Page 1 of 2

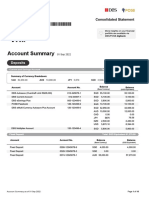

0429020518170-1553

, "%����������%� )��)����,

MAMUN MD AL

12 TUAS DRIVE 1

#01-12

SINGAPORE 638679

.-./0/-.0-0/.-./0-0-0/.-0./0-0

As at 29 Feb 2024

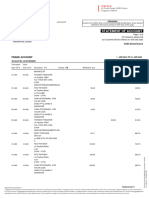

Details of Your POSB Payroll Account Account No.: 449-29493-9

DATE DETAILS OF TRANSACTIONS WITHDRAWAL($) DEPOSIT($) BALANCE($)

Balance Brought Forward 1.33 -

06 Feb Salary 540.13

HAI LECK ENGINEERING

Payment

06 Feb Funds Transfer 300.00 238.80

449-32977-5 : I-BANK

07 Feb Funds Transfer 10.00 228.80

449-22807-3 : I-BANK

10 Feb Cash Withdrawal Others 220.00 8.80

25532617,MOHAMED MUSTAFA & SAMSUDD

CSHBACK

11 Feb Point-of-Sale Transaction 2.05 6.75

25532617,QUALITY FOODS PTE LTD

NETS CONTACTLESS

14 Feb Debit Card transaction 2.00

FRUITS VENDING PTE LTD SI NG 10FEB

5264-7110-2553-2617

14 Feb Debit Card transaction 4.00 0.75

SENTOSA EXPRESS SI NG 11FEB

5264-7110-2553-2617

20 Feb Debit Card transaction 14.06 13.31 -

BUS/MRT 390657894 SI NG 10FEB

5264-7110-2553-2617

27 Feb Debit Card transaction 2.80 16.11 -

BUS/MRT 394093187 SI NG 17FEB

5264-7110-2553-2617

29 Feb Interest Earned 0.00 16.11 -

Total 554.91 540.13

Balance Carried Forward 16.11 -

Message For You

l For all enquiries, please call us at 1800 339 6666.

l Clients Residing in Australia – Limitations to Banking Services & Investment Offerings

With effect from 6 February 2023, there will be limitations in banking services and investment offerings to our clients

whose residential address is in Australia. For more information, please visit our website at

https://go.dbs.com/sg-auresident

PDS_POSBPCMTHE_E_LOC_FP_0d13013400000040_01553

� Page 2 of 2

l Update Your Personal Particulars

If there is any change to your personal particulars or contact details, please update us via digibank online/mobile or

at any DBS/POSB branch.

l To improve user experience, we will be conducting Customer Satisfaction Survey.

As our valued customer, you may be invited to participate via email.

Qualtrics is our official digital survey platform to conduct the surveys.

Rest assured your responses will be treated with absolute confidentiality.

DEPOSIT INSURANCE SCHEME

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary

Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme

member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum

Scheme are aggregated and separately insured up to S$75,000 for each depositor per Scheme member. Foreign currency deposits, dual

currency investments, structured deposits and other investment products are not insured.

GENERAL

Late cheques will be taken into account for interest computation from the next clearing date after the day of deposit.

Exchange rate quoted (if any) is the indicative rate as at the last business day of the month.

Any transactions performed after our cut-off time for statement printing will be reflected in the following month’s statement of account.

Overdraft interest denotes the interest charge on:

- Amount overdrawn due to insufficient funds to meet payment/s eg. cheque clearing (subject to a minimum charge of $20)

Please examine this statement. Subject to any other applicable terms, please notify us of any error or discrepancy within fourteen (14) days

from the date of receipt of this statement.

PDS_POSBPCMTHE_E_LOC_FP_0d13013400000040_01553