0% found this document useful (0 votes)

118 views3 pagesInstitutional Bond Investment Guide

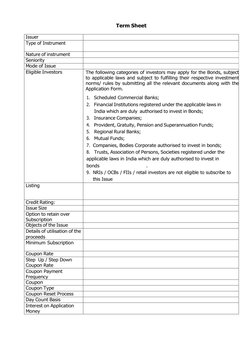

The document outlines the terms of a bond issue, including details such as eligible investors being various financial institutions but excluding NRIs/OCBs/FIIs/retail investors, the seniority, coupon payment frequency, redemption date and amount, and call and put option dates. Credit ratings, issue size, minimum subscription amount, and roles of parties like the debenture trustee are also specified.

Uploaded by

jacobvoigt0Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

118 views3 pagesInstitutional Bond Investment Guide

The document outlines the terms of a bond issue, including details such as eligible investors being various financial institutions but excluding NRIs/OCBs/FIIs/retail investors, the seniority, coupon payment frequency, redemption date and amount, and call and put option dates. Credit ratings, issue size, minimum subscription amount, and roles of parties like the debenture trustee are also specified.

Uploaded by

jacobvoigt0Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd