0% found this document useful (0 votes)

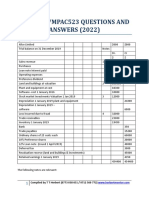

91 views5 pagesUnderstanding Accounting Periods and Corporation Tax

The document discusses accounting periods for companies and corporation tax computations.

1) An accounting period does not start until a company starts trading or its profits become liable for corporation tax. An accounting period ends after 12 months, at the end of the company's accounting period, or when it ceases trading.

2) A corporation tax computation calculates taxable profits by taking total income and gains, subtracting charges on income. Dividends from UK companies are exempt from tax. Tax rates depend on a company's annual profits.

3) Franked investment income includes UK dividends plus a 10% tax credit. It is added to profits to determine the applicable tax rate, though dividends themselves are exempt from tax

Uploaded by

api-3834080Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

91 views5 pagesUnderstanding Accounting Periods and Corporation Tax

The document discusses accounting periods for companies and corporation tax computations.

1) An accounting period does not start until a company starts trading or its profits become liable for corporation tax. An accounting period ends after 12 months, at the end of the company's accounting period, or when it ceases trading.

2) A corporation tax computation calculates taxable profits by taking total income and gains, subtracting charges on income. Dividends from UK companies are exempt from tax. Tax rates depend on a company's annual profits.

3) Franked investment income includes UK dividends plus a 10% tax credit. It is added to profits to determine the applicable tax rate, though dividends themselves are exempt from tax

Uploaded by

api-3834080Copyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd