Profitability Analysis of Sanima Bank Limited: A Project Report

Uploaded by

Surya SatoreProfitability Analysis of Sanima Bank Limited: A Project Report

Uploaded by

Surya SatoreCommon questions

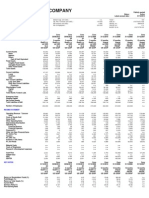

Powered by AIThe ROE for Sanima Bank exhibits a fluctuating trend from 18.67% in FY 2017/18, peaking at 23.20% in FY 2018/19, then decreasing to 16.09% in FY 2029/20, rising slightly to 18.57% in FY 2020/21, and again dropping to 14.13% in FY 2021/22. This fluctuation suggests volatility in the bank’s financial performance, driven by internal and external factors affecting profitability. For investors, this pattern indicates potential risks and underscores the importance of assessing long-term profitability and the bank's ability to maintain or improve ROE amid economic uncertainties .

Qualitative analysis of secondary data, such as annual reports, helps in understanding the broader context of Sanima Bank's financial performance over the fiscal years. It offers insights into non-quantitative factors like management policies, customer satisfaction, and strategic decisions impacting financial results. By analyzing trends in qualitative data alongside quantitative metrics, stakeholders can better grasp the fluctuations in profitability ratios and the operational effectiveness of the bank. This comprehensive approach enables a more nuanced evaluation of performance trends and strategic implications, reflecting qualitative aspects affecting financial health .

Strategies to improve liquidity and profitability include efficient asset management and maintaining a balance between credit risks and economic growth. Rouniyar and Begum's findings emphasize the importance of managing liquidity ratios and controlling non-performing loans, as high credit risk and poor capitalization negatively impact profitability. Rouniyar's study shows that maintaining consistent net profit to total deposit ratios, as observed in banks like NABIL, plays a crucial role, while Begum highlights the negative impact of excess liquidity on banks' ROA .

Earnings Per Share (EPS) and Dividend Per Share (DPS) are both indicators of a company's financial health but serve different purposes. EPS, which fluctuated between 21.22 and 28.22 during the reviewed fiscal years, shows the company's profitability and is a measure of net income earned per share, suggesting value creation. DPS reflects the share of earnings distributed as dividends, indicating cash returns to investors, with fluctuations seen from 14.00 to 21.05. While a higher EPS can attract growth-focused investors, a stable or increasing DPS may be more appealing to income-focused investors. Sanima Bank's changing EPS and DPS highlight the balancing act between retaining earnings for growth and offering shareholder returns .

Internal determinants of bank profitability are influenced by management decisions and include efficiency in asset management, while external determinants encompass macroeconomic factors like economic growth. Sanima Bank considers profitability ratios as a major tool for its analysis, focusing on the relation between profitability ratios and total earnings to evaluate internal performance. Fluctuations in net profit margin, return on assets, and return on equity over various fiscal years highlight these impacts .

Profitability ratio analysis is vital for banks such as Sanima Bank as it provides insights into financial health, operational efficiency, and investment attractiveness. Ratios like ROA, ROE, and net profit margins help assess performance over time, identify trends, and inform strategic decisions by highlighting strengths and weaknesses. This analysis aids in setting financial goals, evaluating managerial effectiveness, and informing stakeholders about value creation. For strategic decision-making, such ratios help in comparing with competitors and market benchmarks, which can drive decisions on resource allocation, product development, and risk management .

Investing in Sanima Bank offers potential long-term benefits due to the bank's commitment to providing high-quality products and services, which positions it as a promising company for long-term investment. Sanima Bank aims to overcome current uncertainties by adhering to a customer-centric approach and offering a wide range of products, such as home, education, auto, and personal loans, as well as comprehensive banking services like mobile banking, ATMs, and foreign currency transactions .

The increasing competition within Nepal's banking sector, with 26 commercial banks, has pressured Sanima Bank's liquidity position, potentially nearing regulatory breaches such as the CCD ratio. The CCD ratio, which limits the proportion of core capital and deposits that can be lent out, is crucial in maintaining liquidity. With more banks entering the market, the competition for deposits intensifies, thereby affecting liquidity as banks vie to offer competitive terms. Sanima Bank must strategically manage its liquidity to ensure compliance with regulatory requirements and sustain profitability .

Macroeconomic indicators like economic growth positively influence bank profitability by enhancing asset management efficiency, as shown in studies of Pakistani banks. Improved economic conditions lead to increased demand for loans and financial products, elevating banks' profitability through enhanced asset utilization measured by ROA and ROE. Conversely, economic downturns increase credit risks, reducing profitability. These indicators are critical for banks to strategize operations and adapt to fluctuating economic cycles. Studies in Pakistan revealed that efficient asset management correlates significantly with profitability, highlighting the importance of economic conditions in financial performance .

The fluctuating trend in Sanima Bank's net profit margin (NPM) from 42.34% in FY 2017/18 to 34.71% in FY 2021/22 indicates varying operational efficiencies and challenges in adapting to market conditions. These fluctuations can be attributed to changes in net profits and total operating revenues. A rising NPM suggests improved cost management and revenue generation, while a decline points to increased operational costs or reduced pricing power. This trend highlights the bank’s ongoing challenges in maintaining profit margins amid economic and competitive pressures, requiring strategic adjustments to sustain profitability .