100% found this document useful (1 vote)

4K views1 pageSMR FOR BIR Sample

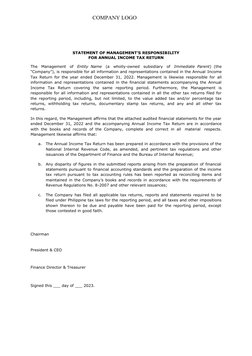

The document is a statement of management's responsibility for an annual income tax return for Entity Name for the year ended December 31, 2022. Management affirms that the financial statements and tax return are complete and accurate according to their books. Management is responsible for all information in the tax return and ensures it complies with Philippine tax law requirements. They also acknowledge responsibility for reconciling any differences between financial and tax accounting treatments of items.

Uploaded by

Ann Cristine CabebeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

4K views1 pageSMR FOR BIR Sample

The document is a statement of management's responsibility for an annual income tax return for Entity Name for the year ended December 31, 2022. Management affirms that the financial statements and tax return are complete and accurate according to their books. Management is responsible for all information in the tax return and ensures it complies with Philippine tax law requirements. They also acknowledge responsibility for reconciling any differences between financial and tax accounting treatments of items.

Uploaded by

Ann Cristine CabebeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd