0% found this document useful (0 votes)

8K views12 pagesCalifornia Life Exam 1

The document contains practice exam questions and answers about California life, accident, and health insurance. It includes multiple choice questions covering topics like medical information reporting requirements, deductibles, disability definitions, unfair competition, pre-existing condition insurance plans, guarantee associations, policy cancellation periods, insurance coverage exclusions, and Medicare benefits. The questions assess knowledge of insurance terms, concepts, and regulations.

Uploaded by

kibabumeghanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

8K views12 pagesCalifornia Life Exam 1

The document contains practice exam questions and answers about California life, accident, and health insurance. It includes multiple choice questions covering topics like medical information reporting requirements, deductibles, disability definitions, unfair competition, pre-existing condition insurance plans, guarantee associations, policy cancellation periods, insurance coverage exclusions, and Medicare benefits. The questions assess knowledge of insurance terms, concepts, and regulations.

Uploaded by

kibabumeghanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

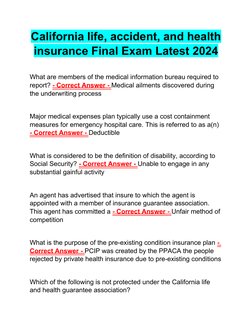

- Insurance Exam Questions Page 1: Contains a series of questions and answers related to medical information bureau, major medical expenses, and pre-existing conditions.

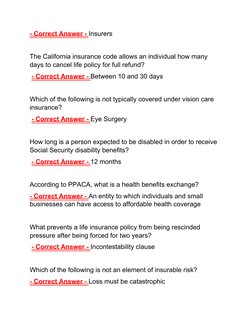

- Insurance Exam Questions Page 2: Continues with questions on California insurance code, vision care, and pre-existing conditions.

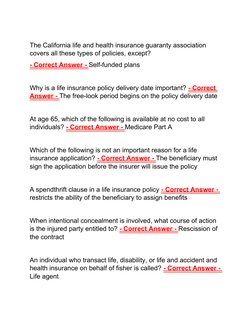

- Insurance Exam Questions Page 3: Features questions on life insurance policies and delivery dates, including Medicare and policy applications.

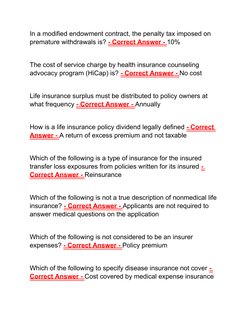

- Insurance Exam Questions Page 4: Includes questions on endowment contracts, health insurance advocacy, and policy dividends.

- Insurance Exam Questions Page 5: Covers topics on Medicare, deferred annuities, and government entitlements.

- Insurance Exam Questions Page 6: Discusses term illustrations, PPACA, and variable annuities.

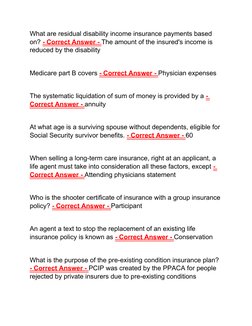

- Insurance Exam Questions Page 7: Asks about residual disability, systematic liquitation, and social security survivor benefits.

- Insurance Exam Questions Page 8: Inquires about premium provision, ERISA, and benefit payments.

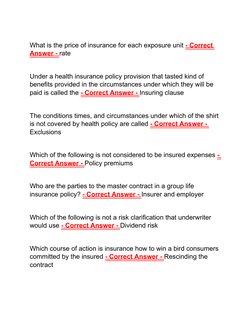

- Insurance Exam Questions Page 9: Explores insurance pricing, exclusions, and liability policies.

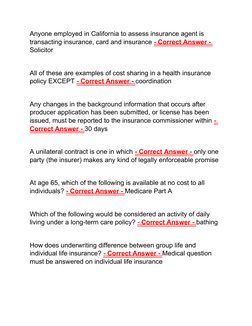

- Insurance Exam Questions Page 10: Questions related to employment, contracts, and Medicare coverage.

- Insurance Exam Questions Page 11: Focuses on long-term care policies, renewable term, and PPO plans.

- Insurance Exam Questions Page 12: Concludes with questions on joint life insurance and probability of events.