100% found this document useful (2 votes)

537 views34 pagesFinancial Analysis for Investors

Financial analysis involves evaluating businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability. It can be conducted internally to help with business decisions or externally to help investors choose investments. Financial analysis evaluates economic trends, sets financial policy, builds long-term plans, and identifies investment opportunities. There are two main types - fundamental analysis uses financial ratios and statements to determine a business's value, while technical analysis evaluates statistical trends in trading data.

Uploaded by

Dianne PilandeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (2 votes)

537 views34 pagesFinancial Analysis for Investors

Financial analysis involves evaluating businesses, projects, budgets, and other finance-related transactions to determine their performance and suitability. It can be conducted internally to help with business decisions or externally to help investors choose investments. Financial analysis evaluates economic trends, sets financial policy, builds long-term plans, and identifies investment opportunities. There are two main types - fundamental analysis uses financial ratios and statements to determine a business's value, while technical analysis evaluates statistical trends in trading data.

Uploaded by

Dianne PilandeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- What is Financial Analysis?

- Introduction to Financial Analysis

- Understanding Financial Analysis

- Types of Financial Analysis

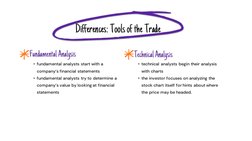

- Differences: Tools of the Trade

- Differences: Time Horizon

- Differences: Trading vs. Investing

- Corporate Financial Analysis

- Types of Corporate Financial Analysis

- Investment Financial Analysis

- Types of Investment Analysis

- Limitations of Financial Analysis

- Real-World Example of Financial Analysis

- Examples of Financial Analysis

- Why Is Financial Analysis Useful?

- How Is Financial Analysis Done?

- What Techniques Are Used in Conducting Financial Analysis?

- The Bottom Line