75% found this document useful (4 votes)

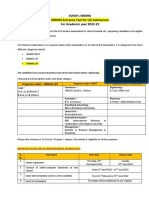

22K views17 pagesBudget Notes

Government budgets are annual financial statements that estimate government receipts and expenditures for the fiscal year. [1] The key components of government budgets are revenue budgets and capital budgets. [2] Revenue budgets deal with recurring transactions that do not affect assets or liabilities, while capital budgets involve transactions that do affect assets or liabilities. [3] Government budgets have multiple objectives including redistribution of income and wealth, allocation of resources, economic stability, and promotion of economic growth.

Uploaded by

Heer SirwaniCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

75% found this document useful (4 votes)

22K views17 pagesBudget Notes

Government budgets are annual financial statements that estimate government receipts and expenditures for the fiscal year. [1] The key components of government budgets are revenue budgets and capital budgets. [2] Revenue budgets deal with recurring transactions that do not affect assets or liabilities, while capital budgets involve transactions that do affect assets or liabilities. [3] Government budgets have multiple objectives including redistribution of income and wealth, allocation of resources, economic stability, and promotion of economic growth.

Uploaded by

Heer SirwaniCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Redistribution of Income & Wealth

- Government Budget & The Economy

- Economic Growth and Regional Development

- Types of Budget

- Understanding Taxes

- Non-Tax Revenue and Capital Receipts

- Budget Expenditure

- Budget Deficit and its Types

- Economic Policy Tools

- Policy Assessment Questions