0% found this document useful (0 votes)

1K views12 pagesTrading Strategy Backtesting Guide

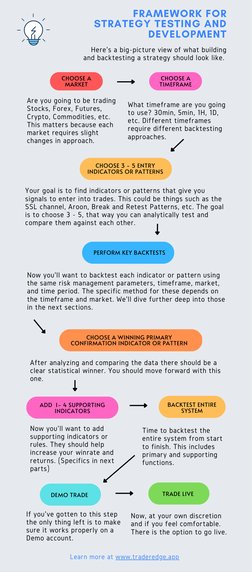

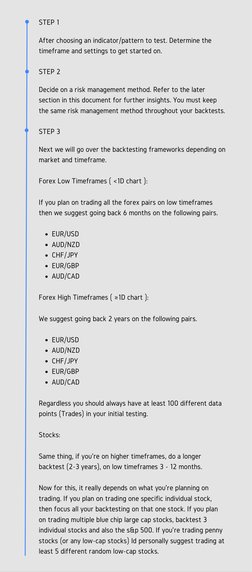

The document outlines a 7-part blueprint for backtesting trading strategies. Part 1 provides an overview framework for strategy testing and development, including choosing a market and timeframe and entry indicators or patterns to backtest. Part 2 discusses the pros and cons of manual vs automated backtesting and why manual backtesting is superior. Parts 3-5 provide step-by-step frameworks for backtesting indicators, supporting indicators, and full strategies. Parts 6-7 cover risk management methods and how to evaluate strategies found online. The goal is to give frameworks to find, build, and optimize a strategy through backtesting.

Uploaded by

estudanteconcurseiro1980Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views12 pagesTrading Strategy Backtesting Guide

The document outlines a 7-part blueprint for backtesting trading strategies. Part 1 provides an overview framework for strategy testing and development, including choosing a market and timeframe and entry indicators or patterns to backtest. Part 2 discusses the pros and cons of manual vs automated backtesting and why manual backtesting is superior. Parts 3-5 provide step-by-step frameworks for backtesting indicators, supporting indicators, and full strategies. Parts 6-7 cover risk management methods and how to evaluate strategies found online. The goal is to give frameworks to find, build, and optimize a strategy through backtesting.

Uploaded by

estudanteconcurseiro1980Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd