0% found this document useful (0 votes)

106 views4 pagesACCT400 Auditing Theory Syllabus 2022

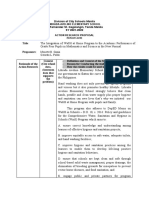

This document is a course syllabus for an Auditing Theory & Practice class at Montclair State University. It outlines the course aims, learning goals, required text, grading structure, and schedule. The aims are to understand the role of CPAs, the services they provide, and how to perform audits, reviews, and compilations. Grading will be based on exams, class participation, homework assignments, and an audit analytics assignment. The course covers topics like professional standards, legal liability, audit evidence, planning, internal controls, and audit reports. Assignments will include textbook questions, case studies, and a pledge to uphold academic integrity.

Uploaded by

porduziltaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

106 views4 pagesACCT400 Auditing Theory Syllabus 2022

This document is a course syllabus for an Auditing Theory & Practice class at Montclair State University. It outlines the course aims, learning goals, required text, grading structure, and schedule. The aims are to understand the role of CPAs, the services they provide, and how to perform audits, reviews, and compilations. Grading will be based on exams, class participation, homework assignments, and an audit analytics assignment. The course covers topics like professional standards, legal liability, audit evidence, planning, internal controls, and audit reports. Assignments will include textbook questions, case studies, and a pledge to uphold academic integrity.

Uploaded by

porduziltaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd