0% found this document useful (0 votes)

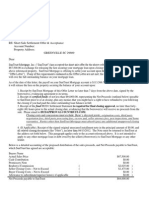

45 views11 pagesUnderstanding Negotiable Instruments

Uploaded by

evelynberko21Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

Topics covered

- Payment Instruments,

- Bill of Exchange,

- Debt Settlement,

- Bearer Debenture,

- Discounted Bill,

- Legal Framework,

- Features of Cheques,

- Bearer Cheque,

- Negotiability Requirements,

- Characteristics of Bills

0% found this document useful (0 votes)

45 views11 pagesUnderstanding Negotiable Instruments

Uploaded by

evelynberko21Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

Topics covered

- Payment Instruments,

- Bill of Exchange,

- Debt Settlement,

- Bearer Debenture,

- Discounted Bill,

- Legal Framework,

- Features of Cheques,

- Bearer Cheque,

- Negotiability Requirements,

- Characteristics of Bills