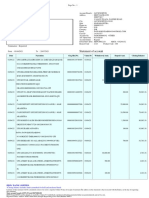

00 UCO BANK 00 UCO BANK Annexure-1

COUNTER FOIL NEFT/RTGS FUNDS REMITTANCE APPLICATION FORM

Form NEFT □ RTGSn Branch Date / / Time

Branch Remit funds through: NEFT d RTGS d (For RTGS- Amount must be for ^ 2 lakhs or more)

Date / / Time

Beneficiary Detai s

By Cash/Cheque/Transfer for RTGS/ Name:

NEFT remittance favouring Account Number:

Account Number:

Beneficiary A/c No: Address:

Bank: Bank Name & Branch:

Branch: IFS Code: Account Type:(S6/CA/CC/0THERS)/ Remittance to INDO Nepal

IFS Code: Amount (to be remitted)

Account Type: NEFT/RTGS Charges

Amount Total Amount

Charges Total Amount in words:

Total Amount Applicant Details (Remitter)

Total Amount in words: Name:

Account Number: Sol Id

Address:

Remitter Name: Mobile/Landline No.: PAN

Remitter A/c No: Email Id:

Address: Purpose of Remittance:

Details of Cash Remitted

Please remit the amount as per above details by debiting cash or my/our K PCS P.

SB/CA/CC/OTHERS Account No. 2000 X

with branch. I/We agree to the terms and 500 X

Seal/Signature of Customer/Remitter conditions printed on the reverse hereof. 200 X

Mobile No. Enclosed Cheque No. /Debit Authority Dated / 100 X

PAN: t enclosed. 50 X

(Refer terms of remittance overleaf.) 20 X

Reference No: 10 X

UTR/ NEFT Ref No.: Coins

Branch Seal Transaction Id: Total

Signature of Authorised Signatory Seal/Signature of Customer/Remitter Sign, of Official Sign, of Official Sign, of Official

(Verifying Doc.) (Maker) (Checker)

� TERMS 8. CONDITIONS OF REMITTANCE

1.The customer shall be responsible for the

accuracy of the particulars given in this payment

order issued by him and shall be liable to

compensate the Bank for any loss arising on

TERMS & CONDITIONS OF REMITTANCE account of any error in his payment order.

1.The customer shall be responsible for the accuracy of the particulars given in this payment order 2.The customer shall ensure availability of funds

in his account properly applicable to the payment

issued by him and shall be liable to compensate the Bank for any loss arising on account of any error order by the Bank. Where however the Bank

in his payment order. executes the payment order without properly

applicable funds being available in the customer's

2.The customer shall ensure availability of funds in his account properly applicable to the payment account, the customer shall be bound to pay to

order by the Bank. Where ho\wever the Bank executes the payment order without properly applicable the Bank the amount debited to his account for

which NEFT/RTGS was executed by the Bank

funds being available in the customer's account, the customer shall be bound to pay to the Bank the pursuant to his payment order, together with

amount debited to his account for which NEFT/RTGS was executed by the Bank pursuant to his the charges including interest payable by the

Bank.

payment order, together with the charges including interest payable by the Bank. 3-The customer hereby authorizes the Bank to

3.The customer hereby authorizes the Bank to debit to his account any liability incurred by him to the debit to his account any liability incurred by him to

the Bank for execution by the Bank of any

Bank for execution by the Bank of any payment order issued by him. payment order issued by him.

4.The customer agrees that the payment order shall become irrevocable when the Bank executes it. 4.The customer agrees that the payment order

shall become irrevocable when the Bank

5. No payment order issued by the customer shall be binding on the Bank until the Bank has accepted executes it.

it and issued the counterfoil of the payment order to the customer. 5.No payment order issued by the customer shall

be binding on the Bank until the Bank has

6.The Bank shall not be liable for any loss of damage arising or resulting from delay due to shut accepted it and issued the counterfoil of the

down/non-connectivity of the system or due to batch-processing taking precedence or any delay in payment order to the customer.

6.The Bank shall not be liable for any loss of

transmission, delivery or non-delivery of Electronic message or any mistake, omission, or error in damage arising or resulting from delay due to

transmission or delivery thereof or in deciphering the message from any cause whatsoever or from its shut down/non-connectivity of the system or due

to batch-processing taking precedence or any

misinterpretation received or the action of the destination Bank or any act or event beyond control. delay in transmission, delivery or non-delivery of

y.The remitter should check all payment instructions carefully. As per NEFT/RTGS rules, funds Electronic message or any mistake, omission, or

error in transmission or delivery thereof or in

are to be credited to destination account number given even if the name of the beneficiary does not deciphering the message from any cause

whatsoever or from its misinterpretation received

tally. The Bank shall not be liable for any loss of damage arising or resulting from such discrepancy. or the action of the destination Bank or any act or

8.Messages received after cut-off time will be sent on the next working day. event beyond control.

7.The remitter should check all payment

9. If there is a banking holiday at destination center on the day of the receipt of the credit notification instructions carefully. As per NEFT/RTGS

at the Treasury Branch, the funds will be credited to the account of the beneficiary on the next rules, funds are to be credited to destination

working day with value date of the previous working day. account number given even if the name of the

beneficiary does not tally. The Bank shall not be

liable for any loss of damage arising or

resulting from such discrepancy.

S.Messages received after cut-off time will be

DISCLAIMER sent on the next working day

Customers/Remitters are advised that credit to beneficiary account will be effected based solely on the beneficiary account number information 9 If there is a banking holiday at destination

mentioned in the request form and the beneficiary name particulars will not be used therefore. center on the day of the receipt of the credit

notification at the Treasury Branch, the funds will

be credited to the account of the beneficiary on

the next working day with value date of the

previous working day.