R.P.R.

2

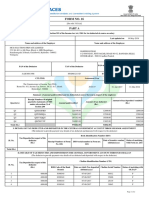

[See Para 2.1(6), 2.4(8), 2.11, 2.61 of Subsidiary Instructions]

LAST PAY CERTIFICATE

Name of the Office: Arignar Anna Govt.Arts & Science College,KKL DDO.Code:4045 DDO Code:

1. Employee details

Name of employee M.RAJESHKUMAR

Employee ID No R20150600

Designation MTS(GENERAL)

Employee’s Group C

Pay level L1; C10 (23500)

PAN Number CBZPR3533D

Aadhaar Card No.

GPF Account No

PRAN Number (covered under NPS) 110066634470

Proceeding on to

2. He/She has been paid salary upto 08.12.2024 at the following

rates:—

(Amount in Rs).

Gross Deductions

Items Amount Claimed upto Items Amount Upto

08.12.2024 08.12.2024

Pay 23500 6065 I Tax

Special Pay Cess on IT

Personal Pay GPF

Allowances GPF Adv.

DA 12455 3214 NPS 3596 928

HRA 2350 606 UTGEGIS 30 30

TA 900 232 CGHS

DA on TA 477 123 LIC

FMA NIC

Total 39682 10240 Total 3626 958

Net in Rs. 36056 9282

1

� 3.His/Her G.P.F./C.P.F./…............................is maintained by the PAO/DDO…...................................................

4. He/She made over the charge of the office of….....................................................on the forenoon/

afternoon of…......................................

5. He/She has been sanctioned leave proceeding joining time for…........... days w.e.f.

……………………..to……………….

6. Recoveries of Income Tax, other recoveries are to be made from the emoluments etc. of the Government

servant as detailed on the reverse.

7. He/She finances the insurance policies detailed below from the Provident Fund:—

Name of Insurance No. of policy Amount of Premium Due date for the payment of

Company Rs. premium

8. Details of P.L.I. policy where premium deduction is done through pay bill:—

Period No. of Policy Amount (in Rs.) Due date for the

payment of premium

Premium GST, if any Total

9. He/She has contributed Rs. 30 p.m.under UTGEGIS

10. Whether the employee resides at Government Rented house : Yes/No.

a: If yes, a: Address……………………………………………

b: House rent recovered upto…………………… License fees (if any)………………

11. Service for the period from………………………………………..to....................................................(during his stay

in this office) has been verified. A copy of LPC has been given to the government servant.

12. The unverified gaps of service including for the periods prior to joining this office are indicated

below:-

Sl. Name of Ministry/ Period No. of Nature of Reasons for non-

No. Department/Office days absence verification

From To

(1) (2) (3) (4) (5) (6) (7)

2

�13. In case of retention of the Laptop; tablet; notepad; or similar devices of similar categories issued tothe

entitled officer: Cost of device:…………………………..Date of issue:…………………………………..

14. Payment history of the all the payments made to the Government Servant during the past one yearare

annexed.

Date: Signature…………………..

Designation ….......................

Details of advances and its recoveries

Name of advance Sanctioned Details of recovery Outstanding Instalment

involving recovery/ amount (Rs.) amount left

adjustment Rate of No. of Total Amount recoverable

Instalment Instalments Recovered till (Rs.)

(Rs.) date

Pay advance….

T.A NA NA

Advance….......

LTC Advance NA NA

H.B. Advance….....

Computer

Advance….

MCA/ OMCA

Int. on Loan

advances

GPF Advance

Festival Advance

Other, if any.

3

� Summary of salary for the financial year 2024-25

Month Gross NPS UTGEGIS Total Net

Allowances deductions salary

Pay HRA TA+ salary

DA

thereon

900

March,2024 22800 11400 2052 450 37602 3420 30 3450 34152

900

April,2024 22800 11400 2280 450 37830 3420 30 3450 34380

900

May,2024 22800 11400 2280 450 37830 3420 30 3450 34380

900

June,2024 22800 11400 2280 450 37830 3420 30 3450 34380

900

July,2024 23500 11750 2350 450 38950 3525 30 3555 35395

900

August,2024 23500 11750 2350 450 38950 3525 30 3555 35395

900

September, 2024 23500 11750 2350 450 38950 3525 30 3555 35395

900

October,2024 23500 11750 2350 450 38950 3525 30 3555 35395

900

November,2024 23500 12455 2350 477 39682 3596 30 3626 36056

December 2024 6065 3214 606 232 10240 928 30 958 9282

Claimed upto 123

08.12.2024

Dress Allow 6250

DA Arrear-1 1714

DA Arrear-2 2644

Ad-hoc bonus 6908

HRA Arrear 684

4

� Extract of other Payment/reimbursement made

Items Reimbursement paid Claim Claim Date Amount

upto (period) Reference

B.No.(CRN)

Year Month

Children Education

2024 08 155 12.08.2024 29813

Allowance

Reimbursement of

Newspaper bills

Reimbursement of

Telephone bills

Any other

reimbursement

Reimbursement of Medical claims (for the last six months)

Claim Reference Claim Date Reimbursement claimed for Period Amount

No. (name of the Family member)

Payment towards Travelling Allowance claims (for the last two months)

Claim Reference Claim Date Tour (Name of the place) Period of tour Amount

No.

Signature /DSC of DDO.........................................

142

� R.P.R. 2

[See Para 2.1(6), 2.4(8), 2.11, 2.61 of Subsidiary Instructions]

LAST PAY CERTIFICATE

Name of the Office: Arignar Anna Govt.Arts & Science College,KKL DDO.Code:4045 DDO Code:

3. Employee details

Name of employee M.JEYAMARY

Employee ID No R20101977

Designation MTS(GENERAL)

Employee’s Group C

Pay level L2; C13 (28400)

PAN Number DYQPM0276J

Aadhaar Card No.

GPF Account No

PRAN Number (covered under NPS) 111001134402

Proceeding on to

4. He/She has been paid salary upto 08.12.2024 at the following

rates:—

(Amount in Rs).

Gross Deductions

Items Amount Claimed upto Items Amount Upto

08.12.2024 08.12.2024

Pay 28400 7329 I Tax

Special Pay Cess on IT

Personal Pay GPF

Allowances GPF Adv.

DA 15052 3884 NPS 4345 1121

HRA 2840 733 UTGEGIS

TA 1800 465 CGHS

DA on TA 954 246 LIC 40 40

FMA NIC

Total 49046 12657 Total 4385 1161

Net in Rs. 44661 11496

143

� 3.His/Her G.P.F./C.P.F./…............................is maintained by the PAO/DDO…...................................................

4. He/She made over the charge of the office of….....................................................on the forenoon/

afternoon of…......................................

5. He/She has been sanctioned leave proceeding joining time for…........... days w.e.f.

……………………..to……………….

6. Recoveries of Income Tax, other recoveries are to be made from the emoluments etc. of the Government

servant as detailed on the reverse.

7. He/She finances the insurance policies detailed below from the Provident Fund:—

Name of Insurance No. of policy Amount of Premium Due date for the payment of

Company Rs. premium

LIC 40 EVERY MONTH

NIC 22961 90 JANUARY

8. Details of P.L.I. policy where premium deduction is done through pay bill:—

Period No. of Policy Amount (in Rs.) Due date for the

payment of premium

Premium GST, if any Total

9. He/She has contributed Rs. p.m.under UTGEGIS

10. Whether the employee resides at Government Rented house : Yes/No.

a: If yes, a: Address……………………………………………

b: House rent recovered upto…………………… License fees (if any)………………

11. Service for the period from………………………………………..to....................................................(during his stay

in this office) has been verified. A copy of LPC has been given to the government servant.

12. The unverified gaps of service including for the periods prior to joining this office are indicated

below:-

Sl. Name of Ministry/ Period No. of Nature of Reasons for non-

144

� No. Department/Office From To days absence verification

(1) (2) (3) (4) (5) (6) (7)

13. In case of retention of the Laptop; tablet; notepad; or similar devices of similar categories issued tothe

entitled officer: Cost of device:…………………………..Date of issue:…………………………………..

14. Payment history of the all the payments made to the Government Servant during the past one yearare

annexed.

Date: Signature…………………..

Designation ….......................

Details of advances and its recoveries

Name of advance Sanctioned Details of recovery Outstanding Instalment

involving recovery/ amount (Rs.) amount left

adjustment Rate of No. of Total Amount recoverable

Instalment Instalments Recovered till (Rs.)

(Rs.) date

Pay advance….

T.A NA NA

Advance….......

LTC Advance NA NA

H.B. Advance….....

Computer

Advance….

MCA/ OMCA

Int. on Loan

advances

GPF Advance

145

�Festival Advance

Other, if any.

146

� Summary of salary for the financial year 2024-25

Month Gross NPS LIC Total Net

Allowances deductions salary

Pay HRA TA+ salary

DA

thereon

1800

March,2024 28400 14200 2556 900 47856 4260 40 4300 43556

1800

April,2024 28400 14200 2840 900 47856 4260 40 4300 43840

1800

May,2024 28400 14200 2840 900 47856 4260 40 4300 43840

1800

June,2024 28400 14200 2840 900 47856 4260 40 4300 43840

1800

July,2024 28400 14200 2840 900 47856 4260 40 4300 43840

1800

August,2024 28400 14200 2840 900 47856 4260 40 4300 43840

1800

September, 2024 28400 14200 2840 900 47856 4260 40 4300 43840

1800

October,2024 28400 14200 2840 900 47856 4260 40 4300 43840

1800

November,2024 28400 15052 2840 954 49046 4345 40 4385 44661

December,2024 7329 3884 733 465 12657 1121 40 1161 11496

Claimed upto 246

08.12.2024

Dress Allow 6250

DA Arrear-1 2188

DA Arrear-2 3284

Ad-hoc bonus 6908

HRA Arrear 852

147

� Extract of other Payment/reimbursement made

Items Reimbursement paid Claim Claim Date Amount

upto (period) Reference

B.No.(CRN)

Year Month

Children Education

Allowance

Reimbursement of

Newspaper bills

Reimbursement of

Telephone bills

Any other

reimbursement

Reimbursement of Medical claims (for the last six months)

Claim Reference Claim Date Reimbursement claimed for Period Amount

No. (name of the Family member)

Payment towards Travelling Allowance claims (for the last two months)

Claim Reference Claim Date Tour (Name of the place) Period of tour Amount

No.

Signature /DSC of DDO.........................................

148