0% found this document useful (0 votes)

2K views3 pagesFixed Income Securities Course Overview

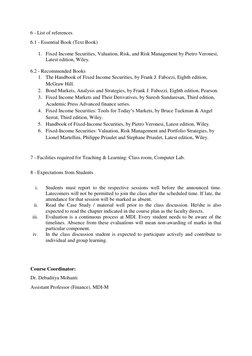

This 3 credit course provides an overview of fixed income securities markets and instruments. It will analyze market characteristics, pricing, valuation, risk and return, and portfolio management techniques. Students will learn tools for bond valuation, term structure modeling, and interest rate risk management. The course aims to cover specific features of the Indian fixed income market and include Excel modeling. Assessment includes exams, quizzes, assignments. Students are expected to read materials in advance and actively participate in class discussions.

Uploaded by

PRAPTI TIWARICopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views3 pagesFixed Income Securities Course Overview

This 3 credit course provides an overview of fixed income securities markets and instruments. It will analyze market characteristics, pricing, valuation, risk and return, and portfolio management techniques. Students will learn tools for bond valuation, term structure modeling, and interest rate risk management. The course aims to cover specific features of the Indian fixed income market and include Excel modeling. Assessment includes exams, quizzes, assignments. Students are expected to read materials in advance and actively participate in class discussions.

Uploaded by

PRAPTI TIWARICopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd