0% found this document useful (0 votes)

580 views26 pagesStandalone Balance Sheet - Lupin LTD.: Particulars

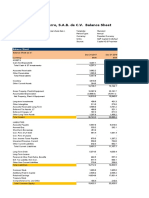

- The document presents the standalone balance sheet and statement of profit and loss for Lupin Ltd. as of March 31, 2021.

- The balance sheet shows the company had total assets of Rs. 218,585.6 million, with non-current assets of Rs. 122,411.9 million including property, plant and equipment, investments, and tax assets. Total equity was Rs. 185,655.7 million.

- The statement of profit and loss shows total income of Rs. 111,850.2 million for the year ended March 31, 2021. Total expenses were Rs. 95,553.2 million, resulting in a profit before tax of Rs. 16,297.0 million.

Uploaded by

shubhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

580 views26 pagesStandalone Balance Sheet - Lupin LTD.: Particulars

- The document presents the standalone balance sheet and statement of profit and loss for Lupin Ltd. as of March 31, 2021.

- The balance sheet shows the company had total assets of Rs. 218,585.6 million, with non-current assets of Rs. 122,411.9 million including property, plant and equipment, investments, and tax assets. Total equity was Rs. 185,655.7 million.

- The statement of profit and loss shows total income of Rs. 111,850.2 million for the year ended March 31, 2021. Total expenses were Rs. 95,553.2 million, resulting in a profit before tax of Rs. 16,297.0 million.

Uploaded by

shubhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd