Acca f3 Fa Exam Kit STUDCO

Uploaded by

Moiz BohraAcca f3 Fa Exam Kit STUDCO

Uploaded by

Moiz BohralOMoARcPSD|20475403

ACCA F3 FA Exam kit

ACCA F3 Financial Accounting (Association of Chartered Certified Accountants)

Studocu is not sponsored or endorsed by any college or university

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

Question Bank

ACCA

Financial Accounting (FA)

Exams from September 2020

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ii I n t r o d u c t i o n ACCA FA Question Bank

No part of this publication may be reproduced, stored in a retrieval system

or transmitted, in any form or by any means, electronic, mechanical,

photocopying, recording or otherwise, without the prior written permission

of First Intuition Ltd.

Any unauthorised reproduction or distribution in any form is strictly

prohibited as breach of copyright and may be punishable by law.

We are grateful to the Association of Chartered Certified Accountants and

the Chartered Institute of Management Accountants for permission to

reproduce past examination questions and model answers.

Additional comments and guidance have been prepared by First Intuition Ltd.

© First Intuition Ltd, 2020

MAY 2020 RELEASE

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank Introduction iii

How to use this Question Bank

1 QUESTION PRACTICE IS KEY TO SUCCESS

This Question Bank has been written to help you pass Paper FA Financial Accounting.

Targeted question practice

In the first section there are banks of questions based around each chapter of the Course Notes. The

number of questions reflects the weighting of the topic to the syllabus. You should attempt the Test

Your Learning Questions where indicated to test your knowledge so far and the practice assessment

(which covers the full syllabus) immediately prior to taking the mock exam. You should also attempt

the ACCA specimen.

Do the practice assessments

The importance of question practice cannot be underestimated and you should attempt both the

mock exam and the ACCA specimen under assessment conditions. For this paper you have two hours

to answer 35 questions in Section A and 2 questions in Section B. It is vital you stick to the time

allocation and answer every question.

The types of question that may be included are as follows:

OT MTQ

Multiple Choice You are required to choose one answer from a list of options

by clicking on the appropriate radio button

Multiple Response You are required to select more than one response from the

options provided by clicking the appropriate tick boxes

Multiple Response You are required to select a response to a number of related

Matching statements by clicking on the radio button which

corresponds to the appropriate response for each statement

Number Entry You are required to key in a numerical response to the

question

Each of the above types of question are included in this Question Bank.

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

iv I n t r o d u c t i o n ACCA FA Question Bank

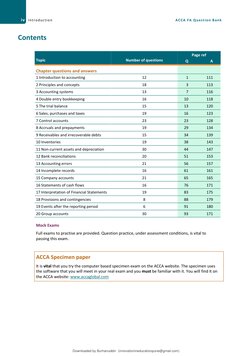

Contents

Page ref

Topic Number of questions Q A

Chapter questions and answers

1 Introduction to accounting 12 1 111

2 Principles and concepts 18 3 113

3 Accounting systems 13 7 116

4 Double entry bookkeeping 16 10 118

5 The trial balance 15 13 120

6 Sales, purchases and taxes 19 16 123

7 Control accounts 23 23 128

8 Accruals and prepayments 19 29 134

9 Receivables and irrecoverable debts 15 34 139

10 Inventories 19 38 143

11 Non-current assets and depreciation 30 44 147

12 Bank reconciliations 20 51 153

13 Accounting errors 21 56 157

14 Incomplete records 16 61 161

15 Company accounts 21 65 165

16 Statements of cash flows 16 76 171

17 Interpretation of Financial Statements 19 83 175

18 Provisions and contingencies 8 88 179

19 Events after the reporting period 6 91 180

20 Group accounts 30 93 171

Mock Exams

Full exams to practise are provided. Question practice, under assessment conditions, is vital to

passing this exam.

ACCA Specimen paper

It is vital that you try the computer based specimen exam on the ACCA website. The specimen uses

the software that you will meet in your real exam and you must be familiar with it. You will find it on

the ACCA website: [Link]

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 1: Introduction to accounting 1

Chapter questions

1: Introduction to accounting

OBJECTIVE TEST QUESTIONS

1 Which of the following provides advice to the International Accounting Standards Board (IASB)

as well as informing the IASB of the implications of proposed standards for users and preparers

of financial statements?

The IFRS Advisory Council

The IFRS Interpretations Committee

The IFRS Foundation

2 A number of different groups of people make use of the information in published financial

statements. These groups include: owners/investors, analysts and advisers, employees, business

contacts, government and the public. What is the missing group?

3 “The supplier of goods on credit needs an indication of future trading, i.e. an indication of future

progress. However, the shareholder needs a statement of financial position, i.e. an indication of

the current state of affairs.”

True

False

4 The main aim of accounting is:

To maintain ledger accounts for every asset and liability

To produce a trial balance

To provide financial information to users of such information

To record every financial transaction individually

5 There are three main pieces of information comprising a set of financial statements. Two of

these are the Statement of Profit or Loss and Other Comprehensive Income and the Statement

of Financial Position. What is the correct name of the missing one?

6 For which purpose would a lender be most likely to use the information in published financial

statements?

Measuring performance, risk and return

Taking buy/sell decisions

Assessment of ability to repay debts

Taking decisions regarding holding investments

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

2 1: Introduction to accounting ACCA FA Question Bank

7 Who sets International Financial Reporting Standards?

The IFRS Interpretations Committee

The International Accounting Standards Board

The IFRS Foundation

The IFRS Advisory Council

8 Determine whether the following statements are TRUE or FALSE.

True False

Sole traders have limited liability

A partnership has to produce financial statements in accordance

with accounting standards issued by the IASB

9 Which of the following are advantages of trading as an unincorporated business?

1 Legal separation of ownership

2 Unlimited liability

1 only

2 only

Both 1 and 2

Neither 1 nor 2

10 Preparation of financial statements is the responsibility of:

Shareholders

Directors

External auditors

Internal auditors

11 Which ONE of the following sentences does NOT explain the distinction between financial

accounts and management accounts?

Financial accounts are primarily for external users and management accounts are

primarily for internal users

Financial accounts are normally produced annually and management accounts are

normally produced monthly

Financial accounts are more accurate than management accounts

Financial accounts are audited by management whereas management accounts are

audited by external auditors

12 The objective of financial statements is to enable users to assess the performance of

management and to aid in decision making.

True

False

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 2: Principles and concepts 3

2: Principles and concepts

OBJECTIVE TEST QUESTIONS

1 Assets are usually valued under which basis?

Historic cost

Net realisable value

Current cost

Fair value

2 What are the TWO fundamental qualitative characteristics of useful financial information?

Relevance and reliability

Relevance and faithful representation

Truth and fairness

Reliability and faithful representation

3 Income and expenses should be recognised in the period in which they have been earned or

incurred, rather than when cash changes hands. Which accounting concept does this illustrate?

Substance over form concept

Consistency concept

Separate entity concept

Accruals concept

4 In the time of rising prices, what effect does use of the historic cost concept have on asset

values and profits?

Overstated Understated

Asset values

Profits

5 If the owner of a business takes goods from inventory for his own personal use, the accounting

concept to be considered is:

Consistency

Accruals

Separate entity

Going concern

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

4 2: Principles and concepts ACCA FA Question Bank

6 Which of the following statements about accounting concepts are correct?

1 The accruals concept is that income should only be recognised when cash is received.

2 The historic cost concept is that assets are initially recorded at their cost.

3 The substance over form convention is that, whenever legally possible, the economic

substance of a transaction should be reflected in the financial statements, rather than

simply its legal form.

4 The going concern concept is the assumption that the entity will continue in operation

for the foreseeable future.

1, 2 and 3

1, 2 and 4

1, 3 and 4

2, 3 and 4

7 Which accounting concept means that similar items should receive the same accounting

treatment?

8 Which of the following best explains what is meant by “capital expenditure”?

Expenditure on maintaining or repairing non-current assets

Expenditure on expensive assets

Expenditure relating to the issue of share capital

Expenditure on the acquisition or improvement of non-current assets

9 A business has incurred the following expenditure. Identify whether each item should be

treated as capital or revenue expenditure.

Capital Revenue

expenditure expenditure

Redecoration of office premises

Upgrade of factory equipment

Cleaning of factory

Purchase of delivery van

10 Capital put into a business by its owner must always be in the form of cash.

True

False

11 Which ONE of the following should be accounted for as capital expenditure?

Cost of painting a building

The replacement of windows in a building

The purchase of a car by a garage for re-sale

Legal fees incurred on the purchase of a building

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 2: Principles and concepts 5

12 A company includes in inventory goods received before the year end, but for which invoices are

not received until after the year end. This is in accordance with:

The historical cost convention

The accruals concept

The consistency concept

The materiality concept

13 When there is inflation, the historical cost concept has the effect of:

Overstating profits and understating statement of financial position values

Understating profits and overstating statement of financial position values

Understating cash flow and overstating cash in the statement of financial position

Overstating cash flow and understating cash in the statement of financial position

14 Which ONE of the following best describes the stewardship function?

Ensuring high profits

Managing cash

Ensuring the recording, controlling and safeguarding of assets

Ensuring high dividends to shareholders

15 The objective of financial statements is to provide useful information to their most important

users. These are (tick all that apply):

investors

lenders

suppliers

taxation authorities

16 Which THREE of the following elements are included in the statement of financial position?

Assets

Equity

Expenses

Income

Liabilities

17 An asset is a present economic resource owned by a business as a result of past events.

True

False

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

6 2: Principles and concepts ACCA FA Question Bank

18 Which of the following will be classified as non-current assets for a dealer in computer

equipment?

(1) Computers for resale

(2) Vehicles for delivering computers

(3) Business capital

(4) Office furniture

(1) and (2)

(2) and (3)

(2) and (4)

(3) and (4)

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 3: Accounting systems 7

3: Accounting systems

OBJECTIVE TEST QUESTIONS

1 Which ONE of the following attributes is most important for any code to possess in order to be

of use in an accounting system?

Easy to change the code number

Each code is unique

A combination of letters and digits to ensure input accuracy

Linked to assets, liabilities, income, expenditure and capital

2 Which of the following are used in a coding system for accounting transactions?

Product code

Nominal ledger code

Department code

All of the above

3 Which of the following would be recorded in the sales day book?

Despatch notes

Sales invoices

Credit notes received

Trade discounts

4 Which of the following is NOT a book of prime entry?

Cash payments book

Sales returns day book

Receivables ledger

Journal

5 Which of the following would NOT be recorded in the cash payments book?

Payment to a supplier

Staff wages paid

Return of goods by a customer

Refund given to a customer

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

8 3: Accounting systems ACCA FA Question Bank

6 A business maintains a petty cash imprest system. The following amounts are paid out of petty

cash during the month of April:

$

Stationery 14.30

Travel expenses 25.50

Office refreshments 12.90

Sundry payables 24.00

What amount is required to restore the imprest balance to $100 at the end of April?

$

7 The petty cash tin contains $200 cash at the beginning of September. The following amounts

have been recorded in the petty cash book for the month:

$

Taxi fares 65.00

Stamps 9.70

Milk and biscuits for office staff 24.35

Contribution to cover the cost of stamps taken for personal use 2.40

How much petty cash is left in the till at the end of September?

$

8 Which of the following documents might be used to record an entry in the cash receipts book?

Credit sales invoice

Sales credit note

Remittance advice

Goods received note

9 An imprest system is:

Accounting computer software

An audit process

Automatic agreement of the cash book and bank statement balances

A method of controlling petty cash

10 B operates the imprest system for petty cash. At 1 July there was a float of $150 but it was

decided to increase this to $200 from 1 August onwards. During July, the petty cashier received

$25 from staff for using the photocopier and a cheque for $90 was cashed for an employee.

In July, cheques were drawn for $500 for petty cash. What was the total expense paid from

petty cash in July?

$385

$435

$515

$615

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 3: Accounting systems 9

11 What is the purpose of an imprest system?

It records the use of a company’s seal

It helps to reconcile the cash book with the bank statement

It helps to control petty cash

It is part of computerised accounting

12 N operates an imprest system for petty cash. On 1 February, the float was $300. It was decided

that this should be increased to $375 at the end of February. During February, the cashier paid

$20 for window cleaning, $100 for stationery and $145 for coffee and biscuits. The cashier

received $20 from staff for the private use of the photocopier and $60 for a miscellaneous cash

sale. What amount was drawn from the bank account for petty cash at the end of February?

$185

$260

$315

$375

13 Which of the following are used in a coding system for accounting transactions?

Department code

Nominal ledger code

Product code

All of the above

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

10 4 : D o u b l e e n t r y b o o k k e e p i n g ACCA FA Question Bank

4: Double entry bookkeeping

OBJECTIVE TEST QUESTIONS

1 Which TWO of the following statements are true?

A debit records an increase in liabilities

A debit records a decrease in assets

A credit records an increase in liabilities

A credit records a decrease in expenses

2 Which of the following would all result in a debit entry being made in the nominal ledger?

Expense, increase in asset, increase in liability

Expense, decrease in asset, increase in liability

Income, decrease in liability, decrease in asset

Expense, decrease in liability, increase in asset

3 What is the double entry to record the purchase of goods on credit?

Debit Credit

Payables

Receivables

Purchases

Sales

4 The double entry system of bookkeeping normally results in which of the following balances on

the ledger accounts?

Debit Credit

Expenses

Capital

Liabilities

Drawings

5 Complete the double entry to record the withdrawal of cash from a business by its owner:

Debit

Credit

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 4: Double entry bookkeeping 11

6 What is the correct double entry to reflect the posting to the nominal ledger of the total from

the sales day book?

Debit Credit

Sales

Receivables

Payables

Cash

7 What is the correct double entry to reflect the posting to the nominal ledger of the total

payables column from the cash payments book?

Debit Credit

Purchases

Receivables

Payables

Cash

8 A business receives an invoice from a supplier of office furniture which is payable in 30 days’

time. What double entry would correctly record this invoice in the nominal ledger?

Debit Credit

Fixtures and fittings

Capital

Payables

Cash

9 Which fundamental accounting principle underpins double entry bookkeeping?

Duality concept

Money measurement concept

Accruals concept

Realisation concept

10 A trader took goods that had cost $2,000 from inventory for personal use. Which of the

following journal entries would correctly record this?

DEBIT Drawings $2,000 CREDIT Inventory $2,000

DEBIT Purchases $2,000 CREDIT Drawings $2,000

DEBIT Sales $2,000 CREDIT Drawings $2,000

DEBIT Drawings $2,000 CREDIT Purchases $2,000

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

12 4 : D o u b l e e n t r y b o o k k e e p i n g ACCA FA Question Bank

11 Consider the following statements and select the correct answer:

1 A credit entry in the cashbook will increase an overdraft

2 A debit entry in the cashbook will increase a bank balance

Both statements are true

Both statements are false

1 is false and 2 is true

1 is true and 2 is false

12 Which of the following best describes “revenue”?

Cash withdrawn from the business by the owner

Interest earned by a business from savings

Income earned from the sale of goods

Cash received from trade receivables

13 Which of the following statements is correct?

A debit entry is required to record an increase in income

A debit entry is required to record an increase in capital

A credit entry is required to record a receipt of cash

A credit entry is required to record a decrease in expenses

14 The following balance is brought down in the general ledger at 30 June 2013.

Payables Control Account

$ $

Balance b/f 57,450

What does this balance represent?

Asset

Liability

15 What is the correct double entry to restore the petty cash imprest balance at the end of the

month?

Debit Credit

Petty cash

Bank

16 Which of the following transactions will have the effect of increasing assets?

Purchase of goods on credit

Sale of goods on credit

Payment to credit supplier

Return of goods from customer

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 5: The trial balance 13

5: The trial balance

OBJECTIVE TEST QUESTIONS

1 What is the primary purpose of a trial balance?

To test the accuracy of the double entry bookkeeping records

To prepare management accounts

To prepare financial accounts

To clear the suspense account

2 A bookkeeper receives a purchase invoice for $78 but records the expense as $87. What type of

error is this?

Omission

Commission

Transposition

Principle

3 What will be the impact on profit and net assets of an error of principle?

Correct Incorrect No impact

Profit

Net assets

4 Which TWO of the following sets of items all appear on the same side of the trial balance?

Sales, interest paid and payables

Sundry expenses, prepayments and purchases

Receivables, drawings and rent expense

Petty cash, rental income and wages expense

Capital, trade payables and other operating expenses

5 Liabilities of a business are $1,207 and assets are $2,143. How much capital is in the business?

$

6 A sole trader had opening capital of $10,000 and closing capital of $4,500. During the period,

the owner introduced new capital of $4,000 and withdrew $8,000 for her own use. What is her

profit or loss for the period?

$9,500 loss

$1,500 loss

$7,500 profit

$17,500 profit

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

14 5 : T h e t r i a l b a l a n c e ACCA FA Question Bank

7 Which of the following is a correct representation of the accounting equation?

Opening capital plus profit less drawings less liabilities equals closing capital

Assets less liabilities less drawings equals opening capital plus profit

Assets less liabilities less opening capital less drawings equals profit

Opening capital plus profit less drawings plus liabilities equals assets

8 Profit is $1,051 and capital introduced is $300. There is an increase in net assets of $833.

What are drawings?

$

9 The following figures are extracted from a company’s statement of financial position:

$

Non-current assets 12,500

Current assets 4,700

Capital 2,000

What is the correct figure for liabilities?

$

10 How should balances be treated at the end of an accounting period?

Income and Assets and

expenses liabilities

Carried forward to start of next accounting period

Transferred to statement of profit or loss

11 On 1 May 2012 the net assets of a business were $10,000. Net assets on 30 April 2013 were

$18,000. Drawings were $500 per month. What was the profit for the year?

$

12 What is the term given to items that a business owns and intends to use for the long term?

Current assets

Non-current assets

Capital

Long-term loan

13 What is the main purpose of the statement of financial position?

To show cash receipts and payments in a period

To show the assets and liabilities of a business

To show the profit for the period

To show how much the business owes its suppliers

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 5: The trial balance 15

14 The accounting equation at the start of the month was assets $14,000 less liabilities $6,500.

During the following month, the business purchased a non-current asset for $6,000, paying by

cheque, a profit of $9,000 was made, and payables of $7,500 were paid by cheque. What would

be the balance on capital at the end of the month?

$

15 The profit of a business may be calculated by using which ONE of the following formulae?

Opening capital – Drawings + Capital introduced – Closing capital

Closing capital + Drawings – Capital introduced – Opening capital

Opening capital + Drawings – Capital introduced – Closing capital

Closing capital – Drawings + Capital introduced – Opening capital

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

16 6 : S a l e s , p u r c h a s e s a n d t a x e s ACCA FA Question Bank

6: Sales, purchases and taxes

OBJECTIVE TEST QUESTIONS

1 The following information relates to Hi’s accounts for the month of October:

$

Sales (including sales tax) 109,250

Purchases (net of sales tax) 84,000

Sales tax is charged at a rate of 15%. Hi’s sales tax account showed an opening credit balance of

$4,540 at the beginning of the month. How much sales tax is owing at the end of the month?

$22,310

$8,328

$6,190

$2,890

2 A debit balance of $806 brought forward in Y’s account in the books of X means that:

X owes Y $806

Y owes X $806

X has received $806 from Y

X has given a discount of $806 to Y

3 The following is an extract from the trial balance of ABC at 31 December 2012:

Debit $ Credit $

Purchases 84,193

Returns 4,129 2,272

Discounts 1,143

What is the correct figure to be shown in the trading account for net purchases?

$80,778

$81,921

$84,193

$84,907

4 What is the correct double entry to reflect the total posting to the nominal ledger from the

purchases returns day book?

Debit Credit

Purchases returns

Receivables

Payables

Purchases

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 6: Sales, purchases and taxes 17

5 A business sells goods on credit for $400 plus sales tax at 20%. What is the correct double entry

to reflect this transaction?

Debit $ Credit $

Receivables 480

Sales 400

Sales tax 80

Receivables 480

Sales 480

Receivables 400

Sales 320

Sales tax 80

Sales 400

Sales tax 80

Receivables 480

6 D sells goods to a customer for $2,500. D offers a 5% discount if the customer pays within 7

days. D expects the customer to take advantage of the discount.

What is the correct double entry to record the transaction?

Dr Receivables $2,375; Cr Sales $2,375

Dr Receivables $2,500; Cr Sales $2,500

Dr Receivables $2,375; Dr Discount allowed $125; Cr Sales 2,500

Dr Receivables $2,500; Cr Discount allowed $125; Cr Sales 2,375

7 What is the correct double entry to record a refund given to a customer?

Debit Credit

Receivables

Cash

Sales

Sales returns

8 The Gold Company makes the following sales during December:

Sale of books (zero rated) $78,000 net

Sale of DVDs (standard rated) $18,800 net

Sale of CDs (standard rated) $4,935 gross

Assuming a standard rate of sales tax of 17.5% what is the total sales tax for the month?

$

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

18 6 : S a l e s , p u r c h a s e s a n d t a x e s ACCA FA Question Bank

Questions 9 and 10 relate to the following information:

Angel purchased goods with a list price of $55,000 at a 10% trade discount and took advantage of a

settlement discount of 5% for payment within 30 days.

9 What is the correct double entry to record the purchase? (Enter amounts in figures).

Debit Credit

Payables $________ $________

Purchases $________ $________

Discounts received $________ $________

10 What is the correct double entry to record the payment? (Enter amounts in figures).

Debit Credit

Payables $________ $________

Cash $________ $________

Discounts received $________ $________

11 Take It has the following balances on its trial balance for the year ended 30 June 2012:

Debit $ Credit $

Sales 172,500

Purchases 109,000

Returns 4,850 3,675

Discounts 750

What is gross profit for the year?

$

12 Which of the following explanations would NOT explain why sales tax is not exactly 20% of total

sales revenue (assuming a standard rate of sales tax of 20%)?

The business makes some zero rated supplies

The business exports some goods which are not liable for VAT

The business is not registered for VAT

The business sells goods to a customer who is not registered for VAT

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 6: Sales, purchases and taxes 19

13 Lo has the following transaction totals for the month of February:

$

Sales (net of sales tax of 19%) 72,400

Purchases (net of sales tax of 19%) 58,800

The balance owing in sales tax at the start of the month was $5,895 and at the end of the month

was $3,465. How much sales tax was paid during February?

$154

$2,584

$3,311

$5,014

14 Which of the following statements relating to a debit note is TRUE? (Select all which apply).

It is raised by the purchaser

It is raised by the seller

It is a formal request for a credit note to be raised

It is recorded in the sales returns day book

15 Edmund has the following totals in his cash book for August:

Date Narrative Total $ Discounts $ Payables $

31 August Total 18,580 380 18,960

What is the correct double entry to record the discount amount in the nominal ledger?

Debit Credit

Discounts allowed $________ $________

Discounts received $________ $________

Payables $________ $________

Receivables $________ $________

16 Lucy sells goods with a net list price of $5,000 to Susan at a 10% trade discount. What are the

net, sales tax (assuming a rate of 20%) and gross amounts to be included on the sales invoice?

Net $ VAT $ Gross $

Invoice totals $________ $________ $________

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

20 6 : S a l e s , p u r c h a s e s a n d t a x e s ACCA FA Question Bank

17 North, which is registered for sales tax, received an invoice from an advertising agency for

$4,000 plus sales tax. The rate of sales tax on the goods was 20%. What would the correct

ledger entries be?

Debit Credit

Advertising expense $4,000 Payables $4,000

Advertising expense $4,800 Payables $4,800

Advertising expense $4,800 Payables $4,000, Sales tax account $800

Advertising expense $4,000, Payables $4,800

Sales tax account $800

18 In July year 1, a company sold goods at VAT rate with a net value of $200,000, goods exempt

from VAT with a value of $50,000 and goods at zero VAT rate with a net value of $25,000. The

purchases in July year 1, which were all subject to VAT, were $161,000 including VAT. Assume

that the VAT rate is 15%. The difference between VAT input tax and VAT output tax is:

DR $9,000

CR $5,850

CR $9,000

None of these

19 Are the following statements correct or incorrect?

(1) Discount received should be recorded on the debit side in the payables ledger account

(2) Discount received should be recorded on the debit side in the general ledger

Statement 1 Statement 2

Correct Correct

Correct Incorrect

Incorrect Correct

Incorrect Incorrect

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 6: Sales, purchases and taxes 21

This page has been left intentionally blank

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

22 6 : S a l e s , p u r c h a s e s a n d t a x e s ACCA FA Question Bank

This page has been left intentionally blank

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 7: Control accounts 23

7: Control accounts

OBJECTIVE TEST QUESTIONS

1 Which of the following items could appear on the credit side of a receivables account?

1 Contra entries

2 Cash received from customers

3 Sales

4 Irrecoverable debts written off

5 Credits for goods returned by customers

6 Refunds to customers

1, 2, 4 and 5

1, 3, 4 and 5

3, 4, 5 and 6

3, 4 and 6

2 A business has the following transactions for the month of June:

$

Credit sales (including sales tax at 20%) 134,500

Sales returns (including sales tax at 20%) 8,200

Cheques received from customers 125,100

The receivables balance at 1 June was $18,700. What was the receivables balance at 30 June?

$

3 A junior bookkeeper has drawn up the following receivables control account:

Receivables control account

$ $

Opening balance 75,000

Cash received 409,500 Sales 468,000

Irrecoverable debt 1,500 Contra 5,200

Sales returns 11,750

Balance carried forward 1,050

486,000 486,000

What should the balance carried forward be after correcting the errors?

$128,450

$118,050

$115,050

$125,450

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

24 7 : C o n t r o l a c c o u n t s ACCA FA Question Bank

4 You are given the following information relating to JKL for the year ended 31 December:

$

Receivables at 1 January 12,500

Receivables at 31 December 14,750

Total cash receipts for the year (including cash sales of $7,000) 95,000

What is the value for sales made on credit for the year?

$85,750

$90,250

$97,250

$100,500

5 Roger’s payables control account had a balance on 1 November of $23,500 credit. During

November credit purchases were $48,600, cash purchases were $3,700 and payments made to

suppliers, excluding cash purchases and after deducting discounts of $1,250, were $53,950.

Purchases returns were $3,700. What was the balance on Roger’s payables control account at

30 November?

$

6 The total of the balances in the payables control account is $2,500 more than the total of the

payable balances extracted from the purchase ledger. Which of the following would explain this

difference?

Cash paid to suppliers has not been posted to some accounts in the purchase ledger

The purchases day book is overcast by $2,500

A contra entry between the purchases and sales ledgers has been omitted from the

purchase ledger but was posted in the payables control account

Discounts received have not been posted in the purchase ledger accounts

7 The following totals have been extracted from the books of Why at 30 April:

$

Sales day book total 212,820

Purchases day book total 173,455

Returns inwards day book total 6,790

Returns outwards day book total 7,300

Discounts received 3,750

Cash receipts from receivables 198,500

Cash payments to payables 148,695

The payables control account had a balance of $18,200 at 1 April. During the month a journal

entry has recorded a contra entry between the receivables and payables account of $540.

What was the balance on the payables control account at 30 April?

$

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 7: Control accounts 25

8 Seena’s payables control account showed a credit balance of $58,743. The individual payables’

accounts in the payables ledger totalled $56,473. The difference could be due to entering a

discount received on the credit side of the control account of:

$

9 Jordan received a statement from one of her suppliers, Peter, showing a balance owing of

$2,890. The amount owing according to the payables ledger account of Peter in Jordan’s

accounts was only $290. Comparison of the statement and the ledger account revealed the

following:

I A cheque sent by Jordan for $360 had not been recorded in Peter’s statement

II Peter had not recorded goods returned by Jordan of $540

III Jordan made a contra entry, reducing the amount owing to Peter by $1,700, for a balance

due from Peter in Jordan’s receivables ledger. No such entry had been made in Peter’s

records.

What difference remains between the two businesses’ records after adjusting for these items?

$Nil

$650

$1,700

$2,240

10 Which of the following errors would NOT be detected by performing reconciliation of the

receivables control account balance to the total in the receivables ledger?

Irrecoverable debt not recorded in customer’s receivables ledger account

Sales invoice not recorded in sales day book

Contra entry entered on debit side of receivables control account

Total from returns inwards day book not posted to receivables control account

11 The balance on Neena’s receivables control account at 30 September was $38,792. Her receivables

ledger showed a total of $41,739. After investigation, Neena discovered the following:

I Discounts received of $410 had been credited to the receivables control account

II An invoice for $2,395 had been posted in the sales day book as $3,295

III Returns inwards of $1,030 had been debited to the receivables control account

What is the remaining difference between Neena’s receivables control account and the

receivables ledger after correcting these errors?

$

12 Which of the following errors should be identified by performing a reconciliation between the

payables control account balance and the total in the payables ledger?

A purchase return of $75 was entered as $57 in the purchases returns day book

Sales of $128 were entered as purchases returns in the purchases returns day book and

in the individual payables account

The total of the purchases day book was miscast by $200

A purchase invoice of $250 was omitted from the purchases day book

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

26 7 : C o n t r o l a c c o u n t s ACCA FA Question Bank

13 At 1 November the payables ledger control account showed a balance of $18,240.

At 30 November the following balances were extracted from the accounting records:

$

Purchases day book total (net of sales tax of 17.5%) 23,800

Returns outwards day book total (gross of sales tax of 17.5%) 1,375

Returns inwards day book total (gross of sales tax of 17.5%) 2,850

Payments to payables after deducting $75 settlement discount 25,925

It is also discovered that:

I A customer’s balance of $1,200 has been offset against her balance of $3,350 in the

payables ledger

II A suppliers’ account in the payables ledger with a debit balance of $300 has been

included in the list of payables as a credit balance

What is the correct balance on the payables ledger control account at 30 November?

$14,780

$15,480

$17,030

$17,630

14 When reconciling the payables control account to the list of balances in the payables ledger it is

discovered that $3,000 of goods returned to suppliers were not recorded in the nominal ledger.

What is the required adjustment to the payables control account?

Debit $3,000

Credit $3,000

Debit $6,000

Credit $6,000

15 Which of the following would NOT be found in the payables ledger control account? (Tick all

which apply.)

Contra entry

Returns inwards

Irrecoverable debts

Discounts received

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 7: Control accounts 27

16 Which of the following statements are true?

1 The total of the returns inwards day book is posted to the debit side of the payables

control account

2 A contra entry should be credited to receivables and debited to payables in the nominal

ledger

3 The sales day book contains details of all sales

4 VAT is excluded from amounts recorded in the receivables and payables control accounts

5 A credit balance on an individual receivables account should be added back to the total

list of receivables balances when reconciling to the nominal ledger

1, 2 and 5

2, 3 and 4

2 only

2 and 5

17 The balance on Crane’s receivables control account on 31 January was $15,205. During the

month, Crane made sales of $87,250 (including cash sales of $4,270) and received $94,310 from

credit customers. Crane also wrote off an amount of $1,050 owing from a customer who went

into liquidation during the month. What was the balance on Crane’s receivables control account

on 1 January?

$

18 On 31 March Olsen had a balance of $62,840 on its receivables control account, compared to a

total balance of $61,910 on the receivables ledger. Upon investigation it was discovered that:

I Late payment interest charged to customers on overdue amounts of $410 had not been

recorded in the nominal ledger

II The balance on H Duck’s account of $390 had been omitted from the total of balances in

the receivables ledger

III Sales returns of $825 had been treated as purchase returns in the nominal ledger

In addition, the company decided to write off $150 in relation to an irrecoverable debt at the

month end. What was the corrected balance on the receivables control account at 31 March?

$61,450

$61,455

$62,275

$62,665

19 Which of the following errors would require a correction to be made in the payables ledger

only? (Tick all which apply.)

Omission of a debit balance on a supplier’s account in the payables ledger total

Omission of a purchase credit note in the purchases returns day book

Failure to record a contra entry in a supplier’s account with a balance owing by the same

business in the receivables ledger

Casting error in the purchases day book

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

28 7 : C o n t r o l a c c o u n t s ACCA FA Question Bank

20 Don’s payables ledger includes an amount owing to Betty of $51,250 at 31 October. Betty sends

a statement showing a balance owing of $52,890 at the same date. Which of the following

would NOT explain the difference?

Betty has failed to record a payment from Don made on 28 October of $1,640

Don has recorded a purchase credit note from Betty for $820 on the wrong side of the

ledger account

Don has failed to record an invoice dated 30 October from Betty for $1,640

Betty has recorded a net payment amount of $8,200 in the sales ledger receipts column

in her cash book instead of the gross amount of $9,840

21 The entries in a sales ledger control account are:

$

Sales 250,000

Bank 225,000

Sales returns 2,500

Irrecoverable debts 3,000

Returned unpaid cheque 3,500

Contra with purchase ledger account 4,000

What is the balance on the sales ledger control account?

$12,000

$19,000

$25,000

$27,000

22 On 1 May, East owed a supplier $1,200. During the month of May, East:

Purchased goods for $1,700 and the supplier offered a 5% discount for payment within

the month

Returned goods valued at $100 which had been purchased in April

Sent a cheque to the supplier for payment of the goods delivered in May

What is the balance on the suppliers’ account at the end of May?

$1,105

$1,100

$1,185

$1,300

23 Alpha received a statement of account from a supplier Beta, showing a balance to be paid of

$8,950. Alpha’s purchase ledger account for Beta shows a balance due to Beta of $4,140.

Investigation reveals the following:

(1) Cash paid to Beta of $4,080 has not been accounted for by Beta

(2) Alpha’s purchase ledger account has not been adjusted for $40 of cash discount

disallowed by Beta

What discrepancy remains between Alpha’s and Beta’s records after allowing for these items?

$Nil

$690

$770

$730

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 8: Accruals and prepayments 29

8: Accruals and prepayments

OBJECTIVE TEST QUESTIONS

1 A company’s telephone bill consists of two elements: a quarterly rental charge payable in

advance and quarterly call charges payable in arrears. On 30 April the company received a bill

for call charges of $300 up to the bill date and $150 for line rental for the quarter commencing

1 May. How much should be included in the company’s statement of financial position for the

year ended 30 June for both line rental and call charges?

Line rental Call charges

Prepayment $50

Prepayment $100

Accrual $100

Accrual $200

2 At 1 September 2012 Riskit had an insurance prepayment of $9,200. On 1 January 2013 the

company paid $42,000 for insurance for the year ended 31 December 2013. What figures should

appear for insurance in Riskit’s financial statements for the year ended 31 August 2013?

Statement of profit or loss Statement of financial position

$23,200 $14,000 accrual

$46,800 $14,000 prepayment

$37,200 $14,000 prepayment

$23,200 $28,000 prepayment

3 Drogba pays rent quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. Annual

rent was increased from $150,000 to $180,000 from 1 October 2011. What rent expense and accrual

should be included in Drogba’s financial statements for the year ended 31 March 2012?

Rent expense Accrual

$165,000 $Nil

$165,000 $30,000

$165,000 $45,000

$162,500 $45,000

4 A company sublets part of its office building for an annual rent of $127,500. The company

receives rent payments quarterly in advance on 1 February, 1 May, 1 August and 1 November.

How much should be included in the company’s statement of financial position as at 30 June

2013?

$10,625 in sundry payables

$10,625 in other receivables

$31,875 in sundry payables

$31,875 in other receivables

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

30 8 : A c c r u a l s a n d p r e p a y m e n t s ACCA FA Question Bank

5 During the year, $6,000 was paid to the water authority. At the beginning of the year, $1,400

was owed and at the end of the year $1,600 was owed. What amount should be included in the

statement of profit or loss for water rates?

$

6 Dunno paid its annual motor insurance premium of $1,200 on 1 April 2012. During the month of

June 2012 Dunno incurred petrol expenses of $130. What is the amount to be included in the

statement of profit or loss for motor expenses for the month of June 2012?

$130

$230

$330

$430

7 Harry received cash for rent totalling $627,200 in the year ended 31 December 2012. Figures for

rent received in advance and in arrears at the beginning and end of the year were as follows:

31 Dec 2011 31 Dec 2012

Rent received in advance $82,300 $68,700

Rent in arrears $34,900 $36,100

What amount should appear in Harry’s statement of profit or loss for rental income for the year

ended 31 December 2012?

$707,200

$547,200

$612,400

$642,000

8 The gas expense account had a balance for reversal of gas accrued at 1 July 2012 of $300.

Payments made during the year ended 30 June 2013 were:

$

Paid 1 August for 3 months to 31 July 2012 700

Paid 1 November 2012 for 3 months to 31 October 2012 720

Paid 1 February 2013 for 3 months to 31 January 2013 960

Paid 30 June 2013 for 3 months to 30 April 2013 840

What should be the entries in the financial statements for the year ended 30 June 2013?

$ Statement of financial position

$ Statement of profit or loss

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 8: Accruals and prepayments 31

9 Matty has occupied rented premises for some years, paying annual rent of $78,000. From

1 April 2013 the rent was increased to $96,000 per annum. Rent is paid quarterly in advance on

1 January, 1 April, 1 July and 1 October each year. What figures for rent should appear in

Matty’s financial statements for the year ended 30 November 2013?

Statement of profit or loss Statement of financial position

$90,000 $8,000 prepayment

$90,000 $16,000 prepayment

$88,500 $16,000 accrual

$90,000 $8,000 accrual

10 Details of a company’s insurance policy are shown below:

$

Premium for the year ended 31 March 2012 (paid April 2011) 10,800

Premium for the year ended 31 March 2013 (paid April 2012) 12,000

What figures should be included in the company’s financial statements for the year ended

30 June 2012?

Statement of profit or loss Statement of financial position

$11,100 $9,000 prepayment

$11,700 $9,000 prepayment

$11,100 $9,000 accrual

$11,700 $9,000 accrual

11 A company sublets part of its office and receives quarterly rent payments from its tenant of

$9,000 on 1 March, 1 June, 1 September and 1 December. At the company’s reporting date of

31 December what amount will be included in the company’s statement of financial position?

$3,000 in sundry payables

$6,000 in sundry payables

$3,000 in other receivables

$6,000 in other receivables

12 Jamie pays monthly rent of $1,000. At the beginning of the year he was $2,000 in arrears and

during the year he paid $13,000. What was the amount in arrears or prepaid at the end of the

year?

$1,000 prepaid

$1,000 in arrears

$2,000 prepaid

$2,000 in arrears

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

32 8 : A c c r u a l s a n d p r e p a y m e n t s ACCA FA Question Bank

13 Kirsty is preparing her financial statements for the year ended 31 December 2012 and discovers

the following:

I An electricity invoice dated 9 January 2013 has not been recorded and includes an

amount for electricity consumed up to 31 December 2012 for $310

II An employee expense claim dated 31 December for $90

III An invoice for the company’s annual insurance premium of $3,000 for the period

1 December 2012 to 30 November 2013 was received and dated 2 January 2013

What amount should be included in Kirsty’s statement of financial position at 31 December

2012?

Accrual of $400 and Prepayment of $250

Accrual of $650 and Prepayment of $Nil

Accrual of $400 and Prepayment of $Nil

Accrual of $650 and Prepayment of $2,750

14 Lennon pays its staff a performance related bonus on 28 February each year in relation to the

previous year. Amounts accrued at the beginning and end of the year are as follows:

31 Dec 2011 31 Dec 2012

$ $

Staff bonus accrual 6,500 10,200

The amount paid out to staff on 28 February 2012 amounted to $7,400, and total salaries paid

for the year 2012 amounted to $310,500. What amount should be charged to the statement of

profit or loss for salaries expense for the year ended 31 December 2012?

$

15 Which of the following statements are correct? (Tick all that apply.)

Deferred income is treated as a prepayment in the statement of financial position

Accrued income should be recognised as revenue in the statement of profit or loss

Prepaid expenses are reflected as a debit balance in the trial balance

Accrued expenses should be credited to the relevant expense account in the statement

of profit or loss

16 On 1 May, A pays a rent bill of $1,800 for the 12 months to 30 April. What is the charge/credit

to the statement of profit or loss for the year ended 30 November?

$

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 8: Accruals and prepayments 33

17 H began trading on 1 July. The company is now preparing its accounts for the accounting year

ending 30 June year 1. Rent is charged for the year from 1 April to 31 March, and was $1,800 for

the year ended 31 March year 1 and $2,000 for the year ended 31 March year 2. Rent is payable

quarterly in advance, plus any arrears, on 1 March, 1 June, 1 September and 1 December.

The charge to H’s statement of profit or loss for rent for the year ended 30 June year 1 is:

$1,650

$1,700

$1,850

$1,900

18 On 1 June year 1, H paid an insurance invoice of $2,400 for the year to 31 May year 2. What is

the charge to the statement of profit or loss and the entry in the statement of financial position

for the year ended 31 December year 1?

$1,000 statement of profit or loss and prepayment of $1,400

$1,400 statement of profit or loss and accrual of $1,000

$1,400 statement of profit or loss and prepayment of $1,000

$2,400 statement of profit or loss and no entry in the statement of financial position

19 On the first day of month 1, a business had prepaid insurance of $10,000. On the first day of

month 8, it paid, in full, the annual insurance invoice of $36,000 to cover the following year.

What is the amount charged in the statement of profit or loss and the prepayment shown in the

statement of financial position at the year end?

Statement of profit or loss $ Statement of financial position $

5,000 24,000

22,000 23,000

25,000 21,000

36,000 15,000

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

34 9 : R e c e i v a b l e s a n d i r r e c o v e r a b l e d e b t s ACCA FA Question Bank

9: Receivables and irrecoverable debts

OBJECTIVE TEST QUESTIONS

1 Rose had receivables of $498,600 at 30 November 2012. Her allowance for receivables at

1 December 2011 was $10,560 and she decided to change that to 2% of receivables at

30 November 2012. On 29 November 2012 she received $870 in full settlement of a debt that

she had written off in the year ended 30 November 2011. What amount should be recognised

with respect to receivables in the statement of profit or loss for the year ended 30 November

2012?

$ Debit / Credit (delete as appropriate)

2 A company has been notified that a customer has gone into liquidation. The company had

previously provided for this doubtful receivable. What is the correct double entry in the

financial statements?

Debit Credit

Allowance for receivables

Bad and doubtful debts expense

Cash

Receivables

3 An increase in an allowance for receivables of $2,000 has been treated as a reduction in the

financial statements. What is the effect of this error on profit and net assets?

Net profit Net assets

Overstated by $4,000

Understated by $4,000

Overstated by $2,000

Understated by $2,000

4 At the beginning of the year, Tiny’s allowance for receivables was $2,000. At the end of the

year, when receivables were $38,500, a specific allowance was made for the whole of Little’s

debt of $600 and for 80% of Large’s debt of $1,000. It was decided to make a general allowance

of 2% of remaining debts. What was the closing balance on the allowance for doubtful

receivables account?

$2,110

$2,138

$4,110

$110

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 9: Receivables and irrecoverable debts 35

Questions 5 and 6 relate to the following information:

At 1 July 2012 a company’s allowance for receivables was $48,000. At 30 June 2013, trade receivables

amounted to $838,000. It was decided to write off $72,000 of these debts and adjust the allowance for

receivables to $60,000.

5 What is the net trade receivables figure to be included in the company’s statement of financial

position at 30 June 2013?

$658,000

$706,000

$718,000

$766,000

6 What is the amount to be included in the statement of profit or loss for irrecoverable and

doubtful receivables expense for the year ended 30 June 2013?

$12,000

$60,000

$72,000

$84,000

7 At 30 September 2011 Martha’s allowance for receivables was $59,000. At 30 September 2012

trade receivables totalled $617,000. It was decided to write off debts totalling $47,000 and to

adjust the allowance for receivables to 5% of trade receivables. What figure should appear in

the statement of profit or loss for these items?

$16,500

$28,500

$77,500

$77,850

8 At 31 December 2011 Donna had receivables totalling $250,000 and an allowance for

receivables of $24,000 brought forward from the previous year. It has been decided to write off

irrecoverable receivables of $17,500 and adjust the allowance for receivables to 4% of

remaining receivables. Rather surprisingly, Donna received $500 on 25 December from an old

customer whose debt had been written off in 2008. What will be the total charge for

irrecoverable debts and receivables allowance appearing in Donna’s statement of profit or loss

for the year ended 31 December 2011?

$

9 The requirement for management to carry out a review of irrecoverable and doubtful

receivables at the end of the year is an example of which accounting concept?

Substance over form

Consistency

Prudence

Business entity concept

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

36 9 : R e c e i v a b l e s a n d i r r e c o v e r a b l e d e b t s ACCA FA Question Bank

10 On 18 April Jane receives a cheque from a customer for $400 which she had written off in the

previous year. What is the correct double entry to record this amount in the nominal ledger?

Debit Credit

Cash

Receivables

Allowance for doubtful receivables

Irrecoverable and doubtful receivables expense

11 Pillay’s receivables ledger at 1 July 2012 showed a total of $61,250. During the year ended

30 June 2013, the sales day book total amounted to $549,600 and the total customer receipts

column in the cash book amounted to $499,800. At the year end it was decided that $4,370 was

to be written off and a general allowance of 5% of receivables should be created. What was the

balance on Pillay’s receivables ledger at 30 June 2013?

$7,080

$101,346

$106,680

$115,420

Questions 12 and 13 relate to the following information:

Kelsey maintains an allowance of 2% of outstanding receivables. On 1 January 2012 the receivables

balance was $80,000 and on 31 December 2012 was $98,000. At the year end it was decided that

$2,800 should be written off and that the balance of $1,000 owing from Larkin should be allowed for.

12 What was the closing balance on the receivables allowance account at 31 December 2012?

$

13 What amount should be included in the statement of profit or loss for irrecoverable and

doubtful receivables expense?

$2,800

$3,800

$4,084

$5,684

14 Gheno has an opening balance on its allowance for doubtful receivables account of $4,000.

During the year, $1,000 of debts were written off, a cheque for $500 was received relating to an

amount that had previously been written off, and a customer went into administration owing an

amount of $650, for which an allowance had not been made. At the year end, the general

allowance was reduced by $400. What was the charge to the statement of profit or loss for

irrecoverable and doubtful receivables in the year?

$750 credit

$1,250 credit

$1,550 credit

None of these amounts

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 9: Receivables and irrecoverable debts 37

15 The sales revenue of a company was $4 million and its receivables were 7.5% of sales. The

company wishes to have an allowance of 3% of receivables, which would result in an increase of

25% above the current allowance. What figure would appear in the statement of profit or loss

for irrecoverable debts?

$

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

38 1 0 : I n v e n t o r i e s ACCA FA Question Bank

10: Inventories

OBJECTIVE TEST QUESTIONS

1 Which of the following statements about the treatment of inventory and work in progress in

financial statements are correct?

1 Inventory should be valued at the lower of cost and net realisable value

2 In valuing work in progress, materials costs, labour costs and variable and fixed

production overheads must be included

3 Inventory items can be valued using either last in first out (LIFO), or weighted average

cost

4 A company’s financial statements must disclose the accounting policies used in

measuring inventories

All four statements

1, 2 and 4

2, 3 and 4

1 and 3 only

2 A business received delivery of goods on 29 November 2012 which were included in the

inventory valuation at 30 November 2012. The invoice for the goods was recorded in December

2012. What effect will this have on the financial statements at 30 November 2012?

Profit Net assets

Overstated

Understated

3 In preparing its financial statements for the current year, a company’s closing inventory was

overstated by $50,000. What will be the effect of this error in the financial statements if it

remains uncorrected?

Current year Next year

profit profit

Overstated

Understated

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 10: Inventories 39

4 Smile Co values inventories on the first in first out (FIFO) basis. During October 2012 the

following inventory movements were recorded:

1 October Balance in inventory 130 items valued at $8 each

3 October Purchase of 190 items at $9 each

4 October Sale of 160 items for $12 each

8 October Sale of 90 items for $15 each

18 October Purchase of 290 items at $10 each

22 October Sale of 70 items for $15 each

What was the closing value of inventory at the end of October?

$

5 Which of the following costs should be included as part of the cost of inventories of finished

goods held by a manufacturing company?

1 Carriage inwards

2 Carriage outwards

3 Depreciation of factory plant

4 Accounts department costs relating to wages for production employees

1 and 3

2 and 3

1, 3 and 4

All four items

6 Warner has inventories of garden chairs at 31 August 2012 which cost $32,000. After the year

end the chairs were sold for a total of $22,500. Warner incurred delivery costs of $1,500 and

paid sales commission of 5% of the sales value. What should be the value of inventories in the

statement of financial position at 31 August 2012?

$

7 The value of inventory included in the financial statements of Samson as at 31 December 2012

was based on an inventory count performed on 4 January 2013 and amounted to $726,200.

Between 31 December 2012 and 4 January 2013 the following transactions took place:

$

Purchase of goods 18,600

Sale of goods at a profit mark up of 40% on cost 14,000

Return of goods to supplier 950

What adjusted figure should be included in Samson’s financial statements for inventories at 31

December 2012?

$753,850

$733,850

$718,550

$696,650

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

40 1 0 : I n v e n t o r i e s ACCA FA Question Bank

8 The closing inventory of Duff amounted to $216,400 at cost, including the following:

I 600 items which had cost $4 each, all of which were sold after the reporting date for

$3 each, with selling expenses amounting to $300 for the batch

II 100 different items which had cost $30 each and which were found to be defective.

Rectification work after the reporting date amounted to $500, after which the items were

sold for $35 each, with selling expenses amounting to $250

What amount should be included in Duff’s statement of financial position for inventories?

$215,250

$215,450

$216,100

$216,400

9 Sandy values its inventory using the first in first out (FIFO) method. At 1 May 2012 the company

had 700 desks in inventory, valued at $110 each. During the year ended 30 April 2013 the

following transactions took place:

1 Jul 2012 Purchased 500 desks for $120 each

1 Nov 2012 Sold 400 desks for $160 each

1 Feb 2013 Purchased 300 desks for $150 each

15 Apr 2013 Sold 250 desks for $175 each

What was the value of the company’s closing inventory of desks at 30 April 2013?

$120,000

$110,500

$93,500

None of these figures

10 Lane sells three products, A, B and C. The following information was available at the year end:

A B C

$ $ $

Original cost per unit 10 8 16

Estimated selling price per unit 15 12 14

Selling and distribution costs per unit 3 5 2

Units Units Units

Closing inventory 200 150 100

What value for inventory should be included in Lane’s statement of financial position?

$4,650

$4,250

$4,800

$7,750

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 10: Inventories 41

11 Discovery values its inventory using the continuous weighted average cost method. At 1 January

2012 it has 220 silos of grain valued at $1,000 each. During 2012 the following transactions took

place:

10 Mar 2012 Sold 80 silos for $1,100 each

18 Mar 2012 Purchased 100 silos for $940 each

30 Jul 2012 Sold 160 silos for $1,300 each

12 Nov 2012 Purchased 90 silos for $1,450 each

What was the value of the company’s closing inventory of grains at 31 December 2012?

$246,500

$208,500

$156,500

$148,500

12 Which of the following statements about inventory valuation are correct?

1 Average cost and first in first out are both acceptable methods of arriving at the cost of

inventories

2 Inventories of finished goods may be valued at labour and materials costs only, without

including overheads

3 Inventories should be valued at the lowest of cost, net realisable value and replacement

cost

4 It may be acceptable for inventories to be valued at selling price less estimated profit

margin

1 and 3

2 and 3

1 and 4

2 and 4

13 In times of rising prices, what will be the effect on a business’ profits of using the following

inventory valuation methods?

Higher Lower

FIFO

LIFO

14 The following information has been extracted from a company’s statement of profit or loss:

$

Sales 156,800

Cost of sales (109,750)

Gross profit 47,050

Opening inventory was $51,300 and purchases were $99,400. What was the value of closing

inventory?

$

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

42 1 0 : I n v e n t o r i e s ACCA FA Question Bank

Questions 15 and 16 relate to the following information:

At 31 March 2013 a company’s trial balance included the following figures:

Debit $ Credit $

Sales 842,800

Purchases 531,620

Returns 9,215 11,700

Inventory at 1 April 2012 77,100

Closing inventory is valued at $96,500.

15 What is cost of sales?

$500,520

$509,735

$512,220

$539,320

16 What is gross profit?

$342,280

$333,065

$318,880

$294,265

17 Santos has inventories valued at cost of $412,300 in his statement of financial position at

30 June. Included in this amount are the following:

I 350 Amples which had cost $15 each which were sold after the reporting date for $12.50

each, incurring selling costs of $700.

II 450 Bodules which had cost $10 each and which were found to be defective. The items

were repaired at a total cost of $1,000 and were then sold for $14.50 each after the

reporting date via a third party who charged commission of 5% on the sales price.

What amount should be included in Santos’ statement of financial position for inventory at

30 June?

$

18 Which of the following statements about the valuation of inventory is correct?

Inventory items are normally to be valued at the higher of cost and net realisable value

The cost of goods manufactured by an entity will include materials and labour only.

Overhead costs cannot be included

LIFO is an accepted valuation method for inventory. FIFO is not an accepted valuation

method for inventory

Selling price less estimated profit margin may be used to arrive at cost if this gives a

reasonable approximation to actual cost

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 10: Inventories 43

19 The inventory value for the financial statements of Q for the year ended 31 May 20X6 was

based on an inventory count on 4 June 20X6, which gave a total inventory value of $836,200.

Between 31 May and 4 June 20X6, the following transactions took place:

$

Purchase of goods 8,600

Sales of goods (profit margin 30% on sales) 14,000

Goods returned by Q to supplier 700

What adjusted figure should be included in the financial statements for inventories at 31 May

20X6?

$838,100

$853,900

$818,500

$834,300

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

44 1 1 : N o n - c u r r e n t a s s e t s a n d d e p r e c i a t i o n ACCA FA Question Bank

11: Non-current assets and depreciation

OBJECTIVE TEST QUESTIONS

1 What is the purpose of charging depreciation in the financial statements?

To ensure that funds are available for replacement of the asset in the future

To allocate the cost of the asset over the accounting periods expected to benefit from its

use

To comply with the substance over form concept

To reduce the cost of the asset in the statement of financial position to its estimated

market value

2 Your firm purchased a machine for $8,000 on 1 January 2010. The machine was expected to

have a useful life of four years and a residual value of $2,000. The asset was depreciated on a

straight line basis starting from the month of purchase. On 31 December 2012 the machine was

sold for $2,600. What was the amount to be included in the statement of profit or loss for the

year ended 31 December 2012 for profit or loss on disposal?

$ Profit / Loss (delete as appropriate)

3 A non-current asset register shows a carrying amount of $106,460. An asset costing $18,000 has

been sold for $6,000, making a loss on disposal of $1,250. No entries have been made in the

non-current asset register for this disposal. What should the balance on the non-current asset

register be?

$88,460

$89,710

$99,210

$101,710

4 An organisation’s non-current asset register shows a carrying amount of $238,100. The non-

current asset account in the nominal ledger shows a carrying amount of $228,100. The

difference could be due to a disposed asset not having been removed from the non-current

asset register:

With disposal proceeds of $15,000 and a profit on disposal of $5,000

With disposal proceeds of $15,000 and a carrying amount of $5,000

With disposal proceeds of $15,000 and a loss on disposal of $5,000

With disposal proceeds of $5,000 and a carrying amount of $5,000

5 What would be the effect of recording an invoice for motor vehicle repairs by debiting the

motor vehicle at cost account?

Overstated Understated

Profit

Net assets

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

ACCA FA Question Bank 11: Non-current assets and depreciation 45

6 Hannah has recorded an invoice for $1,000 relating to computer stationery as a purchase of a

new computer. What would be the correct double entry to correct this error?

Debit Credit

Computer stationery expense

Computer equipment cost

Suspense account

Depreciation expense

7 A machine cost $16,000. It has an expected useful life of six years and an expected residual

value of $4,000. It is to be depreciated at 30% per annum on the reducing balance basis. A full

years’ depreciation is charged in the year of purchase, with none in the year of sale. During year

four, it is sold for $6,000. What is the profit or loss arising on disposal?

$1,884 profit

$800 profit

$512 profit

$512 loss

8 Montana’s plant and machinery ledger account for the year ended 30 September 2013 was as

follows:

Plant and machinery – Cost

$ $

1 Oct 2012 Balance b/f 180,000

1 Dec 2012 Additions 30,000 1 Jun 2013 Disposal 48,000

30 Sep 2013 Balance c/f 162,000

210,000 210,000

Montana’s policy is to charge depreciation at 25% per annum on the straight-line basis, with

proportionate depreciation in the years of purchase and sale. What is the depreciation expense

for the year ended 30 September 2013?

$40,500

$47,250

$48,250

$59,250

9 A business purchased a motor vehicle on 1 July 2012 for $30,000. It is to be depreciated at 25%

per annum on the reducing balance basis, starting from the month of acquisition. The $30,000

was correctly entered in the cash book but was posted to the debit side of the motor vehicles

repairs account. How will the business profit for the year ended 31 December 2012 be affected

by this error?

Understated by $33,750

Overstated by $33,750

Understated by $26,250

Overstated by $26,250

Downloaded by Burhanuddin (innovationineducationpune@[Link])

lOMoARcPSD|20475403

46 1 1 : N o n - c u r r e n t a s s e t s a n d d e p r e c i a t i o n ACCA FA Question Bank

Questions 10 and 11 relate to the following information:

Simpson purchased a property on 1 April 2006 for $240,000 (of which $60,000 related to land).

The building was depreciated at a rate of 2% per annum on a straight-line basis, with a proportionate

charge being made in the year of purchase. On 31 December 2012 the property was revalued to

$820,000 (including $360,000 relating to land).

10 What amount should be included in Simpson’s statement of financial position at 31 December

2012 for the revaluation surplus?

$580,000

$605,200

$604,300

$304,300

11 What amounts should be included in Simpson’s financial statements for the year ended

31 December 2013?

Depreciation expense Land & buildings

$ $

10,635 809,365

10,635 449,365

9,200 810,800

9,200 450,800