0% found this document useful (0 votes)

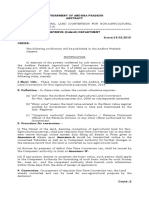

632 views1 pageForm 44 (See Rule 104) (Commutation of N. A. Assessment Certificate)

This document certifies that an individual paid 5 times the annual non-agricultural assessment for a plot of land to the government of Karnataka. This payment allows the individual to commute (change) the annual assessment on the land to exempt it from any future non-agricultural assessments according to the provisions of the Karnataka Land Revenue Act of 1964. The document provides details of the land survey number, village, taluk and district where the land is located and the amount paid.

Uploaded by

ShobhnaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

632 views1 pageForm 44 (See Rule 104) (Commutation of N. A. Assessment Certificate)

This document certifies that an individual paid 5 times the annual non-agricultural assessment for a plot of land to the government of Karnataka. This payment allows the individual to commute (change) the annual assessment on the land to exempt it from any future non-agricultural assessments according to the provisions of the Karnataka Land Revenue Act of 1964. The document provides details of the land survey number, village, taluk and district where the land is located and the amount paid.

Uploaded by

ShobhnaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd