0% found this document useful (0 votes)

911 views15 pagesJournal Entry

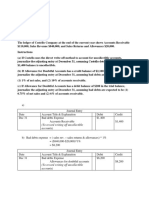

The document contains an example of basic accounting equations and transactions. It shows that at the beginning of the year, total assets were P700,000 and total liabilities were P500,000, with owner's equity of P200,000. Several examples are provided of how the accounting equation (Assets = Liabilities + Owner's Equity) is used to calculate owner's equity based on changes in assets and liabilities. Transactions are also listed showing debits and credits to various accounts.

Uploaded by

NajOh Marie D ECopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

911 views15 pagesJournal Entry

The document contains an example of basic accounting equations and transactions. It shows that at the beginning of the year, total assets were P700,000 and total liabilities were P500,000, with owner's equity of P200,000. Several examples are provided of how the accounting equation (Assets = Liabilities + Owner's Equity) is used to calculate owner's equity based on changes in assets and liabilities. Transactions are also listed showing debits and credits to various accounts.

Uploaded by

NajOh Marie D ECopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

- Basic Accounting Principles

- Transaction Entries

- T-Account Analysis

- Post Journal Ledger

- Trial Balance Preparation