0% found this document useful (0 votes)

2K views2 pagesDCB Bank Fixed Deposit Application Form

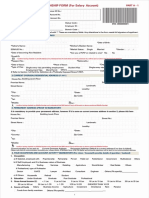

This document is a fixed deposit application form for DCB Bank Limited. It requests information such as the customer name, account number, PAN number, joint applicant details if any, fixed deposit details like amount, period, interest payout frequency and payment instructions. The applicant needs to provide nominee details if required and agrees to terms and conditions for payment of interest and maturity proceeds through NEFT.

Uploaded by

Nikita JainCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views2 pagesDCB Bank Fixed Deposit Application Form

This document is a fixed deposit application form for DCB Bank Limited. It requests information such as the customer name, account number, PAN number, joint applicant details if any, fixed deposit details like amount, period, interest payout frequency and payment instructions. The applicant needs to provide nominee details if required and agrees to terms and conditions for payment of interest and maturity proceeds through NEFT.

Uploaded by

Nikita JainCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd