HBC 2216

W1-2-60-1-6

JOMO KENYATTA

UNIVERSITY

OF

AGRICULTURE AND TECHNOLOGY

University Examinations 2012/2013

THIRD YEAR FIRST SEMESTER EXAMINATION FOR THE DEGREE

OF BACHELOR OF COMMERCE (ACCOUNTING OPTION)

HBC 2216 : ADVANCED TAXATION

DATE: AUGUST 2012 TIME: 2

HOURS

INSTRUCTIONS: ANSWER QUESTION ONE (COMPULSORY)

AND

ANY OTHER TWO QUESTIONS. TAXATION

RATE

TABLES ARE PROVIDED SEPARATELY.

______________________________________________________________________

QUESTION ONE (30 MARKS)

(a) (i) Define the term “tax planning”. [3 marks]

(ii) Explain with examples, two instances in which a business

may apply the concept of tax planning. [6 marks]

(b) Explain the circumstances under which a tax authority may

conduct a PAYE audit on a business. [9 marks]

(c) Discuss the income tax implications of the following from both

the point of view of the employee and that of the employer:

1

� HBC 2216

(i) A retiring director has been paid Sh. 180,000 as pension.

The director retired on 30.6.2011 and her pension benefits

as at 31.12.2010 amounted to Sh.180,000. [3 marks]

(ii) An education allowance is paid to an expatriate member of

staff. His children attend a high cost international school in

Kisumu and the contract of his employment provides for

this payment. [3

marks]

(iii) The executive chairman will be retiring next year and the

company is contemplating giving him an ex-gratia “golden

handshake” amounting to Sh. 200,000 in addition to his

normal benefits. [3 marks]

(iv) A mileage allowance to senior staff who use their own

vehicles from their homes to the office has been proposed.

[3 marks]

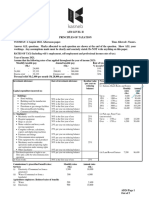

QUESTION TWO (20 MARKS)

Mrs. Orina owns a sugar jiggery in Tabaka, Kisii. The following

particulars relate to assets of the factory in 2010:

1. Purchased a new building from a builder at a cost of Sh.

2,000,000. Administration offices included in the building had an

estimated cost of Sh. 250,000.

2. Purchased three micro computers at a total cost of Sh. 300,000.

3. Other assets of the factor are as follows:

WDV Additions Disposals

1.1.2010

Sh. Sh. Sh.

Office furniture 3,300,000 1,900,000 700,000

Computers 200,000 - 80,000

Tractors 12,000,000 - 2,500,000

Lorries (1 ton) 2,500,000 3,000,000 500,000

Processing machines 4,800,000 2,400,000 1,800,000

Saloon cars 3,200,000 4,000,000 200,000

Buildings 5,000,000 - -

Land 7,500,000 2,000,000 4,000,000

2

� HBC 2216

4. The old buildings were inherited from Orina’s father five years

ago when new and were valued at Sh. 50,000,000.

5. A farm house was constructed in 2010 at a cost of Sh. 600,000.

A cattle dip and milking machinery costing Sh. 120,000 and Sh.

220,000 respectively were constructed and purchased during

2010.

6. The saloon cars (two) disposed of in June 2010 were purchased in

2008 at a cost of Sh. 250,000 each. Another saloon car was

purchased during 2010.

7. Goodwill and patents carried forward from 2008 were valued at

Sh. 1,400,000 on 31 December 2010.

Required:

Capital deductions for Mrs. Orina for the year of income 2010.

[20 marks]

QUESTION THREE (20 MARKS)

(a) List six types of transactions for which the personal identification

number is required. [6 marks]

(b) With reference to the sixth schedule of the VAT Act (Cap. 476)

outline four vatable supplies which are not subject to the VAT

threshold turnover requirements. [4 marks]

(c) XYZ Ltd. has VAT due amounting to Sh. 2,400,000. It was late in

making the returns and payments of the amount due by six

months.

Required:

The penalties that XYZ Ltd. will be required to pay by the VAT

Department. [10 marks]

QUESTION FOUR (20 MARKS)

Amini, Upendo and Umoja are partners in a trading firm sharing profits

and losses in the proportion of [Link]. The profits and loss account of

the firm for the previous year ending 31 December 2011 showed a loss

amounting to Sh. 600,000 before charging the following:

3

� HBC 2216

Interest on capital Commission Salary

Sh. s Sh.

Sh.

Amani 120,000 40,000 20,000

Upendo 80,000 - -

Umoja 160,000 - 40,000

The other incomes of the partners during the same period were

as follows:

Amani - Income from property (net - Sh. 220,000

Upendo - Income from private business - Sh. 400,000

Umoja - Gains from horse racing bets - Sh. 600,000

Required:

Show the assessed income of each partner for the year of

income 2011.

[20 marks]