AMIBROKER AFL

Best Intraday Trading Indicators

J U LY 5 , 2 0 1 7 - 5 M I N S R E A D

Traders only use Most Accurate intraday trading indicators for Intraday Trading Setup. Whether

a trader is a beginner or an experienced, indicators are important. It helps you plan your

trading for the maximum returns. Referring to the intraday trading tips, charts, and indicators

is a common way.

Day trading indicators minimize the risk level. The indicators provide useful information on

market trends. This post guides you to understand the best indicator for intraday trading. As a

thoughtful investor, you also need to decide how much you want to rely on the indicators.

Table of Contents

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

�How to Use Indicators?

Day trading indicators provide good guidance. The most useful information from indicators is

here. Traders use it for assessment of the market scenario before trading.

• The Direction of the current market trend

• Momentum in the investment market

• Chances of pro t

• Volume assessment to know the popularity of the market

• Demand and supply trading theory

The crux lies in nding the right mix of the indicators for pro table decision. Too much of

information might spoil the strategy. Use always the best combination of indicators for

intraday trading.

Top 5 Intraday Trading Indicators For Setup

Not all traders prefer to use the indicators. If you use, pick the most suitable and useful. The

below list contains some common ones.

Oscillators

Oscillators type of indicators re ects up and down ow. Popular oscillators are Stochastics, CCI

or Commodity Channel Index. Others are MACD and RSI.

Volume

Volume indicators are a mix of price data with volume. They determine how strong the trends

in terms of prices.

Overlays

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

�Overlays indicators are Moving Averages and Bollinger Bands. Parabolic SAR and Fibonacci

Extensions are other Overlays. Moving average determines trends. Fibonacci is to plan pro t

targets. CCI have a good number of uses like trends and trade triggers.

Breadth

The Breadth Indicators are stock market-related. The major ones are Ticks, Tiki, Trin and also

the Advance-Decline line. They relate to the sentiment of the traders. They re ect what the

large part of the market is doing.

Bollinger Bands

This comprises three lines. The lines show the moving average, lower limit, and the upper limit.

How to Read Indicators?

Using many indicators is not a good idea. Pick the one among the most useful ones. Also, use

the one that you can read well. Find here an easy way to understand the most popular tools

available.

The Traders Also Like: How to Select Stock For Intraday Without Chart?

1. Moving Averages (M.A.) :

The market trend is bullish when the long-term averages are less. It is bearish when short-term

averages are less. This helps traders to earn indecent pro t in intraday. Its very Simple Intraday

Trading System.

Uses of Moving Average

• To nd the trend, either up or down

• To know the reversal of the trend

• To nd out the stop loss and trailing stop loss

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

� • To nd out the price overextended

Basic Buy signals for MA

• Moving average should almost be parallel and at equal distance

• They should be in ascending order

• Lowest Ma is at the bottom while the highest Ma is at the top

• The rst signal gets generated when the price cuts the short ma from the bottom

Basic Sell signals for MA

• Moving average should almost be parallel and at equal distance

• The moving average should be in the descending order

• The rst signal gets generated when price cuts the higher Ma from the top

2. Moving Average Convergence Divergence (MACD) :

MACD is used to identify the different aspects of the overall trend. These aspects are

momentum, trend direction, and duration. MACD takes the difference between two lines as a

histogram and oscillates above and below center zero line.

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

�3. Bollinger Bands ([Link]) :

The price may go up in some time if the stock trading price is below the lower line. Traders

decide to take a buy share strategy.

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

� • The band may be at high or Low.

• It uses Band Bollinger Demand and Supply Zones.

• Always Buy in demand zone with lower band touching the price at Support.

• Sell In supply zone with higher band touching the price at Resistance.

You Also Like: The Best Intraday Trading Strategies

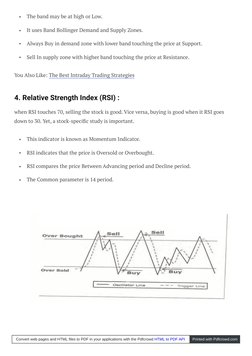

4. Relative Strength Index (RSI) :

when RSI touches 70, selling the stock is good. Vice versa, buying is good when it RSI goes

down to 30. Yet, a stock-speci c study is important.

• This indicator is known as Momentum Indicator.

• RSI indicates that the price is Oversold or Overbought.

• RSI compares the price Between Advancing period and Decline period.

• The Common parameter is 14 period.

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

�Every Trader Must Know: All Time “Best Intraday Trading Techniques “

5. Average Directional Index (ADX) :

ADX is used to quantify the strength of the trend. ADX calculations are based on a moving

average of price range expansion over a given period time. The default setting is 14 bars,

although other periods can be used.

• This Indicator is Momentum Indicator.

• Reading between 0 to 100

• Below 10 to 15 indicates the consolidation.

• > 25 reading indicates the strength

• Calculated from +di and –di

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

�Indicators are not a proven way to earn pro ts. They are good to read the market moods for the

best investment decisions.

If you are looking for intraday trading indicators then this Article is 100% Helpful for Your

Intraday Setup.

About Us

In this blog, you will get to know about the Intraday Indicator and how it works in the share

market. Trading Fuel provides information about the vast topics of the stock market and we

keep on updating our site with new blogs. Finance itself is the vast topic to know, in the stock

market no-body know the complete nance but they keep on learning and making themselves

educate by applying the learning. You can read more from this blog and make yourself updated.

B E S T I NT R A DAY T R A D I N G I N D I C ATO R S

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]

� Prashant Raut

Prashant Raut is a successful professional stock market trader. He is an expert in understanding and

analyzing technical charts. With his 8 years of experience and expertise, he delivers webinars on

stock market concepts. He also bags the ‘Golden Book of World Record’ for having the highest

number of people attending his webinar on share trading.

Convert web pages and HTML files to PDF in your applications with the Pdfcrowd HTML to PDF API Printed with [Link]