0% found this document useful (0 votes)

121 views5 pagesCash Balance Adjustments Summary

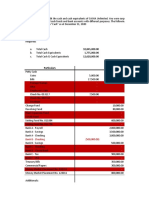

The document contains financial information from multiple cases involving cash accounts and bank reconciliations. It shows unadjusted balances, deposits and withdrawals, as well as adjusted balances after considering items like outstanding checks, deposits in transit, and errors. The goal is to determine the accurate cash and bank balance amounts.

Uploaded by

Scarlet DragonCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

121 views5 pagesCash Balance Adjustments Summary

The document contains financial information from multiple cases involving cash accounts and bank reconciliations. It shows unadjusted balances, deposits and withdrawals, as well as adjusted balances after considering items like outstanding checks, deposits in transit, and errors. The goal is to determine the accurate cash and bank balance amounts.

Uploaded by

Scarlet DragonCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd