage of total accounts receivable, and 3) calculating a percentage of total sales. It provides examples of how to calculate doubtful accounts expense and the allowance for doubtful accounts under each method. It also discusses the advantages and disadvantages of each approach.

Uploaded by

XENA LOPEZCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

Topics covered

- financial risk management,

- accounting cycles,

- adjusting entries,

- accounting for receivables,

- accounting for write-offs,

- financial position,

- financial statements,

- uncollectible accounts,

- aging method,

- credit terms

100% found this document useful (1 vote)

11K views21 pagesChapter 5

This document discusses three common methods for estimating doubtful accounts: 1) aging accounts receivable, 2) calculating a percentage of total accounts receivable, and 3) calculating a percentage of total sales. It provides examples of how to calculate doubtful accounts expense and the allowance for doubtful accounts under each method. It also discusses the advantages and disadvantages of each approach.

Uploaded by

XENA LOPEZCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

Topics covered

- financial risk management,

- accounting cycles,

- adjusting entries,

- accounting for receivables,

- accounting for write-offs,

- financial position,

- financial statements,

- uncollectible accounts,

- aging method,

- credit terms

- Estimation of Doubtful Accounts: Discusses methods of estimating doubtful accounts, including technical knowledge, methods, and arguments for and against various approaches.

- Practical Problems and Examples: Provides a series of questions and problems for practicing the application of estimating methods for doubtful accounts.