0% found this document useful (0 votes)

75 views6 pagesFinancial Overview: Balance Sheet & Income Statement

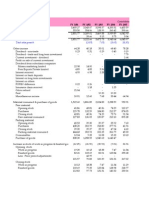

This document contains balance sheet and income statement data from 2020 to 2016 for a company. The balance sheet shows the company had total assets of $66.7 million in 2020, with fixed assets, deferred tax assets, and cash making up a large portion. Total equity was $24.3 million. The income statement indicates the company had sales of $76.7 million in 2020 and a net loss of $1.6 million after taxation.

Uploaded by

Deepak MatlaniCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

75 views6 pagesFinancial Overview: Balance Sheet & Income Statement

This document contains balance sheet and income statement data from 2020 to 2016 for a company. The balance sheet shows the company had total assets of $66.7 million in 2020, with fixed assets, deferred tax assets, and cash making up a large portion. Total equity was $24.3 million. The income statement indicates the company had sales of $76.7 million in 2020 and a net loss of $1.6 million after taxation.

Uploaded by

Deepak MatlaniCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd