0% found this document useful (0 votes)

536 views2 pagesTypes of Account

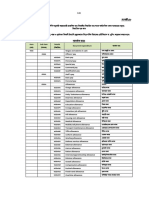

The document describes several types of accounts offered by Axis Bank, including savings accounts, salary accounts, current accounts, safe deposit lockers, safe custody accounts, pension disbursement accounts, and Sukanta Samriddhi Yojana accounts. Savings accounts cater to various customer segments and needs. Salary accounts provide benefits for employees, like special debit cards. Current accounts offer more transactions and services designed for businesses. Safe deposit lockers and safe custody accounts secure customers' valuables and documents. Pension disbursement accounts simplify banking for pensioners. Sukanta Samriddhi Yojana is a government savings scheme exclusively for girls with tax benefits and guaranteed returns.

Uploaded by

Mahak JainCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

536 views2 pagesTypes of Account

The document describes several types of accounts offered by Axis Bank, including savings accounts, salary accounts, current accounts, safe deposit lockers, safe custody accounts, pension disbursement accounts, and Sukanta Samriddhi Yojana accounts. Savings accounts cater to various customer segments and needs. Salary accounts provide benefits for employees, like special debit cards. Current accounts offer more transactions and services designed for businesses. Safe deposit lockers and safe custody accounts secure customers' valuables and documents. Pension disbursement accounts simplify banking for pensioners. Sukanta Samriddhi Yojana is a government savings scheme exclusively for girls with tax benefits and guaranteed returns.

Uploaded by

Mahak JainCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd