0% found this document useful (0 votes)

231 views2 pagesTrade Life Cycle

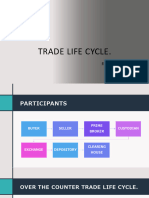

The document outlines the trade life cycle process from order entry to settlement. New orders are captured in the order management system and traders execute trades on exchanges, OTC markets, or internal inventory. The middle office validates and books trades before sending confirmation. The back office handles clearing, settlement, accounting, and interacts with custodians, clearing firms, and commercial banks to complete the process.

Uploaded by

Parmesh MalhotraCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

231 views2 pagesTrade Life Cycle

The document outlines the trade life cycle process from order entry to settlement. New orders are captured in the order management system and traders execute trades on exchanges, OTC markets, or internal inventory. The middle office validates and books trades before sending confirmation. The back office handles clearing, settlement, accounting, and interacts with custodians, clearing firms, and commercial banks to complete the process.

Uploaded by

Parmesh MalhotraCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd