67% found this document useful (3 votes)

16K views2 pagesPositive Pay System

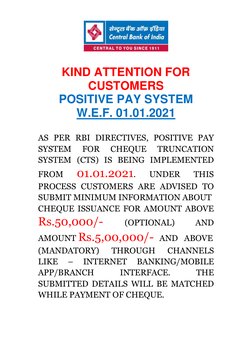

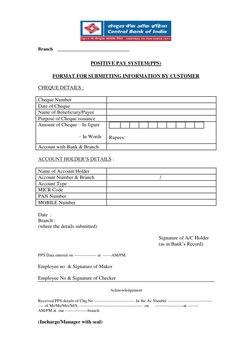

The document provides information about the implementation of the Positive Pay System (PPS) for cheque truncation in India beginning January 1, 2021 per RBI directives. Under PPS, customers will need to submit minimum details of issued cheques above Rs. 50,000 through internet banking, mobile apps, or branches. These submitted details will be matched with cheque payments to validate authenticity. The document also includes a format for customers to provide cheque and account details to the bank under PPS.

Uploaded by

Pinky PatelCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

67% found this document useful (3 votes)

16K views2 pagesPositive Pay System

The document provides information about the implementation of the Positive Pay System (PPS) for cheque truncation in India beginning January 1, 2021 per RBI directives. Under PPS, customers will need to submit minimum details of issued cheques above Rs. 50,000 through internet banking, mobile apps, or branches. These submitted details will be matched with cheque payments to validate authenticity. The document also includes a format for customers to provide cheque and account details to the bank under PPS.

Uploaded by

Pinky PatelCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Positive Pay System Notice: Informs customers about the implementation of the Positive Pay System for cheques and provides guidelines for its usage effective from a specific date.

- Customer Information Submission Form: A form where customers fill in cheque and account holder details for the Positive Pay System submission process.