0% found this document useful (0 votes)

105 views7 pagesJournal Entries

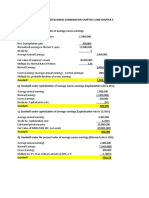

The document contains journal entries recording an investment in XYZ Company and dividend income. It also contains information about the acquisition of XYZ Company by ABC Company, including consideration given, fair value adjustments, goodwill calculation, and amortization of fair value adjustments. Consolidated financial statements are presented, along with elimination entries to combine ABC and XYZ.

Uploaded by

Bas, Jammel BañaresCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

105 views7 pagesJournal Entries

The document contains journal entries recording an investment in XYZ Company and dividend income. It also contains information about the acquisition of XYZ Company by ABC Company, including consideration given, fair value adjustments, goodwill calculation, and amortization of fair value adjustments. Consolidated financial statements are presented, along with elimination entries to combine ABC and XYZ.

Uploaded by

Bas, Jammel BañaresCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd