100% found this document useful (2 votes)

3K views6 pagesTa Bill Format

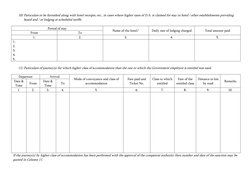

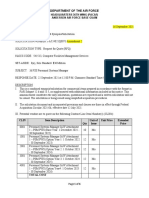

1) This document is a bill form used by government employees in West Bengal, India to claim traveling allowance for official tours.

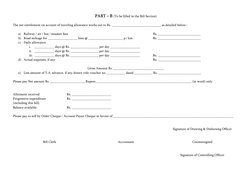

2) The form collects information such as the employee's name, designation, travel details including dates, locations, duration and purpose of travel, mode of transport used, and amount of advance drawn, if any.

3) The net travel allowance is calculated based on actual expenses such as rail/air fare, road mileage, and daily allowance as per eligibility, and the amount payable or recoverable from advances is determined.

Uploaded by

Debprosad RoyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

3K views6 pagesTa Bill Format

1) This document is a bill form used by government employees in West Bengal, India to claim traveling allowance for official tours.

2) The form collects information such as the employee's name, designation, travel details including dates, locations, duration and purpose of travel, mode of transport used, and amount of advance drawn, if any.

3) The net travel allowance is calculated based on actual expenses such as rail/air fare, road mileage, and daily allowance as per eligibility, and the amount payable or recoverable from advances is determined.

Uploaded by

Debprosad RoyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Traveling Allowance Bill for Tour - Part A: This section contains the main form for the traveling allowance bill, to be filled by the government employees outlining journey details.

- Mode of Journey Details: Details related to different modes of journey like Air and Rail, including ticket arrangements and eligibility.

- Accommodation and Higher Class Journey Details: Outlines particulars of stay and the conditions for higher class of accommodation claims.

- Additional Journey Details: Covers additional journey details performed by road or rail, including fare calculations and certifications.

- Net Entitlement and Payment Instructions - Part B: Contains calculation steps for net entitlement in the bill section as well as payment instructions and signatures.

- Treasury and Audit Instructions: Details the instructions for use at the treasury and office of the Accountant General for auditing purposes.

![West Bengal Form No. 2446B

T.R. FORM NO. 23

[See sub-rule (2) of T.R. 4.104]

Bill No.

Da](https://screenshots.scribd.com/Scribd/252_100_85/178/544346178/1.jpeg)