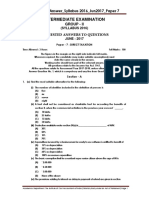

0 ratings0% found this document useful (0 votes) 55 views6 pagesObjective Questions

Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content,

claim it here.

Available Formats

Download as PDF or read online on Scribd

30 re

Multiple Choice Questions :

Chapter — 1: Introduction

1. The constitution of India empowers

8) State Government

6. Gross Tax Liability is calculated on

8) Gross Total Income

©) Income

Tans,

Direct Tar,

to levy tax on income.

’b) Central Government

4) Finance Minister

©) Parliament

a eee b) Profit

a) In :

)_ Expenditure

) Tumover ie

Pe coms TxA, TOE nabggn|_ :

Oa) Sections b) Sub-sections

©) Clauses 4) Subclauses i

4 The rakes the amendment in the form of omission, insertions and substitutions in te

Inoine Tax Act. 2

2 ime Bl ) Finance Minister

¢) Finance Act @) Pasiament

5. The Income Tax Act extends to of India, :

2) States ). Union Territories

©). Citizens

4) Whole

b) Net Taxable Income

4) Salary

-B), 2-2), 8-9), 4-2), (54), (6-b)]

8) Hindu divided family

-©) Hindu undivided family

2. “Residential has nothing to do with:

8) * Constitution

©) Censorship

3.

‘A.OP. isthe abbreviation used for :

4) Association of persons

©) Association of Panchayats

4. AOD. should consist of :

8) Individual only

©) Both of the above

‘Body of individual should consist.

a) Individual only

©) Both ofthe above

&) Human undivided family

®) Human divided family

») Citizenship

4) Change

) Association of professors

Associate of person

) Persons other thar wi

3 Nanas niu oo

) Persons oth

er than individual on

$) “None ofthe above aust only

tual nds

2) Calendar year “penn yf he ncn ni rig:

| 6). Asseseement year @ pcuttng year

j oe Prion by whom any taxi payable under income Tax Ase Pe

a) Individual ‘Tax Receiver is called as :

' ©) Assessee 4) None of the

8. The financial yea in which the income is eared i cllea as thes

f a) Assessment year b) Present year

| ©) Previous year 4) Current year

i 9. Ancompany is always resident in India :

a) Industrial b) Individual

c) Indian 4) Investment

10. Income Tax Act extends to

| a) Whole of India b) Whole of India

©) India and Sri Lanka

xe i

4) None of these **°Pt Jammu & Kashi!

a

(& scanned with OKEN Scanner�. &

we ‘Questions ror

a

‘Anew business Was set up on 15-11-2023 and it commended its business from 1-12-2023, The first

| 1 jrevious year in this case shal be:

| J} 15-11-2023 to 31-3-2024

1-12-2023 to 31-3-2024

) 2023-2024

{None of these

|

|

|

|

|

|

shivaji Unive

pseu is assessable under the Income Tax Act as

a

B

b) An Artificial Juridical Person

¢) A Local Authority 4) None of these

Income Tax Act has schedules,

oB b) 4

3) @ 40

w S8(1)@)GiD isreadas

2) Section 58 schedule (1) clause (a) sub-clause (i

€)_ Section $8 sub-section (1) clause (a) sub-elause (i),

Section 58 sub-section (1) clause (a) schedule

15 159) 0) (iv), is

| a) Section

|g) Clase

“ are definite,

3) Exhaustive definition

b) Sub-section

4) Sub-clause

ic, complete and full,

) Inclusive definition

|

| 9) Sections ® Ck

| Aims regarded asa unit oF assessment as por“

| a) Income Tax Act 8) Parnes

| 6) Companies Act @) Finance Act

im is chargeable wis 45.

| 2 Grim b) Profitand Gains

©) Divi a) Vol bution

[ee ; Voluntary Contribut

| 9) Dividend b) Voluntary Contribution

©) Capital Gains 4) Allofthe above

| A Any sum of money received in excess of © without consideration is chargeable to tax.

| 9 S00 50,000

| 9. 5.00,0001. a) 55,000/

| 200 Revious yer cmnbeof =. tz mona,

2) More than b) Less than

|. ® Only é) Any

| 2. Any sum received or receivable in cash or kind under an agreement for not earrying out an activity in

‘elation to a business is called as -

2) Pin Money b) Mutual Activity

) No Competition Deal 4) Non-compete Agreement

2, is expected to be a periodical monetary retum.

_— ® Salary b) Profit

| y 9 Income @)_ Interest

| are not taxable.

| Tomes 6) Personal Gifts

| Megat income 4) Awards

i ived by wife is not taxable.

| veg 1) Compensation

ty 9 Gin d) Salary

| 7° Theterm *Person* includes _____

WU b) oP

°) Bor d) Allofthem:

(& scanned with OKEN Scanner�32

27,

Fem

rere Pheer Tae,

Partners are liable to pay taxon received from firm.

a) Salary b) Profit

©) Income d) Both (a) & (c)

Tans. (1-0), 2-0), 0), 4-0, (5-2), 6-9, 7-9, B= 29-9, U0~ 9. 4g

(2-3-4 ras eo ae a = 8, (B=, (19 a), 20 —b), 1 ~b), (22

(23 ~c), (24 ~b), (25 ~ 9), 26~ a), (27 -a))

40.

i.

12.

13.

Income deemed to case of:

8) Resident only b) Both R & OR and R but NOR

©) Non-resident 4) Allofthe above

{come which accrue or arise outside India and also received outside India is taxable in case of.

8) Resident only b) Not ordinary resident

©) BothR & OR and R but NOR 4) None of the above

{Income which acerue outside India from a business controlled from Ind

) Resident only

is taxable in case of :

b) Not ordinary resident only

©) Both & OR and R but NOR 4) None of the above

Residential status is determined based on nos. of days stay in :

8) Previous year b) Assessment year

©) Accounting year 4) None of these

‘Total Income of a person is determined on the basis of

a) Residential status in India ) Citizenship in India

©) _ None of the above 4) Both of the above

[nfourze Ltd. is registered in London the control and mangement of its affairs is situated in Indie

Infourge Ltd. shall be :

a) Resident only ») Both ordinarily resident and NOR

©) Not ordinarily resident in Ind @) None of the above

{neomes which accrue or arise outside India but are received directly into India are taxable for case of

a) Resident only ») Both ordinary resident and NOR

©) Non-resident 4) All the assesses

Succces Lid. is an Indian company whose entire contol and management of its affairs is situated

‘outside India success Ltd is :

a) Resident in India

©) Not ordinarily residen

‘Martin Crow a foreign national visited India du

visited India, Martin Crow in this case shall

a) Resident in India

b)_ Non-resident in India

4) None of these

ring previous year for 180 days, Earlier to this he net

e

b) Non-resident

©) Not ordinarily resident in India 4) None of these

Residential status is to be determined for :

a) Previous year b) Assessment year

©) Accounting year 4) None of these

Is an Indian company whose entire control and management of its affairs is situate!

Infaurge shall be : oe

tin India fon-resident in India

3 Healy resident in India 4) None of these

Success Ltd. Is registered in U.K. The control and management of is affairs is situated in Indi. SUS

Ltd. shall be: b) Non-resident

a) Resident in India 4) None of these

Not ordinarily resident in nine us year 2059-24 tier to this

©) Not cr ign national visited India during previous y -24 for 150 days. Earlier

it ‘ :

Resident in India

am Not ordinarily resident in India

b) Non-resident

d) None of these

P|

(& scanned with OKEN Scanner�Objective Questions

14.

a2” 343

Raja a foreign national but a person of Indian origin visited India during previous year 2023-24 for

181 days. During 4 preceding previous years he was in India for 365 days. Raja shall be :

a) Resident in India b) Non-resident in India

c) Not-ordinarily resident in India d) None of the above

If an individual satisfies any of the basic conditions and satisfies only one additional condition, then

also he shall be considered as _ f

a) R&OR b) Non-Resident

c) RbutNOR d) None of the above

Special individuals would become non-resident if their stay in India during previous year is

a) Equal to 182 days b) Less than 182 days

©) More than 182 days d) None of the above

Dividend received from a foreign company in London, taxable in case of following individuals

a) R&OR b) Rbut NOR

c) Non-Resident d) All of the above

Fees for technical services rendered in India but received in London, taxable in case of __

a) RbutNOR b) R&OR

c) Non-Resident d) All of the above

In case of following individuals, global income is taxable

a) R&OR b) RbutNOR

ce) NR d) None of the above

{Ans. (1 - d), (2 —a),-G ~ ©), @ — a), (5 —a), (6 ~ a), (7— A), (8 — ). (9 = by, (10 —a), (11 — =

(13 ~b), 14—b), 15—0), 16~b), (17a), 18a), 9—ayy OP LO 8s AT =a), (12 ~,

© scanned with OKEN Scanner�Dire

356 rer Tay

[Chapter -2 : Definitions (Sections 2 and 3) oe

1. Defination which are definite, specific, complete and full are cal eee

2, Apperson by whom tax payable under the Act is called as_-

Act defines assessment to include :

i Pea ‘means ___ year immediately preceeding the assessment year

5. Person includes a natural human being and also includes __ _orapenonf

6. Any sum of money received without consideration by an individual is P

7. Previous year of a newly set up business can be of 12 months. a

8. Aperiod of 12 months commencing on 1" day of April every year is called an :

9, Any sum received or receivable in cash or kind under an agreement for not carrying out an acti;

ity in

ation to a business is called as. fae ee

10, Any sum of money exceeding €____ received without consideration by an individual i treated ag

Income, :

nL of the Income Tax Act, 1961 gives the definition of various terms.

12, Theacthas____chapters, __sections and_schedules.

1B. ‘means an exception to the provision in section.

14. ‘The two types of definitions are___and.

15. ___ provide scope for interpretation,

16. __is the process of determining the tax payable by an assesseee.

17. Income should be real and not___.

18. Income canbe on___basis or ___basis.

19. Any sum received or receivable in cash or kind under an agreement for not carrying out an activity in

‘elation to a business is called as

20. Non-compete agreements are also called.

‘means a period of 12 months commenci

reecived by a profes

ig from 1" day of April every year.

al sportsman is an income,

Personal expenses is not treated as income.

According to section 2 (8), Assessment includes

25. Free means # casfication ofa paniular term ora part of section,

The term ___ includes individual, HUF, Firm, i

Lae ‘tm, Company, AOP, BOI, Local authority etc,

28. Income is expectedtobea___,

29. gifts are not chargeable to tax.

30. Lossistobe taken as

Ans. (1) exhaustive; 2) Assessee:

(7) less than; (8) Assessment; (9)

298, 14; (13) Prov

(3) Reassessment; (4) Financial; in

Non ~ compete agement io; $e

austive and Inclusive; (15) Inclusive Defra

receipt; (19) Non-compete agreement; (20) Exclu:

Pin, Money:. (24) Reassessment, (23), Explanations

Snetary Return; (29) Personal; (30) Minus income]

Basis of Charge (Sections 4, 5, 6,7, 8, and »

status of the assesses depends on the — of ine assessee in

year.

2. Ifthe assessee doesnot stisty the basic condition he wil be treated ag

3. Ifthe assessee satisfies the basic condition he wll be treated se :

4. A person shall be deemed tobe of an Indian origin ithe or either oF or ‘any of his__were bom?

India,

5. fan individual satisfies only basic condit

‘unsound mind; (6) Gift

1) Section 2; (12) 3,

m and non of the additional condition he witl be calle!

i ined on basis of ___ in India,

ytal Income of a person is determines ia,

Residential status is determined based on number of days stay in

6 ‘Year,

ie Indian Company is always in India.

9.

Residential status has nothing todo with _

(& scanned with OKEN Scanner�Objective Questions rro 357

10. Special individuals shall not be treated as resident unless their stay in India is__ 182 days during

previous year.

[{Ans. (1) Stay, India; (2) Non Resident; (3) Resident; (4) parent, grand parents, undivided; (5) R & OR;

(6) Residential Status; (7) Previous; (8) Resident; (9) Citizenship; (10) Atleast]

© scanned with OKEN Scanner