0 ratings0% found this document useful (0 votes)

304 views11 pages02.partnership Operation1

Uploaded by

Gabriel Tom EntradaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

0 ratings0% found this document useful (0 votes)

304 views11 pages02.partnership Operation1

Uploaded by

Gabriel Tom EntradaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF or read online on Scribd

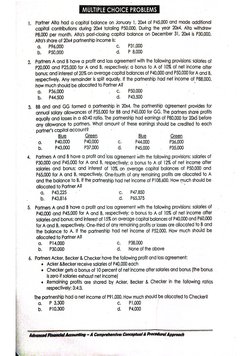

MULTIPLE CHOICE PROBLEMS

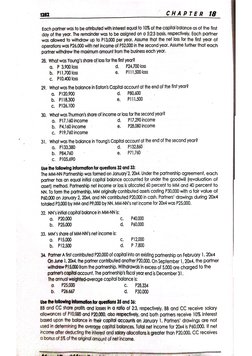

. Partner Alfa had a capital balance on January 1, 20x4 of P45,000 and made additional

capital contributions during 20x4 totaling PS0,000. During the yeor 20x4, Alta withdrew

8,000 per month. Alta's post-closing capital balance on December 31, 20x4 is P30,000.

Alta’s share of 20x4 partnership income is:

a. P96,000 cc. P31,000

b. — P50,000 dP 8,000

Poriners A and B have a profit and loss agreement with the following provisions: solaies of

20,000 and P25,000 for A and 8, respectively; a bonus to A:of 10% of net income after

bonus; and interest of 20% on average capital balances of P40,000 and PS0,000 for A and B,

respectively. Any remainder is spit equally. If the partnership had net income of P88,000,

how much should be allocated fo Pariner A?

0, 36,000 c. — P50,000

b. 44,500 dPA3,500

. BB and and GG formed a partnership in 20x4, The partnership agreement provides for

annual salary allowances of P5,000 for 88 and P45,000 for GG. The pariners share profits

equally and losses in a 60:40 raf. The partnership had earings of P80,000 for 20x5 before

any allowance fo partners. What amount of these eamings should be credited to each

pariner’s capital account?

Blue Green Blue Green

co. —P40,000——_PA0,000 c. 44,000 36,000

b. P4300 ——P87,000 dd. PA5,000 35,000

Partners A and B have a profit and loss agreement with the following provisions: salaries of

30,000 and P45,000 for A and 8, respectively; a bonus to A of 12% of net income after

solories and bonus; and interest of 10%. on average capital balances of P50,000 and

65,000 for A and B, respectively. One-fourth of any remaining profits are allocated fo A

and the balance to B. If he partnership had net income of P108,400. How much should be

allocated to Partner A? E

a. PA3,225 c.PA7.850

b. P3816 d. P6575

Partners A and B have a profit and loss agreement with the following provisions: salaries of

40,000 and P45,000 for A and B, respectively; o bonus to A of 10% of net income after

salaries and bonus; and interest of 15% on average capital balances of P40,000 and Pé0,000

for A and B, respectively, One-third of any remaining profits or losses ore allocated to B and

the balance to A. If the partnership had net income of P52,000. How much should be

allocated to Partner A?

a. P14,000 cc, 38,000

b. — P30,000 d. None of the above

. Partners Acker, Becker & Checker have the following proft and loss agreement;

* Acker &Becker receive salaries of P40,000 each

«Checker gets a bonus of 10 percent of net income after solaies and bonus (the bonus

is ze10 if salaries exhaust net income)

«Remaining profits are shared by Acker, Becker & Checker in the following ratios

respectively: 3:

The partnership had a net income of P91,000. How much should be allocated to Checker?

a. P 3,300 cc. PI,000

b. — P10,300 d. 4,000

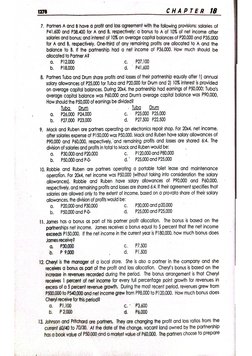

1278 CHAPTER 18

7. Partners A and B have:a profit and loss agreement with the following provisions: salaries of

P41,600 and P38,400 for A and B, respectively; a bonus to A of 10% of net income after

salaries and bonus; and interest of 10% on average capital balances of P20,000 and P35,000

for A and 8, respectively. One-third of any remaining profits are allocated to A and the

balance to 8. If the partnership had a net income of P36,000. How much should be

allocated to Partner A?

0. — P12,000 c. _ P27,100

b. P1800 d, © P41,600

Poriners Tuba ond Drum share profits and losses oftheir partnership equally offer 1) annual

salary allowances of P25,000 for Tuba and P20,000 for Drum and 2} 10% interest is provided

(on average capital bolances. During 20x4, the partnership had eamings of P50,000; Tuba's

‘overage capital balance was P60,000 and Drum's average capital balance was P90,000,

How should the P50,000 of earings be divided?

Tuba Dum Tuba Dum

a. P26,000. P24,000 cc.» 25,000 P25,000

b, 27,000 P23,000 d.P27,500 P22,500

‘Mack and Ruben are partners operating an electronics repair shop. For 20x4, net income,

after salaries expense of P150,000 was P50,000. Mack and Ruben have salary allowances of

90,000 and P60,000, respectively, ‘and remaining profits and losses are shared 6:4. The

division of salaries and profits in total to Mack and Ruben would be:

a, P30,000.and P20,000 c. P120,000.and P80,000

b, 50,000. and P-0- d.° P25,000 and P25,000

| Robbie ond Ruben ore partners operating « portable tollet lease and maintenance

operation. For 20%4, net income was P50,000 (without taking into consideration the salary

cllowances). Robbie ond Ruben have solay alowances of P90,000 and P60,000,

respectively, and remaining profs and losses are shared 6:4. If their agreement specifies that

solaries are allowed only to the extent of income, based on a pro-rata share of their salary

cllowances, the divsion of profs would be:

«a. P20,000 and 30,000 cc. P30,000 ond p20,000

b, P50)000 and P-0- ._P25,000.and P25,000

|. James has 0 bonus as part of his partner profit allocation. The bonus is based on the

patinerships net income. James receives a bonus equal fo 5 percent that the net income

‘exceeds P150,000. If the net income in the curent year is P180,000, how much bonus does

James receive?

a. 30,000 c. P7500

bP 9,000 . dg PISO

12. Cheryl is the manager of a local store. She is also a partner in the company and she

feceives a bonus as part of the profit and loss allocation. Chery''s bonus is based on the

increase in revenues recorded during the period. The bonus arrangement is that Cheryl

receives | percent of net income for every ful petcentage point growth for revenues in

excess of a5 percent revenue growth. During the most recent period, revenues grew from

500,000 to P540,000 and net income grew from P98,000 to P120,000, How much bonus does

Chery receive for this period?

0. PI,100 c.* 3,600

b. P2000 d. P6000

13, Johnson and Pritchard are partners, They are changing the profit and loss ratios from the

current 40/40 to 70/30. At the date of the change, vacant land owned by the partnership

has a book value of P50,000 and a market value of P60,000. The partners choose to prepare

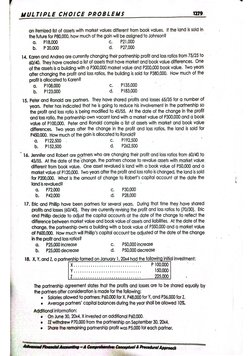

MULTIPLE CHOICE PROBLEMS 279

an itemized Ist of assets with markét values different from book values. If the land is sold in

the future for P80,000, how much of the gain will be assigned to Johnson?

a. P18,000 cc. P21,000

b. P-20,000 d. 27,000

14, Karen and Andrea are currentty changing their partnership profit and loss ratios from 75/25 to

60/40. They have created a list of assets that have market and book vaive differences. One

of the assets is a building with a P300,000 market value and P200,000 book value. Two years

after changing the profit and loss ratios, the building is sold for P380,000. How much of the

profitis located to Karen?

a. P108,000 cc. P135,000

b. P123,000 d. _ P183,000

15, Peter and Ronald are partners. They have shored profits and losses 65/35 for a number of

yeas. Peter has indicated that he is going to reduce his involvement in the partnership so

the profit and loss ratio is being modified fo 45/55. At the date of the change in the profit

‘and loss ratio, the partnership own vacant land with a market value of P300,000 and a book

value of P100,000. Peter and Ronald compile a list of assets with market and book value

differences. Two years after the change in the profit and loss ratios, the land is sold for

450,000. How much of the gain is allocated to Ronald?

a. P122,500 cc. P192,500

b. P152,500 d.— P262,500

16. Jennifer and Robert ore partners who are changing their profit and loss ratios from 60/40 to

45/55. At the date of the change, the partners choose to revalue assets with market valve

different from book value. One asset revalued is land with a book value of P50,000 and a

market value of P120,000. Two years after the profit and loss ratio is changed, the land is sold

for P200,000. What is the amount of change to Robert's capital account at the date the

landis revolved?

a. P72,000 c. — P30,000

b. P4200 d. P28,000

17. ric and Philip have been partners for several years. During that time they have shared

Profi ond losses (60/40). They are curently revising the profit and loss ratios to (70/20). Eric

‘and Philip decide to adjust the copital accounts at the date of the change to reflect the

difference between market vaive and book vaiue of assets and labilfies. At the date of the

‘change, the porinership owns a building with a book valve of P350,000 and a market value

‘of P400,000. How much wil Philip's capital account be adjusted at the date of the change

in the profit ond loss ratios?

a. P25,000 increase c. 50,000 increase

b. 25,000 decrease d. 50,000 decrease

18. X,Y, and Z, a partnership formed on January 1, 20x4 had the following intial investment:

P 100,000

150,000

225,000

The partnership agreement slates that the profils and losses, are to be shared equally by

the partners after consideration is made for the following:

+ Solaries allowed to partners: P60,000 for X, P48,000 for Y, and P3é,000 for 2,

«Average partners’ capital balances during the year shall be allowed 10%.

‘Additional information:

* On June 30, 20x4, X invested an additional P60,000.

* IL withhdrew P70,000 trom the partnership on September 30, 20x4,

Share the remaining partnership profit was P5,000 for each partner,

es

_Acdvanced Financial Accounting ~ A Comprehensive: Conceptual & Procedural Approach

_

1280 ‘ CHAPTER 18

Partnership net profit on December 31, 20x4 before salaries, interests and partner's share on

the remainder was:

o. P199,750 c, P211,625

b. P207,750 d. P202,750

19. Aparinership begins its ist year with the folowing capital balances:

‘Athur, copital. P 60,000

Baxter, capital

Cartwright, copit

The atcles of partnership stipulate that profits and losses be assigned in the following

manner:

+ Each partner is allocated interest equal to 10 percent of the beginning copital

bolonce. :

+ Boxteris olocoted compensation of P20,000 per year.

«Any remaining profits and losses are alocated on a 33:4 bass, respectively.

+ Each partner s allowed to withdraw up to P5,000 cash per yeor.

‘Assuming that the net income is P50,000 and that each partner withdraws the maximum

‘amount allowed, What is the balance in Cartwright's capital account at the end of that

year?

a. —P105,800 c. 106,900

b. — P106,200 dd. P107,400

20. Apartnership begins its fist year of operations with the following capital balances:

Winston, Capital... P 110,000

Durham, Capital ‘80,000

Solem, Cpit 110,000

‘According to the aricles of parinershp, al profs willbe assigned os folows:

‘Winston will be aworded an annual salary of P20,000 with P10,000 assigned to

Soler.

«The partners willbe attributed interest equal fo 10 percent of the capitol balance as

Of the fist day of the yeor.

«The remainder will be assigned on a 52:3 bass, respectively.

«Each partner is alowed to withdraw up to P10,000 per year.

‘Assume that the net loss for the fist year of operations is P20,000 and that net income for

the subsequent year is P40,000. Assume also that each partner withdraws the maximum

‘mount from the business each period. What is the balance in Winston's capital account

at the end of the second year? *

a. —P102,600 c. — P108,600°

b. — P104,400 d. —-P109,200

21. Arthur Plack, a partner in the Bite Partnership, has @ 30% participation in partnership profits

‘and losses. Plack’s capital account had a net decrease of Pé0,000 during the calendar

yeor 20x4, During 20x4, Plack withdrew P130,000 (charged against his capital account) and

contributed property valued at P25,000 to the partnership. What was the net income of the

Brite Partnership for 204%

a. P150,000 ¢. —P350,000

b. P233,333 d.—P550,000

22. Fox, Greg, and Howe are partners with average capital balances during 20x4 of P120.000,,

60,000, and P40,000, respectively. Partners receive 10% interest on their average capital

balances. After deducting salaries of P20,000 to Fox and P20,000 to Howe, the residual

‘Advanced Financial Accounting ~ A Comprehensive: Conceptual & Procedural Approach

MULTIPLE CHOICE PROBLEMS 1281

profit or loss is divided equally. In 20x4 the partnership sustained a P33,000 loss before

interest Gnd solaties to partners.

By what amount should Fox's capital account change?

a. P 7,000increase cc. — P-35,000 decrease

b. P-11,000 decrease d. — P-42,000 increase

23. The DEF partnesship reported net income of P130,000 for the year ended December 31,

20x4, According fo the partnership agreement, partnership profils and losses are to be

distibuted as follows:

dD £ £

- | P25,000 | 20,000 | 25,000

Salaries .

Bonus on net inc¢ 10%

Remainder 60% 30% 10%,

How should porinership net income for 20x4 be allocated to D, E, and F? ©

2 E E D E E

@. P78.000 P39,000 P29,700 c. 52500 P75,000. 22,500

b. — P66,200 34,100 P42,500 d. — P66,200 P34,100 P29,700

Use the following information for questions 24 to 27:

Cleary, Wasser and Nolan formed a partnership on January 1, 20x4, with investments of P100,000,

150,000 and P200,000, respectively. For division of income, they agreed to (1) interest of 10% of

the beginning capitol bolance each year, (2) cnnual compensation of P10,000 to Wosser ond

{3) sharing the remainder of the income or loss in a ratio of 20% for Cleary and 40% each for

Wasser and Nolan. Net income was P150,000 in 20x4 and P180,000 in 20x5. Each partner

withdrew P1,000 for personal use every month during 20x4 and 20x5.

24, What was Wasser’s share of income for 20x4?

a. P63,000 d. — P29,000

b. 53,000 fe. P51,000

cc. 58,000

25. What was Nolan's capital balance at the end of 20x4?

. 200,000 d.P246,000

| b. P224,000 fe. P254,000

| c. 238,000 .

26. What was Cleary’ share of income for 20x5?

a. 34,420 d. — P-70,040

b. P75,540 e. P61420

| cc. P6554

27. What was Wasser's copital balance at the end of 20x5e

. P201,000 d.P304,040

b. P263,520 e. °P313,780

c. 264,540

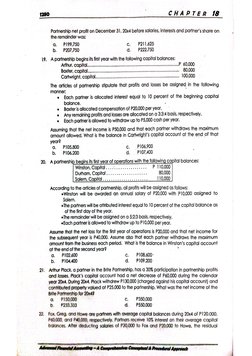

A its frst yeor of operations with the following capital bolances:

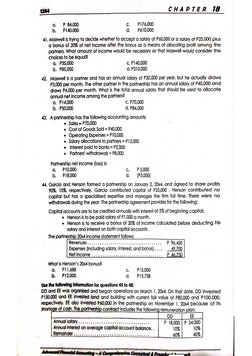

| Use the following Information for questions 28 to 31:

} ns x

|

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:

Young was to be awarded an annual salary of P26,000 with P13,000 salary assigned to Thurman,

ici saci dirpeecetiesecicseore teense ps

Advanced Financial Accounting ~ A Comprehensive: Conceptual & Procedural Approach 3

1282 CHAPTER 18

Each pariner was to be atiributed with interest equal fo 10% of the capital balance as of the first

day of the year. The remainder was to be assigned on a 5:2:3 basis, respectively. Each partner

‘was allowed to withdraw up to P13,000 per year. Assume that the net loss for the first year of

‘operations was P26,000 with net income of P52,000 in the second year. Assume further that each

partner withdrew the maximum amount from the business each year.

28, What was Young's share of loss for the fist year?

a. P 3,900 loss d, — P24,700 loss.

'b. PH,700 loss e. — PI11500 loss

cP 10,400 loss

29. What was the balance in Eaton's Capital account at the end of the first year?

a. P120,900 d. 60,600

b. P118,300 e, P1150

cc. P126,100

30. What was Thurman's share of income or loss forthe second year?

a. P17,160 income d.P17,290income

b, P4,160 income e, P28,080 income

cc. P19,760 income

31. What was the balance in Young's Capital account at the end of the second year?

a. P133,380 d. P132,860

b. P84760 e. P71760

cc. P105,690

Use ihe following information for questions 32 and 33:

The MM-NN Parinership was formed on January'2, 20x4. Under the partnership agreement, each

poriner has an equal intial capital balance accounted for under the goodwil (revaluation of

asset) method. Partnership net income or loss is allocated 40 percent to MM and 40 percent to

NN. To form the partnership, MM originally contributed assets costing P30,000 with a fair value of

60,000 on January 2, 20x4, and NN contributed P20,000 in cash. Partners’ drawings during 20x4

totaled P3,000 by MM and P9,000 by NN. MN-NN's net income for 20x4 was P25,000.

32. NN'sinitial capital bolance in MM-NN is:

a. P20,000 c. P4000

b. 25,000 d, — P60,000

33. MM's share of MM-NN’s net income is:

a. 15,000 c. P1200

b. P12,500 d. P7800

34, Partner A fist contriouted P20,000 of capital nto an existing partnership on February 1, 20x4

(On June 1, 0x4, the partner contiibuted another P20,000. On September 1, 20x4, the partner

witlew P1000 from the portnership. Withdrawals in excess of 5,000 are charged to the

partner's capital account. The partnership's fiscal yeor end is December 31.

‘The annual weighted-overage capital bolance is:

0. P2500 Cc. P28,334

b. P26667 dd, — P30,000

Use the following information for questions 35 and 36:

88 ond CC share profits and losses in a ratio of 2:3, respectively, BB and CC receive salary

allowances of P10,000 and P20,000, also respectively, and both partners receive 10% interest

based upon the ‘bolance in ther capital accounts on January 1. Partners’ drawings are not

used in determining the average capital balances. Total net income for 20x4 is P60,000. If net

income after deducting the interes! and salary allocations is greater than P20,000, CC receives

a bonus of 5% of the original amount of net income.

rrr erent ES

reer een

MULTIPLE CHOICE PROBLEMS 1283

8B cc

January 1 capital balances p~ 200000 Pp” 300000

Yearly drawings (P1,500.¢ month) 18,000 18,000

35. What are the total amounts for the allocation of interest, solary, and bonus, and, how much

‘over-allocation is present?

. 60,000 and PO: ‘ ¢, 83,000. and PO.

b. 80,000 and P20,000 d. 83,000 and P23,000

36. If the partnership experiences a net loss of P20,000 for the year, what will be the final

‘amount of profit or (loss) closed to each partner's capital account?

2. (P30,000)'to BB and P10,000t0CC_——c,_(P8,000) to BB and (12,000) to CC

bb. (P10,000} to BB and (P10,000) to CC d,_P 10,000 to BB and (P30,000) to CC

37. The JPB partnership reported net income of P160,000 for the year ended December 31, 20x4,

‘According fo the partnership agreement, partnership profi and losses are to be distbuted

s follows: i

J z a

50,000 | 40,000 | P30,000

ie | se | 10%

Remainder i positive) 6% | 30% | 10%

Remainder (i negative) aom_| 40% | 30%

How shuld porinentip net income for 2x4 be olocated oP, andb?

1 P 8 1 p B

©. P9600 48.000 16000 —c. —_P60,000° 60,000 P40,000

b. P5800 64,000 P3800 d. 46,000 48,000 46,000,

Use the following information for questions 38 and 39:

‘The APB porinership agreement specifies that parinership net income be allocated as follows:

Partner | PorinerP | Portner B

Salary allowance .. 30,000 | P10,000 | P49,

Interest on average capital balances 10% 10%

Remainder........2+ 40% 40% 20%

‘Average capital balances for the curent year were P50,000 for A, P30,000 for P, and P 20,000 for

B.

38." Assuming a current year net income of 150,000, what amount should be allocatéd to each

partner?

A EB & A Bb B

a. 60,000 P40,000 P30000 c. P24,000 38,000 P54,000

b. P5900 P37,000 P5400 di. 58,000 38,000 54,000

‘39. Assuming a curtent year net income of P50,000, what amount should be alocated to each:

partner?

A B B A BR B

a. 20,000 20,000 P1000 —c.—PI9,000 (3,000) P34,000

b, P1600 P1600 P8000 = d,_—~PI7,000-P -0-~. P33,000

40. The capital account bolances for Donald & Hanes Partnership on January 1, 20x4, were os

follows:

Salaries...

Bonus on net income

Donald, capital. P 200,000

Hones, capital. 100,000

Donald and Hanes shared net ‘income and losses in the ratio of 3:2, respectively. The

partners agreed to admit May to the partnership with a 35% interest in partnership copital

‘and net income. May invested 100,000 cash and no goodwill was recognized, What is the

balance of May's capital account after the new partnership is created?

‘Abvanced Financial Accounting ~ A Comprehensive: Conceptual & Procedural Approach

1288 CHAPTER 18

a, P 84,000 c. — PI76,000

b, — P140,000 d, — P610,000

41, Maxwell ying to decide whether to accept a salary of P40,000 or a salary of P25,000 plus

{© borus of 20% of net income after the bonus as a means of allocating profil omong the

patiners. What amount of income would be necessary so that Maxwell would consider the

choices to be equal?

a, P35,000 ¢, P140,000

'b, 85,000 d,P210,000

42, Maxwel is a partner ond has on annul salary of P30,000 per yeor, but he actually draws

73,000 per month. The other partner in the partnership has an annual salary of P40,000 and

draws P4000 per month, What isthe total annual salary that should be used fo allocate

‘annual net income among the portners?

a, P14,000 1c. P70,000

b. P50,000 dd P84,000

48. Aparnership has the folowing accounting amounts:

«Soles = P70,000

*# Cost of Goods Sold = P40}000

+ Operating Expenses = P10,000

«Salary allocations to partners = P13,000

+ Interest paid to banks = 2,000

+ Partners withdrawals = P8,000

Partnership net income (ss) is:

a. 10000 c. P5000

b. P1800 d. (P3000)

‘44, Garcia and Henson formed a partnership on January 2, 20x4, and dgreed to share profits

90%, 10%, respectively. Gorcia contributed capital of P25,000 . Henson contributed no

copital but has a speciaized experlse ond manages the fim full ime. There were no

‘withdrawals during the year. The parinership agreement provides forthe following:

Copital accounts are to be credited annually with interest at 5% of beginning capital.

‘* Henson is to be paid salary of P1,000 a month.

‘* Henson is to receive a bonus of 20% of income calculated before deducting his

salary and interest on both capital accounts.

‘The partnership 20x4 income statement follows:

Revenves. P 96,450

Expenses (including salary, interest, and: bonus). 49,700

Net income . 46.750

What is Henson’s 20x4 bonus?

. PI1,688 c. P1500

b. 12,000 dPIS.738

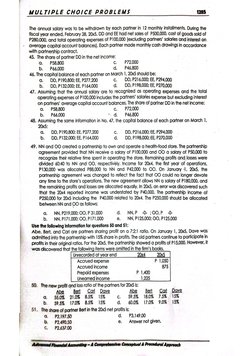

Use the following information for questions 45 to 48;

DD and EE was organized and began operations on March 1, 20x4. On that date, DD invested

150,000 and EE invested land and building with current fair value of P80,000 and P100,000.

tespectively. EE also invested P60,000 in the partnership on November 1, 20x4 because of its

shortoge of cash. The partnership contract includes the following remuneration plan:

0D FE

‘Annual satory... ae P 18,000 | P 24,000

‘Annual interest on average capital account balance. . 10% 10%

MULTIPLE CHOICE PROBLEMS 1285

The annual solary was fo be withdrawn by each partner in 12 monthly installments. During the

fiscal year ended, February 28, 20x5, DD and EE had net soles of P500,000, cost of goods sold of

280,000, and total operating expenses of P100,000 (excluding partners salaries and interest on

‘average capital account balances), Each partner made monthly cash drawings in accordance

with partnership contract.

45, The share of partner DD in the net income:

a. 58,800 c. 72,000

b. P66,000 d. P46,800

46. The capital balance of each partner on March 1, 20x5 should be:

, DD, P190,800; €€, P277,200 cc. DD,P216,000; EF, P294,000

b. DD, P132,000; EE, P164,000 d. DD, P198,000; E€; P270,000

47. Assuring that the annual solary ore to recognized as operating expenses and the total

operating expenses of P100,000 inciudes the partners’ salaries expense but excluding interest

(on partners’ average capital account balances. The share of pariner DD in the net income:

o. P5880 c. P7200

b. P66,000 P4600

48, Assuming the some information in No, 47, the capital balance of each partner on March 1,

0x5:

@. DD, P190,800; EE, P277,200 cc. _DD,P216,000; EE, P294,000

b. DD, P132000; EE, P164,000 d, 0D, P198,000; £6, 270,000

49. NN and 00 created a partnership to own and operate a heaith-food store. The partnership

‘agreement provided that NN receive a salary of 100,000 and OO a salary of P50,000 to

‘recognize their relative time spent in operating the store. Remaining profits and. losses were

divided 60:40 to NN and 00, respectively. Income for 20x4, the fist year of operations,

130,000 was allocated P88,000 to NN and P4200 to OO. On January +1, 20x5, the

partnership agreement was changed to reflect the fact that OO could no longer devote

‘any fime fo the store's operations. The new agreement allows NN a salary of P180,000, and

the remaining profits and losses are allocated equally. In 20x5, cn error was discovered such

that the 20x4 reported income was understated by 40,000. The partnership income of

250,000 for 20x5 including the 40,000 related to 0x4. The P250,000 should be allocated

belween NN and 00 os folows:

‘a. NN, P219,000; 00, P 31,000 d. NP 0. ;00,P 0

b. NN, 171,000; 0O, P171,000 fe. NN,P125,000; 00, P125,000

Use the following information for questions 50 and 51:

Abe, Bert, ond Catt are partners sharing profit on a 7:2:1 ratio. On January 1, 20x5, Dave was

‘admitted into the partnership with 15% share in profits. he old partners continue to participate in

Profits in their original ratios, For the 20x5, the parinership showed a profits of P15,000. However, it

‘was discovered that the following items were omitted in the firm's books.

Unrecorded at year end 0x4

Accrued expense P 1,050

Accrued income 875

Prepaid expenses P 1,400

Uneamed income 1,295

50. The new profit and loss ratio of the partners for 20x5 is:

Abe Bet Cot Dave Abe Ber Co Dave

@. 55.0% 210% 85% 15% c, 57.5% 180% 7.5% 15%

b. 595% 170% 85% 15% d. 600% 170% 90% 15%

51. The shore of pariner Bertin the 20x5 net profisis:

a. 2,197.50 d.P3,149.00

b. P2,490.50 @, Answer not given,

c. P2637.00

‘Advanced Financia Accounting ~ A Comprehensive: Conceptual & Procedural Approach

}

THEORIES 1287

‘Multiple-Choice

2B. Portnership drawings are

‘@.clways maintained in a separate account from the poriner’s copital account.

'. equal fo partnen salaries. ‘

. usualy mointgined in @ separate craw account with any excess draws being debited directly 10

the capital account. ‘

d. not discussed inthe speciic contract provisions ofthe partnership.

30, Drawings

@. are advances to a partnership.

b. are loans to a partnership.

c., are a function of interest on partnership average capital

ate the same nature os withdrawals,

31. Withdrawals from the partnership accounts are typically not used

<2. Torecord compensation for work performed in the business

bb. Toreduce the partners’ capital account balances at the end of an accounting period

<. Torecord interest earned on a partner’ capital balance

. Toreduce the basic investment that has been made in the business to record a reword

for ownership inthe parinership

232. Which o he folowing’s nota withdrawal ha! may be found in « partneip’s drawing accounte

(.. Removal of cash by partner

Payment of a partner's speeding ficket by the parinership

‘c. Removal of inventory by a partner

d._Alof the above may be found.in a drawing account

38 Viti a he folowing statements Is corect with regard fo drawing accounts that may be used by a

perhentip®

Drawing accounts ae closed fo the pariners* capital accounts ot the end of the accounting

period

'b. Drawing accounts establish the amount hat may be taken from the partnership by a partner in a

given fime period

cc. Drawing accounts ore similar o Retained Eomings in a corporation

d._ Drawing accounts appear on the balance sheet as a contra-equity account

34, Which ofthe Tolowing would be least ikely o be used as a means of allocating profits among partners

‘who are active in the management of the partnership?

«©. Salaries

'b. Bonus as a percentage of net income before the bonus

cc. Bonus as a percentage of sales in excess of a targeted amount

. Interest on average capital balances

35. Which ofthe folowing best describes the use of interest on invested capital as a means of allocating

Profits?

©. IHinterest on invested capitals used, it must be used forall partners,

b. Inerestis alocated onli theres partnership net prof

C. Invested capital balances are never affected by drawings of the porinerships.

d. Use of beginning or ending measures of invested capital may be subject fo manipulation that

distorts the measure of invested capital.

36. A partnership ‘agreement call for allocation of profits and losses by salary allocations, a bonus

location, interest on capital, wth any remainder to be allocated by preset ratios. fa partnership has

loss to allocate, generaly which of the folowing procedures would be applied?

‘0, Any oss would be allocated equally to all partners.

'b, Any salary allocation criteria would not be used.

C. The bonus criteria would not be used.

d. The loss would be allocated using the profit and los ratios, only, :

7. If the partnership agreement provides a formula for the computation of a bonus to the partners, the

‘bonus would be computed

©. next fo ast, because the final allocation isthe distribution of the profit residual,

b, before income tax allocations are made.

. offer the salary andinterest allocations are made.

d. in any manner agreed to by the partners,

—

1288 CHAPTER 18

38. Which of the following statements is true conceming the treatment of salaries in partnership

‘accounting?

‘0. Partner solaries may be used to allocate profits and losses; they are not considered expenses of

the portnership

b, Partner salaries are equal to the annual partner draw.

c. The solary of a partner is treated in the same manner os salaries of corporate employees.

d. Partner salaries are directly closed to the capital account.

39, Partners active in a portneship business should have their share of parineship projils based on the

folowing

‘2. a combination of solries plus interest based on average capital balonces,

. a combination of salaries ond percentage of net income after salaries and any other allocation

bass.

c._solaries only,

d._ percentage of net income after solaris is paid to inactive partners.

40, Which ofthe folowing could be used as « basi fo alocate profs among partners who ore

‘active in the management ofthe partnership?

1. Allocation of salaries 3, The amount of ime each partner works.

2, The number of years with the partnership. 4. The average copital invested,

.1and2 d.l,3and4

b.land3 e.1,2,3and 4

c.1,20nd3

41. In partnership, interest on capital investment is accounted for as a[n)

a. retum on investment c. allocation of net income

'b, expense d. reduction of capitol

42, Bobvand Fred form a partnership and agree to share profs ina 2 to | ratio. During the first year of

‘operation, the partnership incurs a P20,000 loss. The partners should share the losses

{@. bosed on their average capital balances. c, equally

». ina 2to | rafo, 4. based on their ending capital bolances

43, Which ofthe folowing interest component calculation bases least susceptible fo manipulation when

‘allocating profits ond losses to partners?

a. Beginning capital account balance

b. Average of beginning and ending capital account balances

¢. Weighted average capital account balance

d. Ending capital account balance

44, A porinerstip agreement cals for alocation of profs and josses by salary allocations, @ bonus

‘location, interest on capital, with any remainder to be allocated by preset ratios. Ita partnership has

‘aoss to alocate, generally which of the following procedures would be applied?

{@, Any loss would be allocated equally to al partners,

. Any Salary allocation citeia would not be used.

. The bonus cfteia would not be used.

4. The loss would be allocated using the profit and lss ratios, only.

45, What is the underying purpose of the interest on copital balances component of allocating

partnership profs ond losses?

‘0. Compensate partners who contibute economic resources to the partnership

. Reward iabor and expertise contibutions

¢. Reward for special responsbilies undertaken

4d. None of the above

‘48, Whats the undertying purpose of the salary component of alocating partnership profits ond losses?

‘Compensate partners who contibute economic resources to the partnership

Reward labor and expertise contibutions

Reward {or special responsbilties undertaken,

‘None ofthe above,

o.

b.

©.

d,

You might also like

- Partnership Profit and Loss Allocation GuideNo ratings yetPartnership Profit and Loss Allocation Guide4 pages

- Partnership Income Allocation StrategiesNo ratings yetPartnership Income Allocation Strategies23 pages

- SET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer KeyNo ratings yetSET A ACC 110 - CFE - SY 2023 2024 1st Sem - Answer Key19 pages

- Lecture 4 Partnership Operation - Practice SetNo ratings yetLecture 4 Partnership Operation - Practice Set8 pages

- 01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 OperationsNo ratings yet01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 Operations5 pages

- Partnership Capital Contributions and Profit Sharing AnalysisNo ratings yetPartnership Capital Contributions and Profit Sharing Analysis3 pages

- AFAR 1.0 Partnership-Accounting ASSESSMENTNo ratings yetAFAR 1.0 Partnership-Accounting ASSESSMENT5 pages

- Test Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,000No ratings yetTest Bank Advanced Acctg. I Antonio Dayag: D. A, P65,000 B, P81,00045 pages

- Partnership Capital and Profit Allocation AnalysisNo ratings yetPartnership Capital and Profit Allocation Analysis78 pages

- Partnership Accounting Scenarios and ProblemsNo ratings yetPartnership Accounting Scenarios and Problems3 pages

- Partnership Profit and Loss Distribution GuideNo ratings yetPartnership Profit and Loss Distribution Guide5 pages

- Partnership Profit Distribution Exam QuestionsNo ratings yetPartnership Profit Distribution Exam Questions3 pages

- Cpa Review School of The Philippines ManilaNo ratings yetCpa Review School of The Philippines Manila4 pages

- Question 3 and 4 Are Based On The FollowingNo ratings yetQuestion 3 and 4 Are Based On The Following5 pages

- Partnership Accounting Adjustments GuideNo ratings yetPartnership Accounting Adjustments Guide13 pages

- Partnership Capital Contributions and AllocationsNo ratings yetPartnership Capital Contributions and Allocations13 pages

- Session 2 - Partnership Operations - Problems January 29, 2016No ratings yetSession 2 - Partnership Operations - Problems January 29, 201610 pages

- Partnership Liquidation and Profit Sharing ProblemsNo ratings yetPartnership Liquidation and Profit Sharing Problems7 pages