0% found this document useful (0 votes)

1K views1 pageHSN Codes & GST Rates

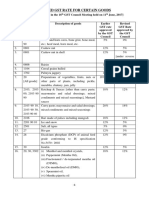

This document provides a list of goods and services classified under different Harmonized System of Nomenclature (HSN) codes and their applicable GST rates. It includes HSN codes and GST rates for various paper products like envelopes, notebooks, paper plates; books, newspapers and periodicals; printed materials like calendars, posters and forms; and job work services related to printing. The document notes that the chart was prepared by an advisory panel and users should verify the classifications and rates for their specific products.

Uploaded by

Bipin AmbedkarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views1 pageHSN Codes & GST Rates

This document provides a list of goods and services classified under different Harmonized System of Nomenclature (HSN) codes and their applicable GST rates. It includes HSN codes and GST rates for various paper products like envelopes, notebooks, paper plates; books, newspapers and periodicals; printed materials like calendars, posters and forms; and job work services related to printing. The document notes that the chart was prepared by an advisory panel and users should verify the classifications and rates for their specific products.

Uploaded by

Bipin AmbedkarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- GST Rates for Items