0% found this document useful (0 votes)

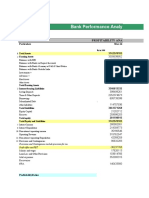

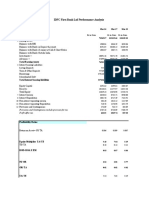

97 views21 pagesFinancial Ratios of Bangladeshi Banks (2017-2021)

The document contains financial ratios for five banks in Bangladesh from 2017 to 2021. It includes current ratio, debt to total assets ratio, return on assets, return on equity, net profit margin, capital adequacy ratio, non-performing loans, tier 1 capital ratio, earnings per share and loan to deposit ratio. The ratios show the financial performance and health of the banks over the five-year period.

Uploaded by

Najmus SakibCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

Topics covered

- Financial Ratios,

- Financial Sustainability,

- Banking Sector Challenges,

- Islamic Banking Principles,

- Current Ratio,

- Banking Sector Performance,

- Financial Data Interpretation,

- Loan to Deposit Ratio,

- Investment Ratios,

- Return on Asset

0% found this document useful (0 votes)

97 views21 pagesFinancial Ratios of Bangladeshi Banks (2017-2021)

The document contains financial ratios for five banks in Bangladesh from 2017 to 2021. It includes current ratio, debt to total assets ratio, return on assets, return on equity, net profit margin, capital adequacy ratio, non-performing loans, tier 1 capital ratio, earnings per share and loan to deposit ratio. The ratios show the financial performance and health of the banks over the five-year period.

Uploaded by

Najmus SakibCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

Topics covered

- Financial Ratios,

- Financial Sustainability,

- Banking Sector Challenges,

- Islamic Banking Principles,

- Current Ratio,

- Banking Sector Performance,

- Financial Data Interpretation,

- Loan to Deposit Ratio,

- Investment Ratios,

- Return on Asset