0% found this document useful (0 votes)

2K views14 pagesSierra ES Chartbook Layout Tutorial

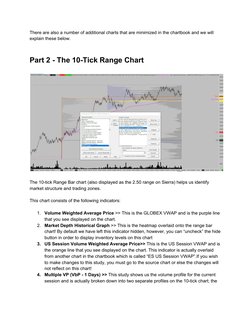

This document provides a legend for the charts and studies used in the TRADEPRO Academy ES chartbook for Sierra Chart. It describes the purpose and components of the 10-tick range bar chart, 5-tick range bar chart, 5-tick reversal (footprint) chart, heatmap chart, and other minimized charts. The legend is intended to help users understand the chartbook and replicate it on other platforms.

Uploaded by

Carl AssadCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views14 pagesSierra ES Chartbook Layout Tutorial

This document provides a legend for the charts and studies used in the TRADEPRO Academy ES chartbook for Sierra Chart. It describes the purpose and components of the 10-tick range bar chart, 5-tick range bar chart, 5-tick reversal (footprint) chart, heatmap chart, and other minimized charts. The legend is intended to help users understand the chartbook and replicate it on other platforms.

Uploaded by

Carl AssadCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Introduction

- Part 1 - The TPA ES Chartbook

- Part 2 - The 10-Tick Range Chart

- Part 3 - The 5-Tick Range Chart

- Part 4 - The 5-Tick Reversal Footprint Chart

- Part 5 - The Heatmap Chart

- Part 6 - The Equity Correlations Chart

- Part 7 - The Inverse Correlations Chart

- Part 8 - The 60-Minute Bar Chart (Pivot Chart)

- Part 9 - The Depth of Market (DOM)